As an analyst with a background in cryptocurrency and market analysis, I find Renzo Token’s (REZ) debut on Binance and subsequent price drop disheartening. The token, which serves as a strategy manager for EigenLayer, had initially garnered significant attention with a market capitalization of $289 million on its listing day. However, the sudden 43.4% decrease in value over the past 24 hours is concerning.

As a researcher studying market trends, I’ve noticed that the Renzo Token (REZ) under the liquid restaking protocol has taken a hit in the last 24 hours, with this decline occurring not long after its listing on Binance.

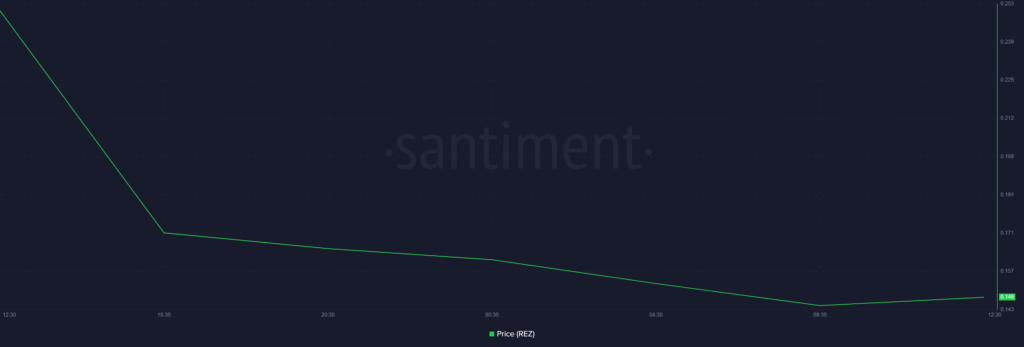

The initial introduction of Renzo Token into the marketplace was signified by a market capitalization worth $289 million. In more current news, the token now carries a value of $0.1444 and boasts a market capitalization of $169 million. This represents a significant 43.4% drop in worth within just one day, an unexpected decline given its substantial daily trading volume of $396 million.

The EigenLayer strategy manager represented by the token had its first appearance on Binance for trading on April 30, according to a recent report from crypto.news. Yet, following this promising event, the token experienced a substantial decline in value, losing close to half of it.

Significantly, the price drop for REZ occurred on Tuesday, coinciding with the hour leading up to the Renzo Protocol token airdrop’s listing on Binance. Approximately 7% of REZ’s total supply was distributed among over 100,000 eligible recipients. Eligibility was determined by users holding a minimum of 360 ezPoints prior to the April 26 snapshot.

As a crypto investor, I’m excited to prepare for the upcoming events surrounding $REZ on April 30th.

— Renzo (@RenzoProtocol) April 30, 2024

The underperformance of Renzo Token on its debut trading day can be linked to the price instability of its EZETH token, which occurred on April 24. This event marked the end of the Season 1 airdrop distribution. Dramatically, the value of EZETH on Uniswap dipped to $688, causing it to deviate significantly from Ethereum‘s price. Consequently, numerous forced sales or liquidations took place due to this price discrepancy.

As a crypto investor, I felt a pang of disappointment when this unfortunate event transpired, as it instilled a sense of unease among investors and prompted many to sell off their REZ holdings in order to minimize potential losses if the token’s value continued to decline. The market turbulence we’ve seen lately only amplified REZ’s downturn, leaving us all bracing for further drops.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-05-01 12:50