What does the launch of the new digital currency mean for the future of XRP and the crypto market?

On April 4, Ripple (XRP) revealed their entry into the stablecoin sector by introducing a new digital currency that is pegged to the US dollar. This move is intended to enhance the stability and user-friendliness of the XRP Ledger.

Ripple intends to support its new stablecoin by holding US dollar deposits, short-term American government securities, and comparable assets. Additionally, there will be regular external audits and monthly disclosures of the coin’s reserve details.

Ripple’s latest action positions it against heavyweights such as Tether’s USDT and Circle’s USDC in the stablecoin marketplace. However, for Ripple’s CEO, Brad Garlinghouse, this is a logical progression, connecting the worlds of conventional finance and cryptocurrency.

Introducing a stablecoin is a logical progression for Ripple, connecting the worlds of conventional finance and cryptocurrency. With:

— Brad Garlinghouse (@bgarlinghouse) April 4, 2024

At launch, Ripple’s stablecoin can be used in the United States, relying on both its XRP Ledger and Ethereum (ETH) blockchain as foundations. Future goals include expanding to decentralized finance (DeFi) systems and international markets.

How did the community react?

People in the community have different views and are making guesses about the impact of Ripple joining the stablecoin market.

A user showed enthusiasm, implying a possible link between Ripple’s stablecoin and the Palau Stablecoin (PSC), referring to a successful past trial collaboration.

One user interprets Ripple’s introduction of a stablecoin as a positive development for both XRP and Ripple’s platform.

It is expected that XRP will bring about advantages like wider applications, drawing in more developers to the community, and enhanced credibility with the US authorities due to their investment in dollars and U.S. securities.

Despite the widespread optimism, there are voices of doubt within the community. One individual has warned against making hasty assumptions that Ripple’s stablecoin will outshine existing heavyweights such as USDC and USDT. They believe the market capitalization may not exceed one billion dollars.

The claim that Ripple’s stablecoin will surpass USDC and USDT is being made prematurely. Its market capitalization is unlikely to exceed one billion dollars. I’d be glad to place a wager if you’re feeling bold.

— 𝕾𝖈𝖆𝖒𝖘 𝖆𝖗𝖊 𝖇𝖆𝖉 (aka. ScamDaddy𝕏) (@ScamDetective5) April 4, 2024

Why a stablecoin now?

Ripple’s decision to launch its own stablecoin stems from several key factors.

Initially, Ripple is involved in a lawsuit with the Securities and Exchange Commission (SEC) concerning the labeling of XRP as a security. Consequently, Ripple has been forced to consider other means to expand and secure its future.

An potential reason why Ripple has launched a stablecoin project is the growing influence of stablecoins in the resurging decentralized finance (DeFi) market.

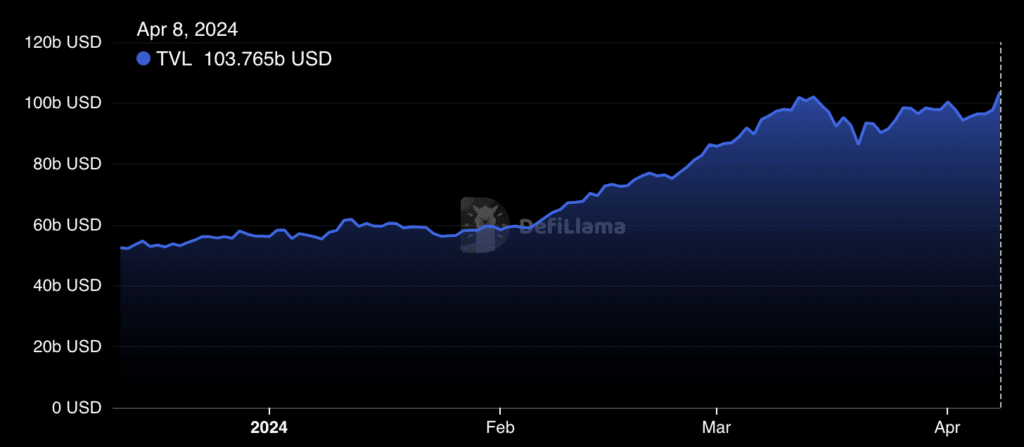

Starting January 2024, the combined value secured on all decentralized finance (DeFi) platforms has grown from approximately $56 billion to $103 billion.

Because stablecoins are crucial for liquidity and trading on decentralized finance (DeFi) platforms, Ripple, being a large owner of XRP, may view this as an opportunity to boost transaction volume on the XRP Ledger.

Monica Long, President of Ripple, emphasized the unique features of the XRP Ledger, including its decentralized exchange and built-in automated market maker capabilities, which are intended to make XRP act as a connecting currency. Long announced that by introducing a reliable stablecoin, Ripple intends to boost usage and progress.

In addition, Ripple’s actions are impacted by the struggles encountered by prominent stablecoin creators, such as Tether and Circle. Notably, there have been occasions when their stablecoins momentarily deviated from the $1 mark.

Additionally, Tether has been subject to various accusations and worries about its involvement in enabling illegal transactions.

A study reveals that among all stablecoins, USDT is the most frequently used in illicit transactions, amounting to approximately $19 billion in suspicious activities. This figure outshines that of other stablecoins such as USD Coin (USDC).

The worry that USDT has been linked to illegal transactions has grown stronger following reports of its involvement in problematic situations in Southeast Asia.

In a UN report published in January 2024, there were noted cases of the digital currency USDT being used for money laundering activities and fraudulent schemes, most notably on illegal online gambling sites based in that area.

These occurrences have brought up worries regarding the reliability and clarity of current stablecoin platforms, leading Ripple to present a new alternative.

What to expect next?

In simple terms, US Dollar Tether (USDT) holds around 70% of the total market share in the stablecoin sector, making it the leading player. For Ripple to match this level of dominance is a challenging feat.

In the congested market of stablecoins, where contenders such as USDC and BUSD are actively seeking the spotlight, Ripple must have a well-thought-out plan and garner broad acceptance to succeed.

Additionally, trust is crucial in the stablecoin market, and a mistake could result in severe repercussions, as demonstrated by Terra UST’s failure.

Comparing situations, Cardano‘s (ADA) endeavor to join the stablecoin sector through Djed in January 2023 is an illuminating example. At first, there was considerable enthusiasm. However, Djed has yet to leave a significant footprint in the market. Currently, its market value amounts to only slightly more than $3 million.

In spite of the obstacles, there’s plenty of potential for fresh ideas and expansion. With the increasing interest in stablecoins, it’s a great time for newcomers to find their place in this growing market.

It remains to be seen if Ripple is up to the task and will leave an enduring mark in this cutthroat industry with time being the decisive factor.

Read More

- Silver Rate Forecast

- Gods & Demons codes (January 2025)

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Superman: DCU Movie Has Already Broken 3 Box Office Records

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-04-08 18:22