As a seasoned crypto investor with a keen interest in Ripple (XRP), I’ve witnessed the token’s volatile price action for years. The recent surge in XRP’s price, which reached $0.5705 on Tuesday, has filled me with a mix of excitement and caution.

Ripple’s price experienced a strong recovery this week, driven by increased whale activity.

As someone who closely follows the cryptocurrency market, I’ve witnessed firsthand Ripple’s (XRP) impressive price recovery this week. The surge in XRP’s value was primarily fueled by heightened whale activity, leading the token to reach a high of $0.5705 on Tuesday – its peak since April 12th. This marked a significant 50% increase from its lowest point this month. The experience of observing such volatility and price swings in the crypto market is both exhilarating and unpredictable, making each day an adventure for those of us invested in it.

As a researcher, I’ve noticed an intriguing correlation between the surge in Ripple’s performance and substantial whale purchases. According to Santiment’s data, large XRP wallets amassed over $300 million worth of tokens between July 12th and 15th.

As a crypto investor, I’ve noticed the significant increase in XRP accumulation during the timeframe of July 7th to 13th, which coincided with a impressive +36% surge in the price of XRP. It would be wise to monitor the actions of these key stakeholders moving forward and observe if they continue to amass XRP, as this could potentially indicate further price movements.— Santiment (@santimentfeed) July 15, 2024

Large transactions like these often indicate that insiders are buying ahead of a major event.

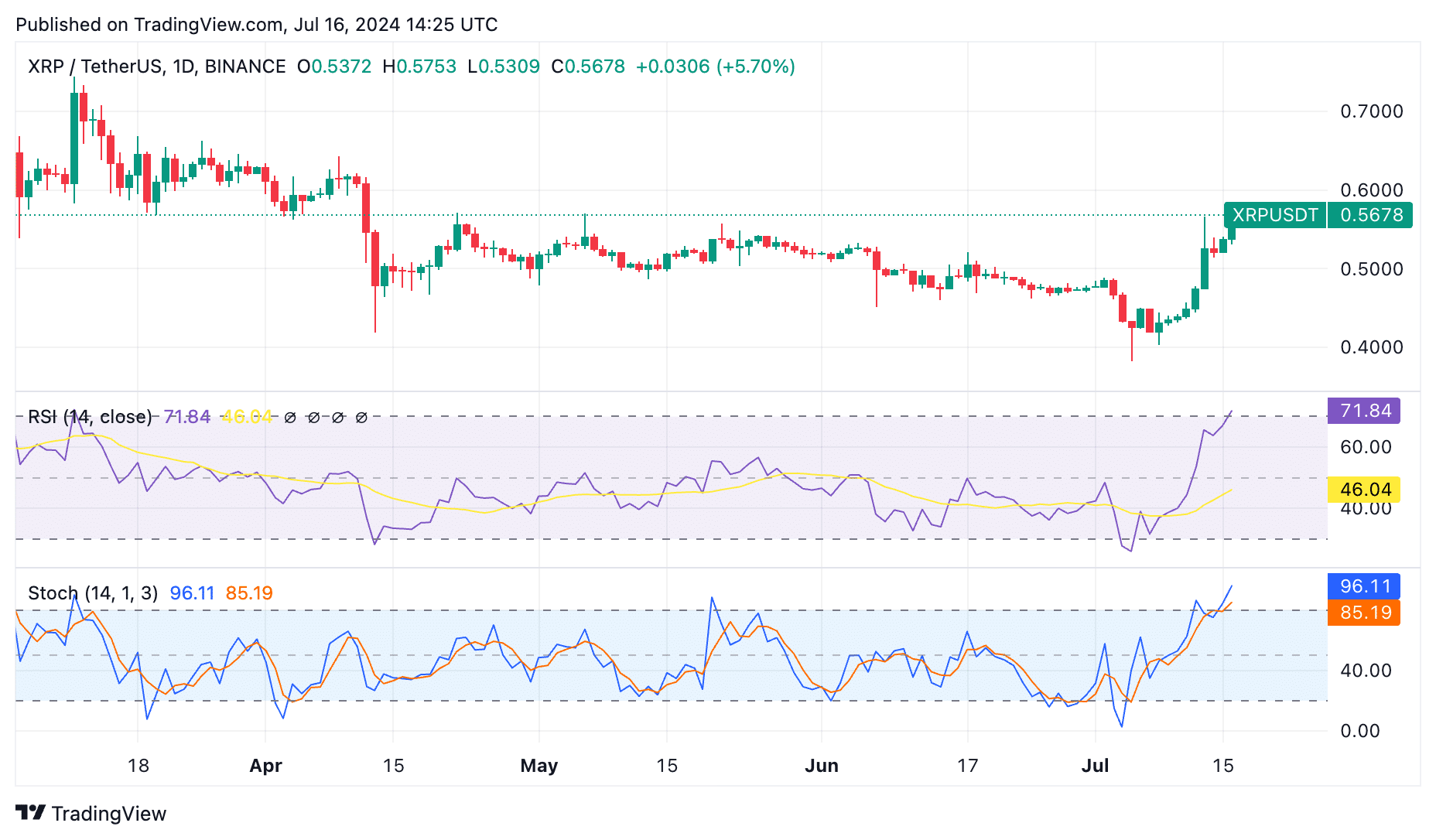

The A/D indicator’s record high on the charts indicates robust accumulation of XRP. Furthermore, XRP has broken through significant resistance at $0.4845, its lowest point in January, and now hovers above both its 200-day and 50-day EMAs. The ADX reading of 34 signifies a notable momentum driving the trend.

The ADX (Average Directional Index) is a widely-used technical analysis tool that assesses the intensity of a trend in financial markets. When the ADX value exceeds 25, it generally indicates that an asset’s price movement is exhibiting strong momentum.

Ripple rises amid risk-on sentiment

In a favorable investment climate, the value of Ripple surged. Concurrently, the US Dollar Index (DXY) dipped from its peak at $106.30 this year to $104.40.

The VIX index currently stands at 13, indicating a relatively calm market, as the Dow Jones, S&P 500, and Nasdaq 100 indices reach new heights. Specifically, the Dow Jones has hit an all-time record of $40,700, while the S&P 500 and Nasdaq 100 are currently trading at $5,640 and $18,500, respectively.

During this period, the majority of cryptocurrencies went up in value. Bitcoin made its first attempt in weeks to surpass the significant barrier at $65,000, while the crypto fear and greed index moved closer to the “greed” threshold.

Although XRP‘s price has surged lately, a potential reversal could occur as the Relative Strength Index (RSI) now stands at 72, suggesting the market is overbought. Additionally, the Stochastic oscillator lines have also signaled an overbought condition.

One potential risk for Ripple lies in its foundational elements. In my previous piece, I noted that Ripple was developed with the intention of simplifying cross-border transactions for businesses within the banking and remittance sector.

Certain firms have discovered that stablecoins or tokenized systems serve as more suitable substitutes than Ripple’s on-demand liquidity solution for some. For instance, MoneyGram, in collaboration with Stellar, facilitates users to transfer and receive USDC stablecoins across borders effortlessly.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-07-16 19:06