As a seasoned analyst with over two decades of experience navigating the tumultuous waters of financial markets, I’ve seen my fair share of legal battles and market swings. The recent ruling in the Ripple v. SEC case has certainly added another intriguing chapter to this ongoing saga.

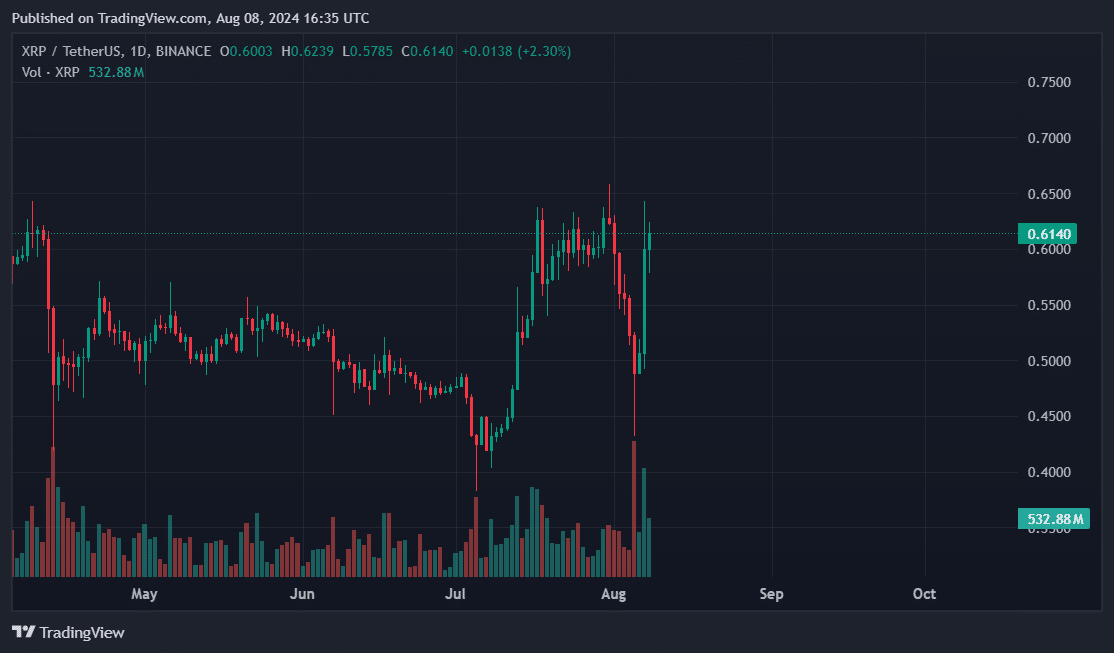

In simple terms, following the verdict in the Ripple vs. SEC case, the crypto market witnessed a significant surge for XRP, similar to a “god candle.” However, the head of AMLBot cautioned that if the Securities and Exchange Commission decides to appeal, this could delay the price’s upward trend.

In the previous year, Ripple’s (XRP) early victory against the SEC sparked a positive response in financial markets. The belief that crypto investments made by retail investors don’t fall under the category of securities gained momentum across the emerging industry, boosting prices. Similarly, the August 7 decision by U.S. federal judge Analissa Torres influenced XRP’s current market position.

At the time of reporting, Ripple had increased by 23%, as investigations by Torres revealed no breaches of federal securities laws in transactions involving retail investors through cryptocurrency exchanges.

Despite being penalized with a $125 million fine by the U.S. Securities and Exchange Commission for selling XRP institutionaly, which was considered as a violation, Ripple was held accountable.

In response to a question from crypto.news on Aug. 8, AMLBot CEO Slava Demchuk stated that if the SEC decides to appeal the case, he believes the price will decrease. However, if the SEC does not pursue an appeal, there’s a possibility we could witness the price increasing.

Ripple and its CEO Brad Garlinghouse celebrate the verdict as a win, but Demchuk predicts that the Securities and Exchange Commission (SEC) may challenge this decision. After a lengthy four-year court battle, an SEC appeal could add more confusion to Ripple’s digital currency, as some believe it functions similarly to a stock.

How Ripple’s ruling impacts future SEC v. Crypto cases

Approximately four months prior to the November presidential elections, Torres delivered his final decision. It’s generally thought that a new government will take office and potentially alter the Securities and Exchange Commission’s (SEC) stance on cryptocurrencies. However, Demchuk expressed a different viewpoint, suggesting that the election outcome is unlikely to significantly shift the SEC’s current approach.

Despite the ruling on XRP, the court’s decision has paved the way for the digital asset sector to contest the Securities and Exchange Commission’s (SEC) assertion that many cryptocurrencies qualify as securities.

According to Demchuk’s perspective, it could be safer to sell tokens through cryptocurrency exchanges instead of doing so directly, as this move might help prevent the token from being labeled as a security.

Examined closely, companies dealing with cryptocurrencies such as Uniswap Labs and ConsenSys (the firm behind MetaMask) might choose to use this example as a defense strategy in their ongoing legal disputes with the Securities and Exchange Commission (SEC).

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-08 19:52