Oh, the comic spectacle of markets: observe, if you please, how the Bitcoin ETFs pirouette upon the stage for a splendid fourth evening, managing a net gain fit only for a miser’s purse—$5 million, all courtesy of Blackrock’s IBIT, while the ether ETFs, with a dramatic sigh, empty their pockets to the tune of $17.6 million. Bravo, sirs! 👏💸

Bitcoin Persists As Ether Pouts—The Comedy of Inflows and Outflows Unfolds!

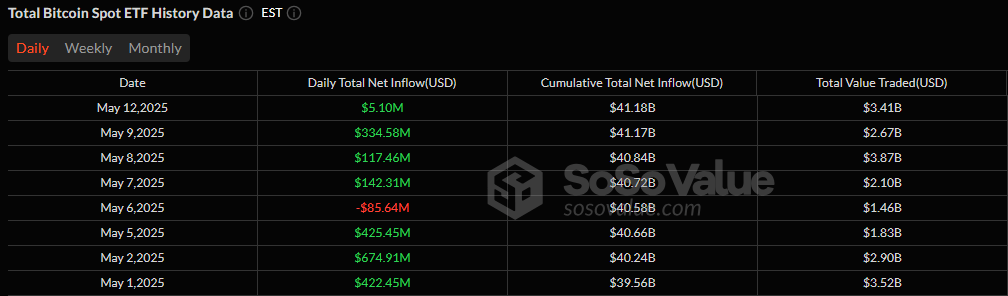

Indeed, the grand ballet slows, yet falters not. Bitcoin ETFs have tiptoed to a demure net inflow of $5.10 million—a streak of four days unbroken! Applause goes solely to Blackrock’s IBIT, which, like the crown prince at a masquerade, has summoned $69.41 million in fresh coin from eager hands. 🎭

Yet behind the scenes, a farce ensues! Grayscale’s GBTC weeps as $32.93 million waltz out the door, Bitwise’s BITB loses $17.73 million with a sigh worthy of a tragic heroine, then Fidelity’s FBTC, tail between legs, forfeits $11.11 million, and Invesco’s BTCO tosses away $2.54 million for good measure. Still, the trading fever rages at $3.42 billion, and all the bitcoin ETFs, outlandish in their finery, strut about with $119.67 billion in net assets. Mon dieu!

Ether ETFs, poor relations in this financial farce, trudge back into the storm: $17.6 million gone! Grayscale’s ETHE was relieved of $9.61 million, Fidelity’s FETH bid adieu to $7.98 million, while the remaining seven ether ETFs sat stone-faced with nary a sou in positive flow. Volume gamely played along at $678.24 million—with net assets left at a less-than-regal $8.46 billion. Perhaps a lemonade stand is in order? 🍋

As the bitcoin ETFs gingerly scale the heights, the ether funds are left with little but splendid exit music. Shall this comedy of errors continue? Who knows! For now, dear reader, the streak staggers on—clown nose firmly in place. 🤡

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

2025-05-13 18:41