As a seasoned crypto investor with a decade-long journey under my belt, I can confidently say that this recent approval by the SEC for Nasdaq to list options for BlackRock’s iShares Bitcoin Trust ETF is nothing short of groundbreaking. My life has been filled with rollercoasters of emotions in the crypto realm, but this development feels like a steady climb up the mountain – finally reaching a plateau that promises unobstructed views of new horizons.

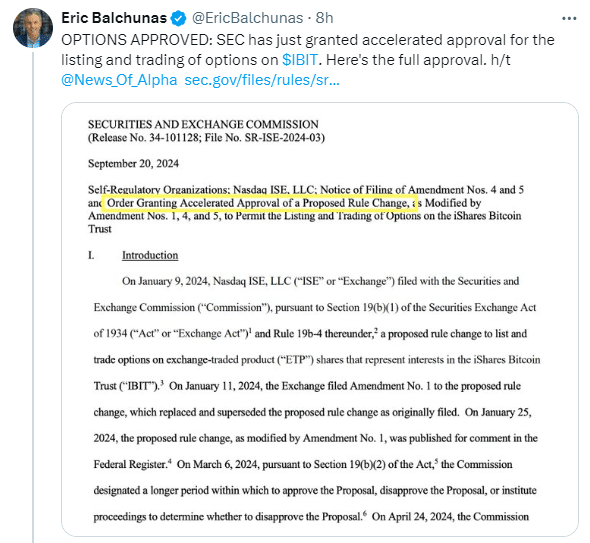

On September 20th, it was announced that the Securities and Exchange Commission (SEC) gave Nasdaq permission to list options for BlackRock’s Bitcoin Trust ETF, known as IBIT. This means that investors can now trade options on this ETF just like they would with other ETFs.

As per the SEC’s announcement, options for the IBIT stock will be settled physically and will adhere to American-type exercise conventions. It’s crucial to note that, according to Nasdaq, these options on IBIT must meet certain criteria to guarantee that the underlying security is broadly owned and frequently traded in the market.

According to Eric Balchunas, an analyst at Bloomberg ETF, he hinted on social media platforms that there might be a surge in approvals for options trading linked to Bitcoin Spot ETFs in the near future.

On the other hand, it’s worth mentioning that both the Office of the Comptroller of the Currency (OCC) and the Commodity Futures Trading Commission (CFTC) are required to grant their consent before trading can commence officially. The timeframe for their decisions remains unclear.

During August, the trading volume for the IBIT Bitcoin ETF surpassed $875 million, making up more than a third ($1.3 billion in total) of the trading volume for all Bitcoin investment products that trade on the spot market.

The Nasdaq is planning to obtain approval from the Securities and Exchange Commission (SEC) to enable options trading for Ethereum Exchange Traded Funds (ETFs) that track the price of spot Ethereum, signaling a rising appetite for financial instruments tied to cryptocurrencies.

Obtaining this approval signifies a substantial advancement in broadening investment possibilities for Bitcoin traders, and it underscores the growing recognition of digital assets within conventional financial systems.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-09-21 08:57