As a seasoned researcher immersed in the dynamic world of digital assets and blockchain technology, I have witnessed firsthand the tumultuous relationship between regulatory bodies like the SEC and the rapidly evolving crypto industry. The aggressive enforcement actions by the SEC against crypto firms over the past decade are nothing short of staggering, with the staggering settlements reaching an unprecedented $7.42 billion to date.

This year, a significant portion of the vigorous legal actions taken by the SEC against digital assets have resulted in multi-billion dollar settlements.

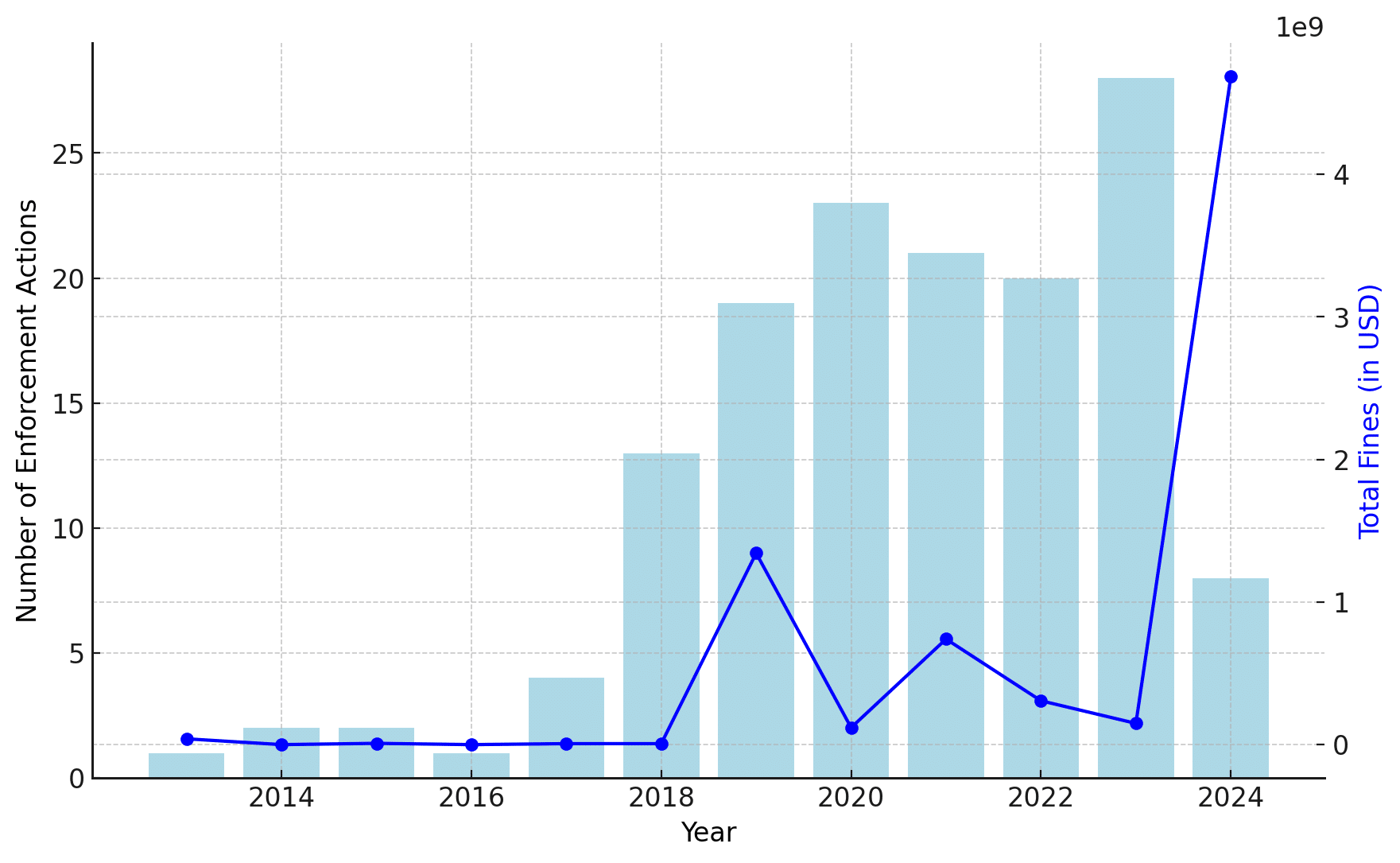

Ever since the U.S. Securities and Exchange Commission started keeping a closer eye on the emerging crypto market back in 2013, fines imposed on crypto companies have accumulated to an astounding $7.42 billion, as per a study from Social Capital Markets that I recently came across on crypto.news.

In 2024, a significant portion – about 68% or $4.68 billion – of the SEC’s total penalties throughout its history were imposed on cryptocurrency companies, reflecting the agency’s increased enforcement efforts in the Web3 sector.

In an unprecedented move, the Securities and Exchange Commission (SEC) and Terraform Labs, led by Do Kwon, reached a monumental settlement worth $4.68 billion. This settlement surpasses the previous record set by the U.S. Justice Department, Binance exchange, and its founder, Changpeng Zhao, who agreed to a $4.3 billion settlement in 2023.

In 2023, the SEC saw a surge of activity in cryptocurrency-related enforcement cases. Not only did they handle 11 cases that year, but it was also their busiest period yet. During this time, they brought charges against 30 Web3 service providers and managed to recover $150 million through settlements.

SEC suits jumped since 2018

2018 saw a significant increase in the SEC’s enforcement actions against cryptocurrency entities, making it the first year that fines imposed on digital asset companies exceeded ten.

By the year 2019, the typical annual fine for crypto businesses saw an unprecedented surge of approximately 20 times, mainly because of a massive $1.2 billion civil penalty levied on Pavel Durov’s Telegram Group Inc. and its affiliate, The Open Network (TON) Issuer, which triggered this increase.

The sequence of lawsuits indicates that the Securities and Exchange Commission (SEC) has been implementing its “enforcement-focused regulation” strategy even before Gary Gensler became chairman.

For numerous individuals in web3, the name Gary Gensler is often associated with strong anti-cryptocurrency regulatory discourse. In fact, during the 2024 Bitcoin (BTC) conference, over 20,000 attendees enthusiastically cheered former President Donald Trump’s promise to dismiss Gensler if he were re-elected.

Currently, I, as a researcher, find myself in a context where Gensler persists as the head of the Securities and Exchange Commission (SEC). The agency’s operations continue to focus on a wide-ranging clampdown within the cryptocurrency sector. This joint effort has gained significant attention and become infamous under the name “Operation Choke Point 2.0.

As a researcher delving into the world of cryptocurrencies, I’ve noticed that entities such as Coinbase and Ripple (XRP) find themselves embroiled in legal disputes with the Securities and Exchange Commission (SEC). Notably, Chair Gensler has expressed his viewpoint that the majority of digital assets fall under the classification of securities. This implies that these assets may not be in compliance with existing federal laws due to their non-compliance status.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- USD JPY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-09-09 19:47