As a seasoned analyst with over two decades of experience in global financial markets, I have witnessed numerous monetary policy shifts by central banks and their impact on various asset classes, including cryptocurrencies. The recent call by Senators Warren, Whitehouse, and Hickenlooper for an aggressive rate cut by the Federal Reserve is not unprecedented, but it underscores growing concerns about the U.S. economy’s health.

Despite talk of a robust American economy, three Democratic senators have advocated for the Federal Reserve to adopt a bold change in its monetary policy strategy.

Senator Elizabeth Warren from Massachusetts, who is skeptical about cryptocurrencies, urged the Federal Reserve and its chair, Jerome Powell, to decrease interest rates by 0.75 percentage points as a means to reduce the threat of recession. In their joint letter with Senators Sheldon Whitehouse and John Hickenlooper, they cautioned that smaller reductions in funding could lead to economic downturns.

If the Federal Reserve moves slowly in reducing interest rates, there’s a chance it could unnecessarily push our economy towards a recession. Many economists have been warning about this risk since July, emphasizing that the Committee should take more proactive steps in lowering rates initially to protect the job market from potential dangers.

Sen. Elizabeth Warren to Fed on rate cuts

On September 16th, the issued document arrived within two days prior to the upcoming Federal Open Market Committee meeting, which was scheduled for Wednesday, the 18th of September.

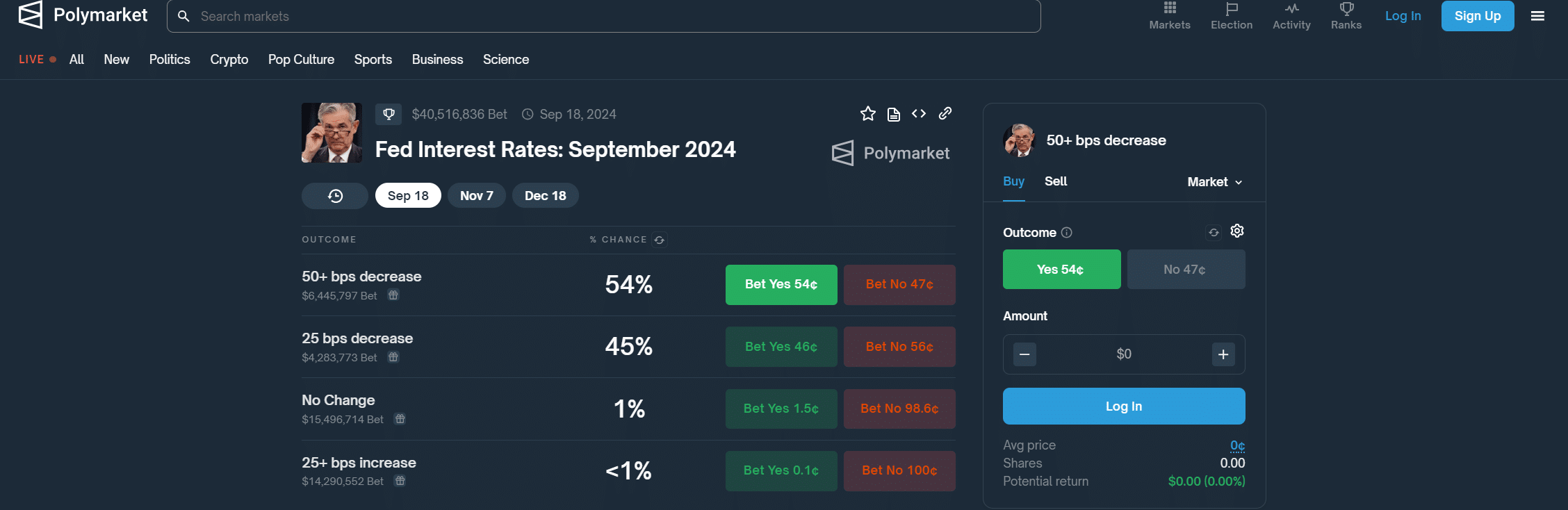

Market predictions suggest that Federal Reserve Chair Jerome Powell may shift towards a more accommodative stance (dovish pivot) during the FOMC meeting. However, it’s still uncertain at this point what specific interest rate reduction the central bank is leaning towards.

What are the odds?

According to the CME FedWatch tool, there is approximately a 61% chance of a 0.5 percentage point decrease in interest rates and a 39% chance of a smaller 0.25 percentage point adjustment. A week ago, the tool indicated only a 14% possibility of a larger 0.5 percentage point cut in interest rates.

On crypto forecasting platforms, there was significant support for the 50 basis point adjustment option. According to Polymarket’s data, there was a 53% likelihood of a 50 bps announcement, with a 45% chance of a 25 bps change following. Previously, users had predicted a 78% probability of a 25 bps shift. Users have placed bets totaling over $40.5 million via the Polygon-based platform concerning this month’s FOMC decision.

Fed cut impact on crypto market

If the Federal Reserve follows predictions and reduces interest rates, financial experts anticipate that funds will move towards riskier investments such as cryptocurrencies. There’s ongoing discussion among market participants about what a more aggressive or moderate shift in policy might mean for the Fed’s perspective. A stronger shift could signal economic downturn concerns, while a more moderate one may indicate a better control over inflation.

As a researcher, I find myself reflecting on the words of Horizen Labs CEO and co-founder, Rob Viglione, who recently shared his insights with crypto.news. He suggested that the anticipated Federal Reserve rate cut could potentially spark a bullish fourth quarter for digital assets such as Bitcoin (BTC) and Ethereum (ETH). It’s interesting to note that traditionally, the fourth quarter has shown higher cryptocurrency prices compared to mid to late third quarters.

For a while, there might be a significant increase in prices, particularly for Ethereum and Bitcoin. However, this short-term spike may lead to increased market instability. In the long haul, an extended period of low interest rates could foster more creativity and investment in blockchain technology and crypto-related businesses.

Rob Viglione, Horizen Labs CEO and co-founder

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-09-16 19:47