🚨 SHIBA INU: The Great Shift 🚨

- The unwavering resolve of the Shiba Inu faithful has been on full display, as long-term holders rose 7.5% in the face of falling prices.

- The large holder netflows, once a harbinger of doom, have reversed sharply negative, down 212% over the quarter.

As the seasons change, so too do the fortunes of the Shiba Inu investor ecosystem. In Q1 2025, a seismic shift has occurred, leaving the once-mighty short-term speculative trading in its dust.

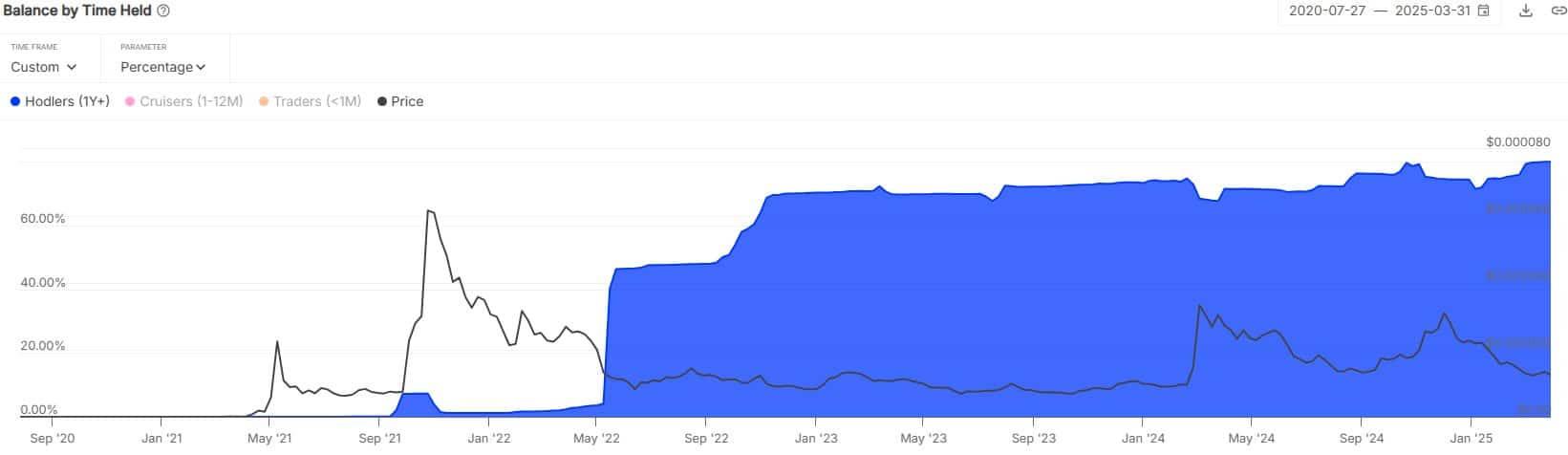

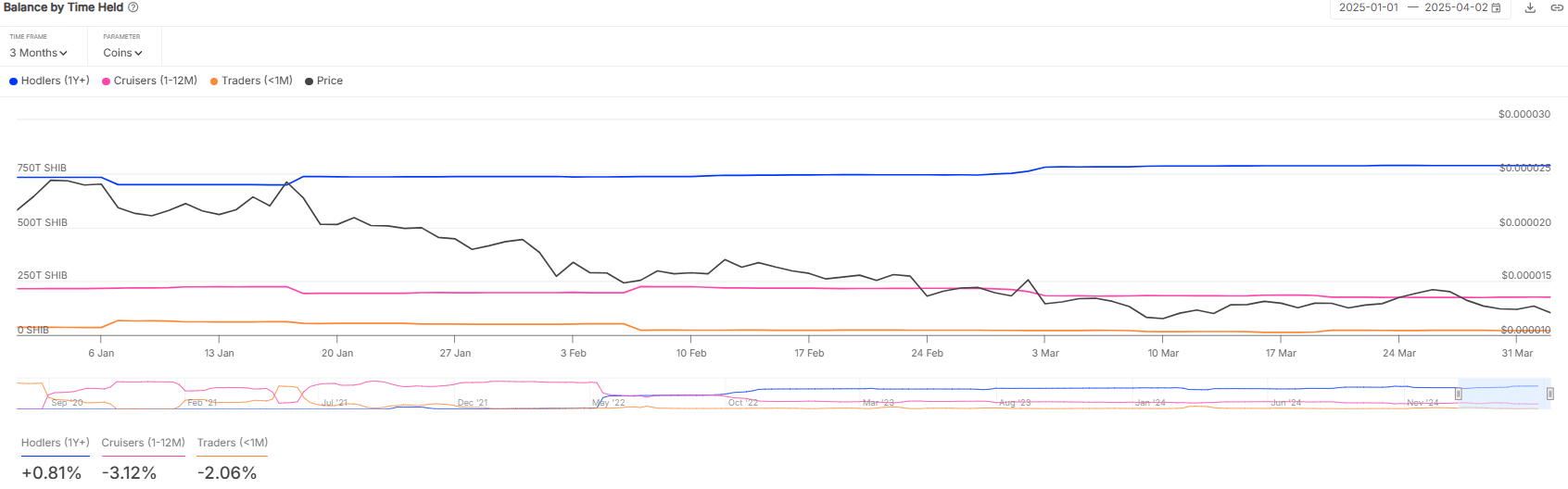

According to the sage analysts at IntoTheBlock, long-term holders now command a staggering 80% of the total SHIB supply. It is as if the very fabric of the memecoin’s existence has been transformed, leaving behind the fleeting whims of the speculative traders.

The Diamond Hands Have Spoken

It appears that the wise and patient long-term investors have emerged victorious, their unwavering conviction a beacon of hope in a sea of uncertainty.

A comprehensive analysis of wallet behavior reveals a consistent growth in SHIB holdings by long-term investors, those stalwart souls who have held on for more than a year.

SHIB whales, those mighty behemoths of the Shiba Inu universe, increased their holdings by 7.5% in Q1 2025, despite a 45% price drop. Their wallets, once overflowing with tokens, now bulge with an impressive 787 trillion SHIB.

In contrast, the mid-term holders, those fickle creatures of the crypto realm, cut their positions by 18%. The short-term traders, those fleeting spirits of speculation, saw their holdings plunge by 43%, shrinking from 36 trillion to just under 21 trillion SHIB.

The Great Exodus

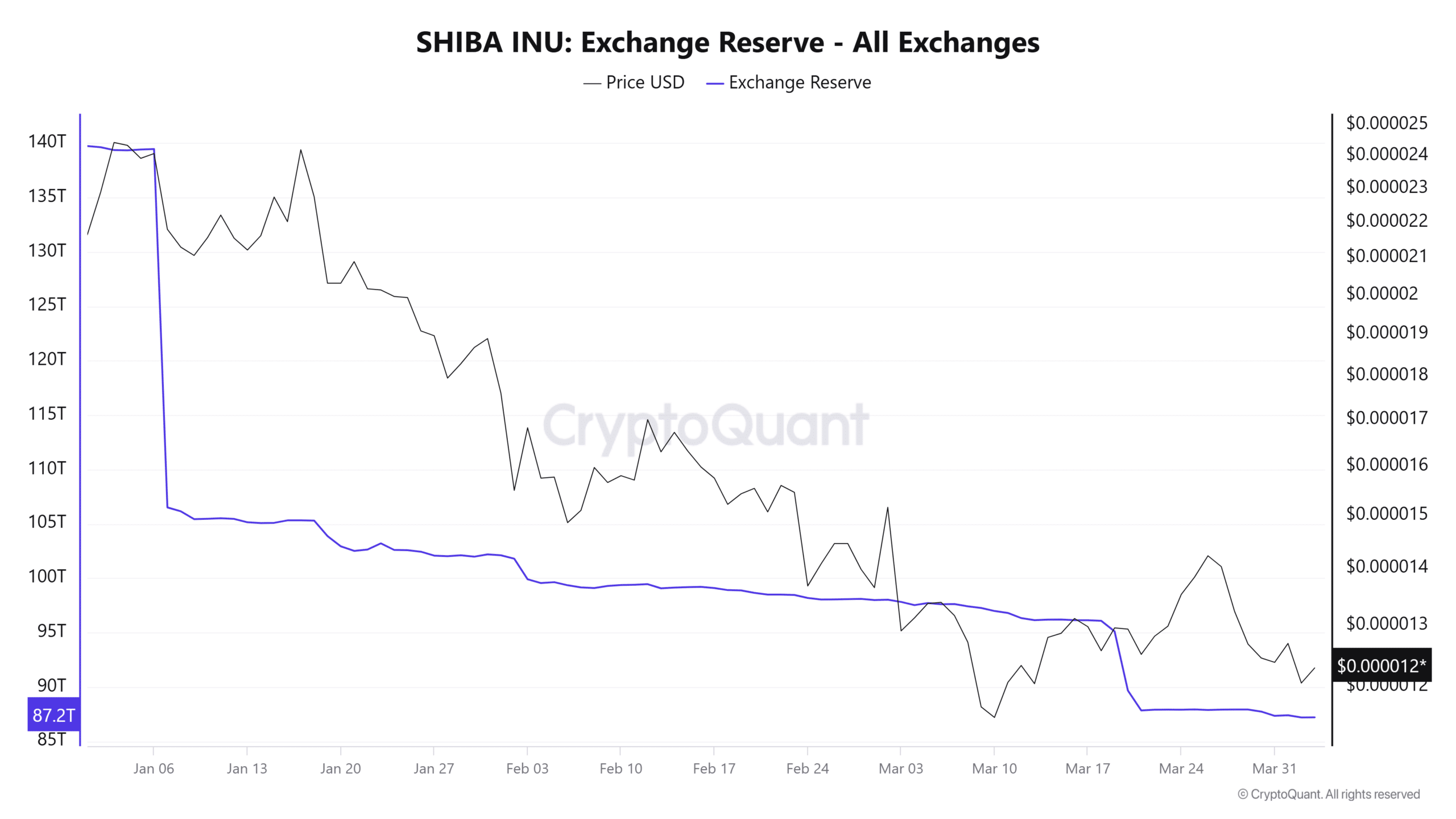

Supporting this behavioral pivot, data from CryptoQuant reveals that SHIB exchange reserves dropped 37.6%, from 139.7 trillion to 87.2 trillion in the same period.

This sharp outflow suggests a tightening of sell-side liquidity, a phenomenon typically seen as bullish in volatile conditions.

Yet, despite this trend, SHIB’s price continued to fall, a testament to the influence of larger market forces or insufficient demand.

The Whales’ Dilemma

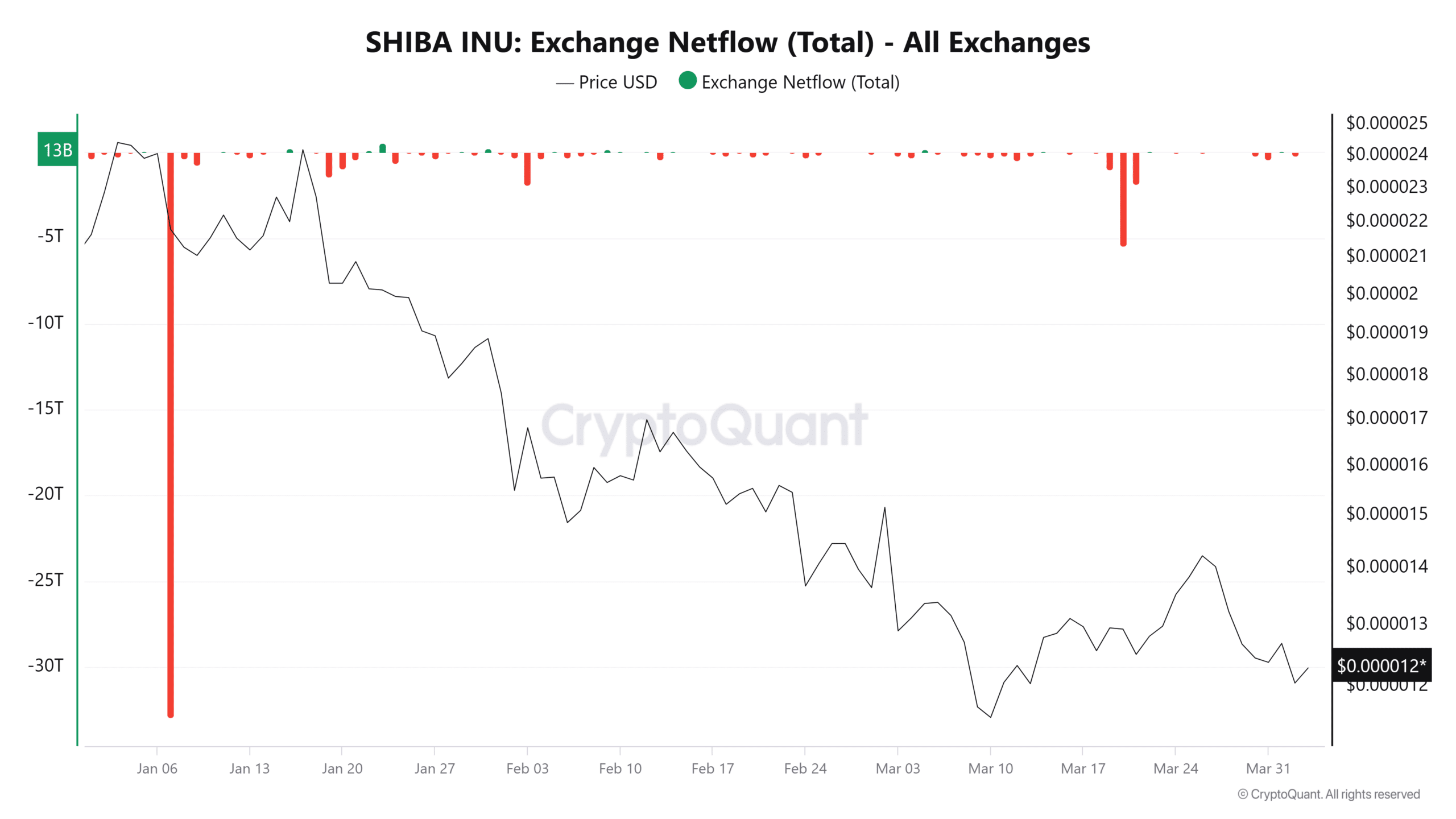

Further complicating the narrative, IntoTheBlock’s large holder netflow data reveals conflicting behavior.

On the 6th and 7th of January, inflows soared as over 33 trillion Shiba Inu entered exchanges.

Netflows then plunged by more than 212% through February and March. Yet SHIB’s price held steady, hinting that whale moves no longer dictate the market.

Despite this massive swing in large holder behavior, SHIB’s price remained mostly stable during high-volume events.

This decoupling suggests that whale movements may no longer hold the sway they once did—or that other factors, like retail sentiment or broader market conditions, are taking precedence.

Retail sentiment and broader conditions appear to override big-player influence, suggesting a more mature market. Speculative trading has slowed, while accumulation has strengthened.

Buy the Dip or Exit the Ship?

CryptoQuant data shows two major netflow spikes.

For example, on the 7th of January, 32.94 trillion SHIB flowed into exchanges, then prices slid to $0.0000218. As well as, on the 2nd of March, a 33.84 trillion SHIB influx preceded a drop to $0.00001516.

These deposits often signal large sell-offs, suggesting strategic repositioning by major holders. Despite these events, exchange reserves shrank, indicating whales’ sales were overshadowed by ongoing withdrawals.

The Calm Before the Climb?

SHIB’s daily chart, despite an 18% drop, remains above key support. On-balance volume shows growing accumulation.

Holding durations are rising, exchange reserves are shrinking, and netflows point to structural change.

Long-term holders now dominate supply, while speculative players wane. Though price has struggled in early 2025, behavioral data suggests strengthening confidence.

If accumulation persists and exchange liquidity tightens, Shiba Inu could see more stable market behavior soon.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2025-04-03 16:14