It appears that a jovial band of crypto enthusiasts are spinning yarns about the Grand Old Fed, whispering that our dear monetary wizard might soon deliver a rate cut. All this hoopla stems from an offhand remark by one Neel Kashkari, the ever-dashing head of the Minneapolis branch. 😏

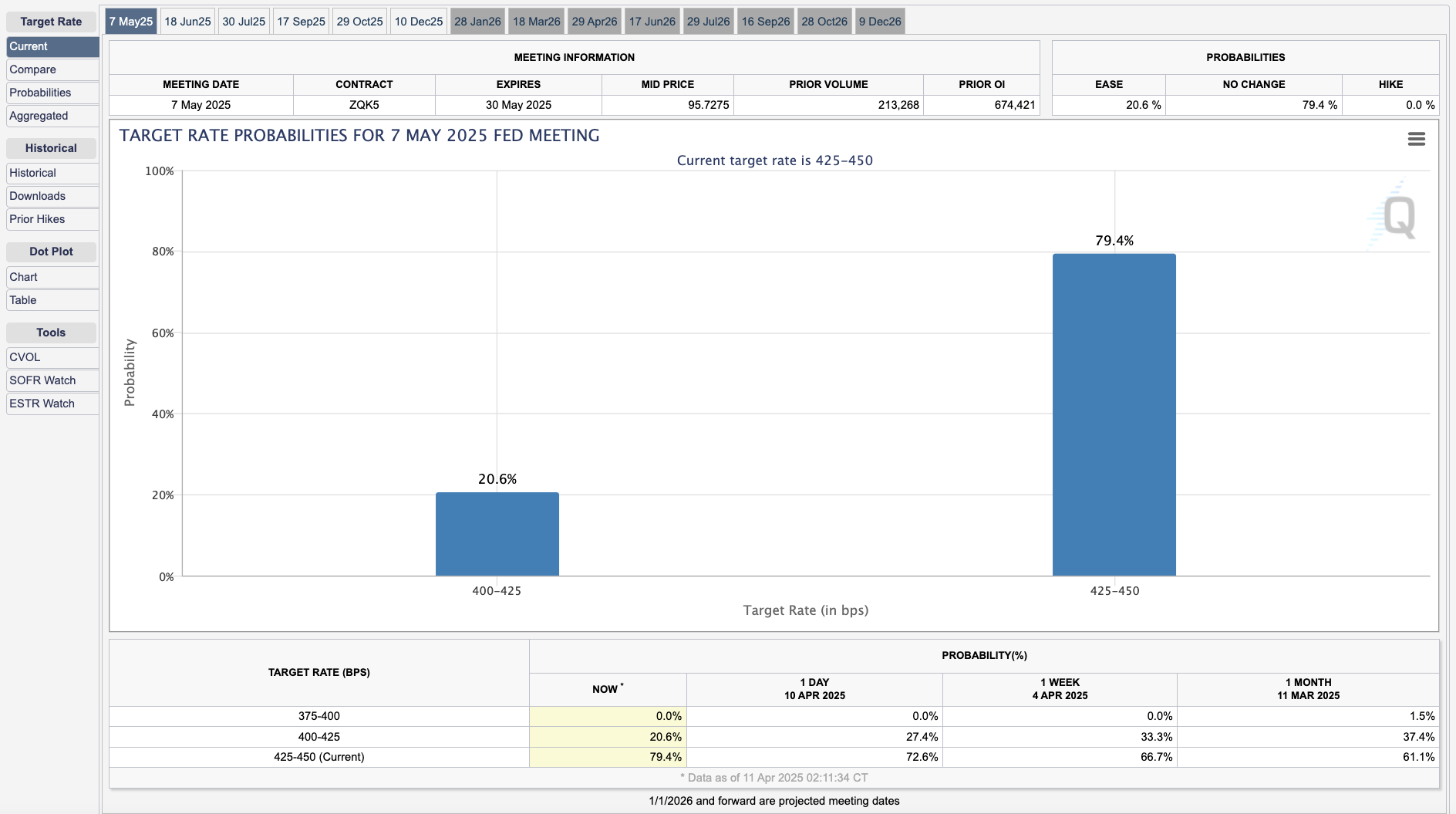

Meanwhile, Miss Susan Collins, leader of another regional Fed establishment, has most decidedly quashed such ambitions—declaring rate cuts as likely as a quiet afternoon in Blandings. The number crunchers at CME reckoned the probability at a mere 20.6%.🤷♂️

Rampant Rumors and Market Mayhem

With Trump’s tariffs throwing a spanner in the works and causing market kerfuffles, the crypto fraternity has been desperate for a champion in high places. The ever-repeating hope of a magical rate cut has now become as fanciful as a Jeeves-ready plan to fix a wonky teapot.

During a lively CNBC chinwag, our friend Kashkari let slip some remarks that—when taken out of context—ignited an epidemic of cheeky speculation:

“There are tools there to provide more liquidity to the markets on an automatic basis that market participants can access, in addition to the swap lines you talked about for global financial institutions. Those tools are absolutely there,” he declared with the nonchalance of a chap remarking on a fine day stroll.

Not long after, several prominent crypto characters began parading parts of this quote as if it were the latest catchphrase in town, insinuating that the Fed was on the brink of lowering rates to stave off economic mayhem. What a jolly jest! 😆

These rather misguided claims amassed thousands of views and reposts, with some even suggesting that the Fed was about to embark on a money-printing spree.

In truth, Kashkari’s complete address made clear that his so-called “tools” were simply measures aimed at domestic inflation and employment, rather than a wild adventure in global trade. In short, tariffs or no tariffs, the chance of a rate cut remains as slim as a Wimpy’s chance in a boxing match.

After the rumor mill had had its fun, another notable Fed honcho shed light on the subject of these monetary implements.

In a subsequent chat with the Financial Times, Miss Susan Collins of Boston declared in no uncertain terms:

“We have had to deploy quite quickly, various tools [to address the situation.] We would absolutely be prepared to do that as needed. The core interest rate tool we use for monetary policy is certainly not the only tool in the toolkit, and probably not the best way to address challenges of liquidity or market functioning,” she proclaimed with the finality of a well-timed quip.

Both Collins and Kashkari, regally at the helm of their respective Fed salons, made it quite clear that a rate cut is not on the horizon. And yet, like a mischievous cricket in the lounge, social media continues to chirp out its own version of events. 😜

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2025-04-11 23:22