As a seasoned analyst with over two decades of experience in the financial industry, I have witnessed the evolution of finance from traditional brick-and-mortar institutions to digital platforms. However, nothing quite compares to the revolutionary potential that Singularity Finance brings to the table. The convergence of AI, blockchain technology, and real-world assets is not just a novel concept; it’s a game changer.

Picture a world where you can effortlessly invest in familiar territories like real estate, but with the rapid pace and technological prowess of today’s advancements. That’s exactly what Singularity Finance aims to create.

The fusion of Artificial Intelligence (AI) and blockchain technology is quickly advancing, and this revolutionary system aims to convert tangible real-world assets into digital tokens (TRWATs), thereby merging them seamlessly with the AI marketplace. This creates an array of opportunities for both investors and developers.

First, let’s examine the current financial market landscape, and then we’ll discuss Singularity’s key role in determining the future direction of finance.

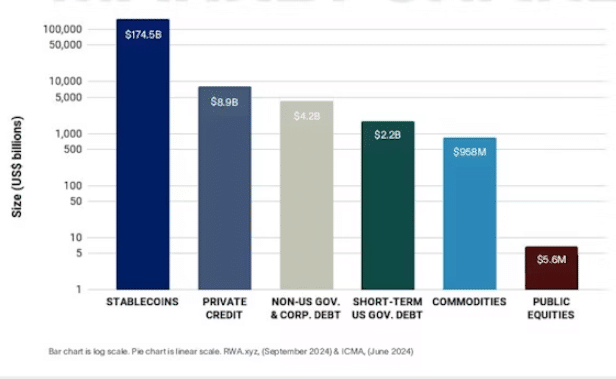

Over the past couple of years, investors worldwide have come to appreciate the value of digital assets that represent real-world items (tokenized real-world assets or TRWAs). For example, stablecoins have experienced an astounding surge by over 3800% in a mere four years. Notably, the market share of these tokenized assets has also risen significantly by approximately 90%.

As a crypto investor, I’ve been impressed by the rapid growth of this relatively new sector. It’s hard to believe it’s only been around, but it’s amassed a significant value of $186 billion so far – that’s an impressive 32% increase just this year! The surge behind RWA tokenization is undeniable, with some sub-sectors experiencing extraordinary growth recently.

To illustrate, the Real World Assets (RWA) lending market has experienced an incredible surge, rising from approximately $95 million in February 2021 to more than $10.7 billion in February 2024. This represents a mind-boggling growth of over 11,163% within just three years.

In the same vein, it’s anticipated that the digital real estate market could be worth approximately $26 billion by 2034. Consequently, prominent financial organizations such as Goldman Sachs, BlackRock, and JPMorgan Chase have significantly increased their investments in this area. Notably, a recent poll indicates that an impressive 86% of Fortune 500 leaders acknowledge the potential advantages of tokenization.

In the midst of this expansion, a noteworthy project capturing the interest of numerous investors and cryptocurrency aficionados is Singularity Finance. This project is an EVM-compatible Layer 2 (L2) solution, aimed at tokenizing and seamlessly merging the AI economy into a single, comprehensive platform.

Singularity Finance aims to unite three distinct realms – Artificial Intelligence (AI), Regulated Financial Institutions (RWAs), and blockchain technology. This unique union is designed to improve the effectiveness and efficiency of on-chain applications, paving the way for a groundbreaking epoch in decentralized financial services empowered by AI.

Singularity Finance’s testnet set to go live

Recently, Singularity Finance unveiled plans for the launch of their testnet, scheduled for December 30th, 2024. This upcoming event will see the initiation of a three-month campaign, incentivized to attract and empower developers. They are presented with an exceptional chance during this period to actively participate.

- Stress-test the network

- Provide valuable feedback

- Actively shape the future of decentralized AI-powered financial services

According to Cloris Chen, co-founder and CEO of Singularity Finance, launching our testnet is a significant move towards making the rapidly growing AI economy accessible to everyone. By connecting DeFi with AI-based assets that can be traded as tokens, we’re not just developing a new blockchain; instead, we’re nurturing an environment where finance and artificial intelligence intersect, opening up unparalleled possibilities.

Beyond that, developers can expect an effortless integration process, complemented by tools they’re accustomed to when it comes to deploying smart contracts. Moreover, a robust incentive scheme complete with interactive rankings is implemented to foster ongoing engagement.

The test network offers developers an effortless way to join and uses familiar systems for the deployment of smart contracts. Furthermore, it encourages active involvement with a well-structured incentive scheme featuring changing rankings. Developers can accumulate points by engaging in numerous tasks, such as:

- Completing transactions

- Testing features

- Contributing to the community

The testnet points can be transformed into real-world advantages on the mainnet, providing an immediate route for early adopters to secure a substantial advantage in the Singularity Finance system.

Fueled by strategic partnerships

For several months now, Singularity Finance has been leading the charge in the Real-World Assets (RWA) and Artificial Intelligence (AI) market by forging significant collaborations. One such partnership is with the world’s largest volume-wise web3 accelerator, Outlier Ventures.

Through partnership, the RWA Base Camp Accelerator was created – a 12-week initiative that offers selected startups a financial investment of $100,000 together with extensive mentorship. Additionally, they will have access to workshops focusing on essential business development areas including legal structures, token creation, and community management.

A notable collaboration was formed with Rebalance Finance, a Decentralized Finance (DeFi) platform that leverages AI for optimizing the distribution of stablecoins into tokenized RWAs. This partnership has improved the liquidity options within the ecosystem, providing users with a stable yield generation experience and simplifying the tokenization process.

To wrap things up, in the early part of this year, Singularity Finance teamed up with Kommunitas, a crowdfunding platform that operates on a decentralized model and has managed to amass over $20 million through 200 Web3 projects so far. Additionally, Particula, an analytics platform boasting support for over 1,000 tokens and 20+ asset classes, has been incorporated into Singularity’s service offering. This integration aims to empower users with more data-driven decision-making capabilities.

The future of DeFi and AI

At a glance, it appears that Singularity Finance’s primary goal revolves around tokenizing essential elements within the artificial intelligence (AI) value chain. This encompasses the monetization of AI computing resources, fostering the development and exchange of AI-generated assets, and providing users with enhanced control over their data in the AI environment.

The far-reaching effects of this technological integration are significant, as Singularity Finance aims to disrupt conventional investment boundaries, potentially revolutionizing the way the world engages financially on a global scale.

Moving forward, it’ll be intriguing to observe the realization of the company’s aspirations for a financially inclusive, open, and tech-driven future. This could potentially reshape the way investors perceive value within a progressively digital landscape.

Also Read : Stablecoin Yield-As-A-Service vs Yield-Bearing Stablecoins: Which Is Best?

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-12-10 18:45