As a seasoned analyst with years of experience navigating the tumultuous seas of the cryptocurrency market, I can say with confidence that this latest dip in Bitcoin’s price has sent ripples felt far and wide across the crypto landscape. The market capitalization dropping by 2.3% within a day is a stark reminder of how interconnected these digital assets are.

Historically, fluctuations in Bitcoin‘s value have had a ripple effect on the entire cryptocurrency market, often creating uncertainty about the performance of alternative cryptocurrencies.

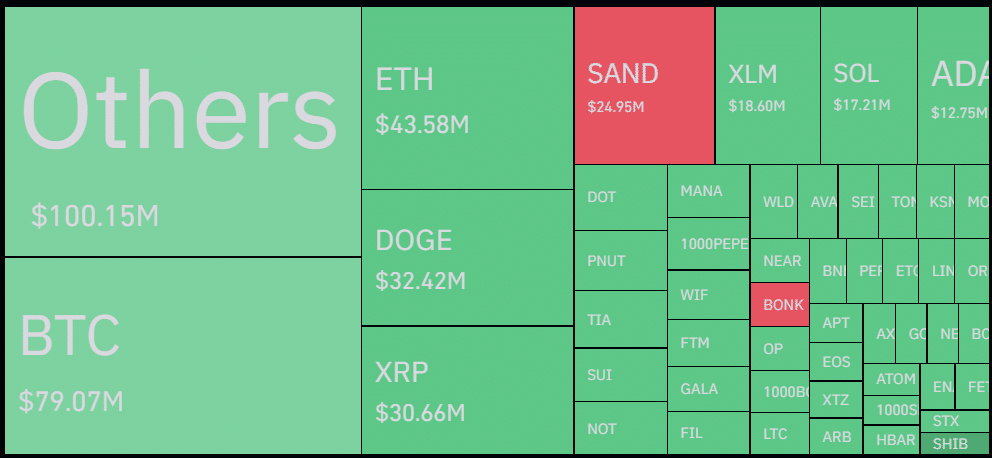

Currently, Bitcoin’s (BTC) dip below the $98,000 threshold has triggered a broad market slump, particularly affecting smaller-cap altcoins. Over the last 24 hours, the total value of the global cryptocurrency market has decreased by approximately 2.3%, dropping to an estimated $3.47 trillion based on data from CoinGecko.

As an analyst, I observed a significant drop in the cryptocurrency market value, dipping to approximately $3.38 trillion on a daily basis. This decline represented a substantial loss of over $120 billion. However, the market soon demonstrated a reversal, regaining upward momentum once more.

As a result, the overall value of crypto liquidations climbed up by 35% to reach approximately $494.5 million, as per Coinglass’ data. Out of this total amount, around $366 million represent long positions, while the rest, about $127.8 million, are short positions.

In the past day, small-scale alternative cryptocurrencies (altcoins) saw more than $100 million worth of positions being liquidated, with $83.7 million in long positions and $16.4 million in short positions. This amount exceeds Bitcoin’s liquidations for the same period, which totaled approximately $79 million, consisting of $56.4 million in long positions and $22.6 million in short positions.

According to data provided by Coinglass, The Sandbox (SAND) is the only major altcoin with dominating short liquidations as its price registered a 31% rally over the past day. Bonk (BONK) also has a slightly bullish liquidation map due to its wild roller coaster ride between $0.0000431 and $0.0000486.

As a crypto investor, I noticed that the prominent altcoin, Ethereum (ETH), saw a whopping $43 million worth of liquidations in the last 24 hours, with long positions taking the lead. Consequently, Ethereum dropped by 1.1%, settling at $3,385.

As an analyst, I’ve observed a striking pattern in recent liquidations within the cryptocurrency exchange market. Specifically, Binance, OKX, and Bybit are dominating with liquidations amounting to approximately $216 million, $120 million, and $116 million respectively.

The biggest sale, valued at approximately $13 million, involving Bitcoin (BTC) and Tether (USDT), took place on Binance, which is known as the leading cryptocurrency exchange in terms of trading volume.

Notably, given the excessive and avaricious market atmosphere, it’s quite typical that we’re experiencing a correction across the board now.

A new surge in Bitcoin’s price growth might ignite even stronger optimism among investors, which could also influence the performance of other cryptocurrencies.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

2024-11-25 10:12