As a seasoned crypto investor with a decade-long journey through the digital asset landscape, today’s market turmoil feels like a rollercoaster ride I never wanted to hop onto again. The massive liquidations we witnessed today are a stark reminder of why risk management is crucial in this unpredictable world.

In a single day, the cryptocurrency market experienced an extraordinary surge, as indicated by liquidation figures showing that over 200,000 traders were forced to sell their holdings. This resulted in a significant reduction in the total market capitalization.

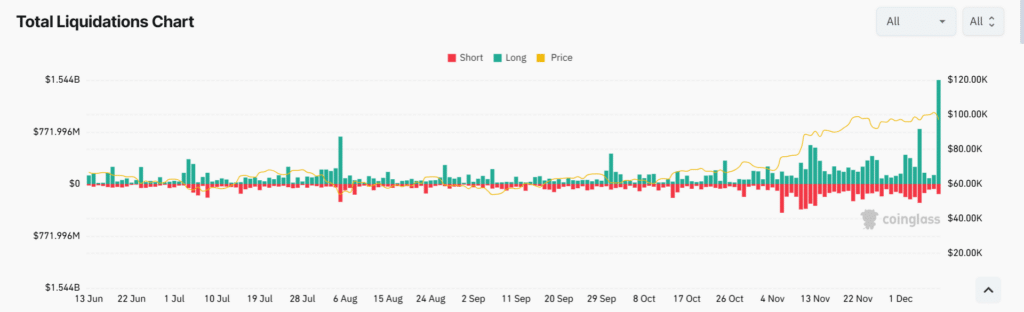

Based on information from CoinGlass as of December 10th, there have been significant liquidations in the market this year, with approximately $1.7 billion being lost during a single trading day. As I write, roughly $1.53 billion has been invested in long positions, while short positions have seen about $155 million in spending.

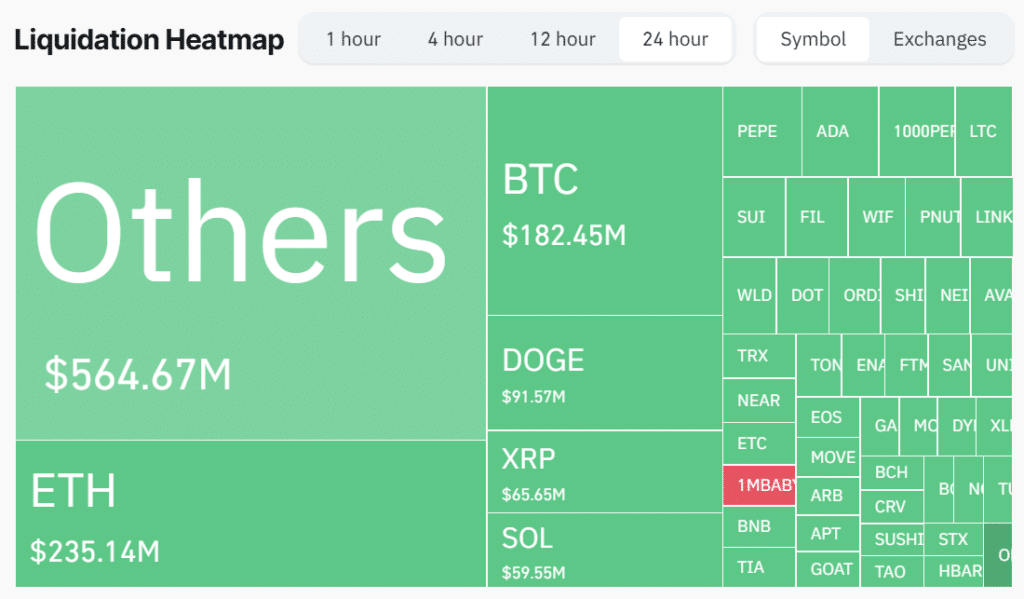

In the past 24 hours, small-cap cryptocurrencies are responsible for the majority of liquidations, totaling approximately $564 million. The overwhelming majority of these liquidations, around $543 million, were from long positions, while short positions accounted for a relatively minimal $21 million. An estimated 500,000 traders have experienced losses today.

Ethereum (ETH) is the next token that saw major liquidation with $235 million – $214 million longs and $21 million shorts. The token dropped 7% from the highest level of the day to $3,686.

The Bitcoin (BTC) market has experienced approximately $182 million worth of liquidation, with $140 million being long positions and $42 million being short ones. Furthermore, the value of Bitcoin has dipped below the symbolic $100,000 threshold, currently sitting at around $96,652 after a day’s trading.

As an analyst, I’ve observed some significant liquidation events across major cryptocurrency exchanges. Binance led the pack with over $739 million in total liquidations, which was staggering. Following closely were OKX and Bybit, reporting liquidations of approximately $422 million and $369 million, respectively. Notably, the single largest liquidation occurred on Binance involving Ethereum-USDT, amounting to a substantial $19.69 million.

Additionally, the market capitalization decreased by 6.62%, amounting to $3.44 trillion, and the trading volume surged by 113% to reach $313 billion over the course of a single trading day.

Massive crypto liquidations in a year

Today’s cryptocurrency liquidations set new records for the past year, or represent the biggest liquidations since 2021, following a significant surge in several digital assets, including Bitcoin and Ripple (XRP), which have experienced rapid price increases.

Over the past month, I’ve noticed a substantial surge of approximately $500 million within just a few days, suggesting a wave of fresh crypto investors flooding the market. Furthermore, it seems that liquidations have been on an upward trajectory throughout the year.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD JPY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-12-10 02:32