As a seasoned analyst with over two decades of trading experience under my belt, I’ve seen markets soar and plummet like a rollercoaster ride through Crypto Valley. This recent $170-billion recovery in the cryptocurrency market is reminiscent of a phoenix rising from the ashes, and it’s always intriguing to see which coins are leading the charge.

The surge within the general cryptocurrency market led to a restoration of approximately $170 billion in total value, causing the market capitalization to increase by 8%, reaching an impressive $2.26 trillion.

Here are some of the most notable movers to watch this week.

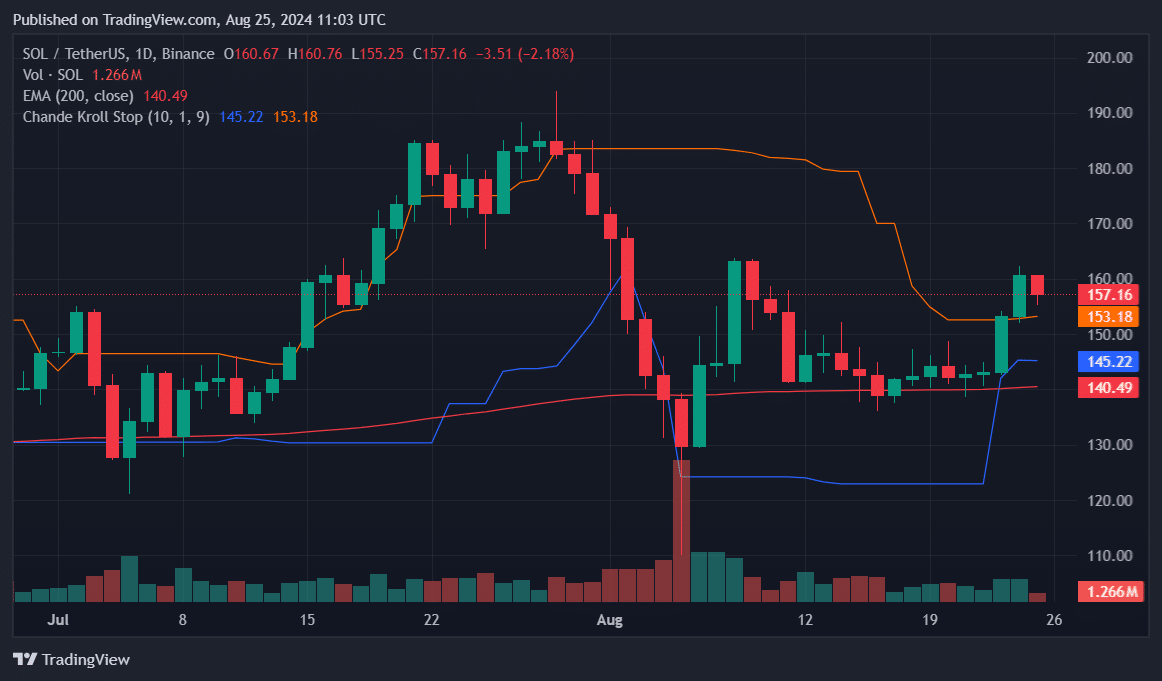

Solana reclaims $160

Over the past seven days, Solana (SOL) experienced a significant increase of approximately 12%, regaining the $160 mark and reaching a two-week peak of $162 on August 24. This impressive growth occurred despite some challenges in its ETF offering. Following a robust close last week, SOL has since retreated to $157.17 as of now.

Despite that, Solana currently hovers over its 200-day Exponential Moving Average (EMA) at $140.12, which indicates persistent bullish energy. For this week to continue supporting this positive trajectory, it’s crucial for Solana’s price to stay above the 200-day EMA.

As I analyze the market, the Chande Kroll Stop indicators suggest that my stop loss for a long position should be set at $145.22, while a profit-taking level is positioned at $153.18. Maintaining prices above this crucial resistance level of $153.18 is essential to continue capitalizing on potential gains. A drop below this level could potentially trigger a bearish reversal in the market trend.

As an investor with over two decades of experience under my belt, I strongly advise keeping a keen eye on the market this week. The price levels to focus on are the $160 and $162 resistance zones, areas where the stock has previously struggled to break through. If the stock manages to surpass these hurdles, it could indicate a bullish trend that I would not want to miss out on. However, if we see a decline instead, watch for the key support at $153.18. Having witnessed numerous market fluctuations throughout my career, I can tell you that this level has held strong in the past and may do so again. Keep your investment strategy flexible and be prepared for either scenario to unfold.

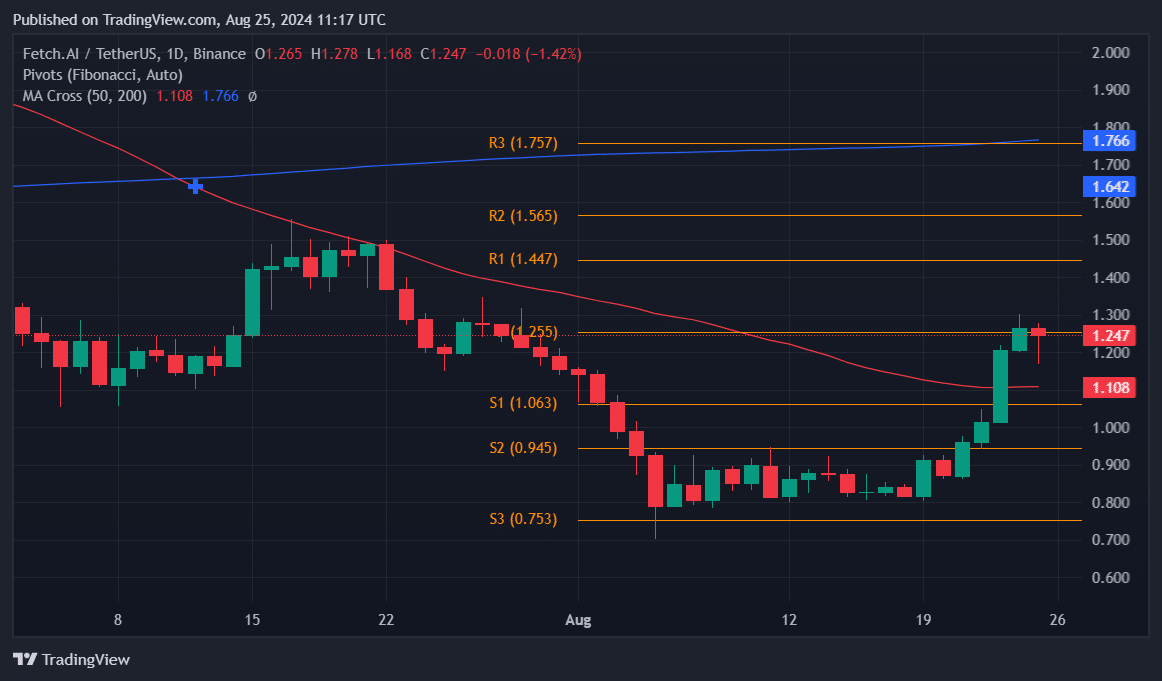

FET spikes 50%

Last week, Fetch.ai (FET) ended up among the top performers, experiencing a surge of 50% and returning to the $1 mark. On August 24th, FET touched its monthly high at $1.3, but has since pulled back slightly to $1.249.

At the moment, FET is priced higher than its 50-day Moving Average (at $1.108), suggesting a positive medium-term trend. Yet, it remains beneath its 200-day Moving Average ($1.766), hinting at ongoing long-term bearish feelings.

As a seasoned investor with over two decades of experience in the stock market, I have learned that understanding technical analysis is crucial to making informed investment decisions. This week, I am closely watching the resistance points for FET at $1.447 and $1.565. These levels are significant because they represent potential roadblocks for the stock’s upward momentum. However, if the stock can break through these barriers, it could target the 200-day EMA as a potential next stop.

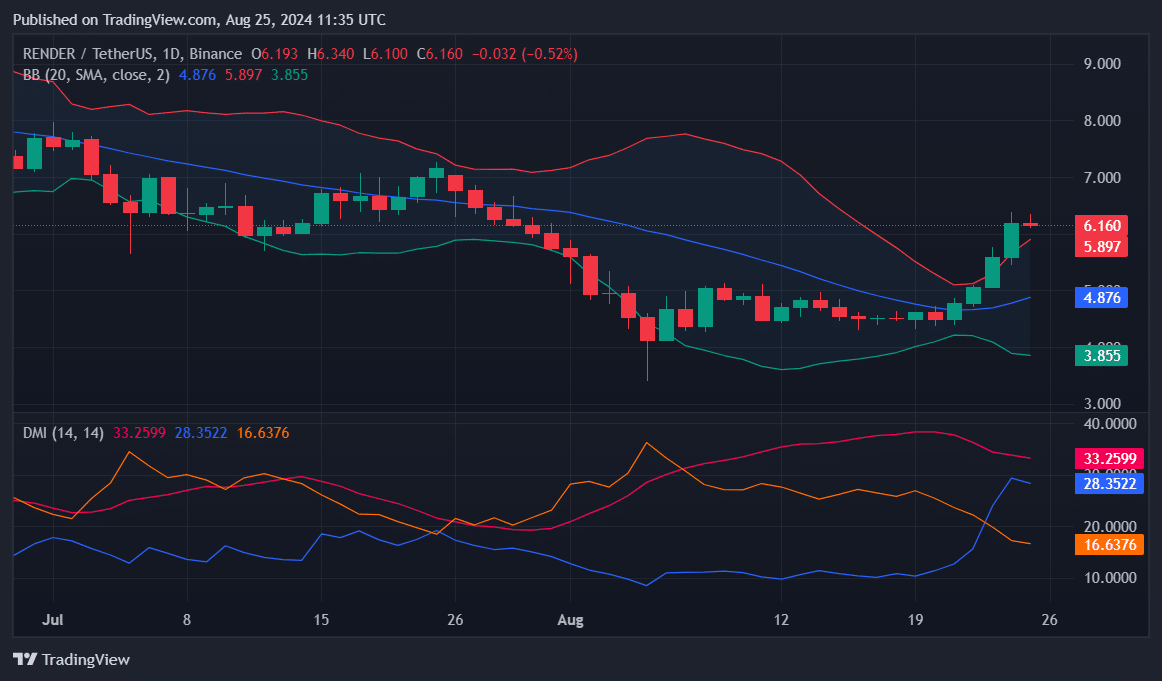

RENDER breaches upper Bollinger Band

Render (RENDER) saw a 37% rise last week, reclaiming the $6 level for the first time this month.

At present, RENDER stands at $6.153, and it’s sitting nicely above its Upper Bollinger Band at $5.894. This frequently indicates signs of an overbought market, suggesting that a possible downtrend or period of stability could be imminent.

However, the strong trend indicated by the ADX at 33.25 supports the idea of sustained upward momentum. The asset maintains a bullish bias with the +DI at 28.35 and -DI at 16.63.

If the ongoing trend continues throughout this week, Render might look to reach increased goals near $6.5 and possibly even touch $7.0.

Regardless, dipping below the Upper Band could potentially prompt me, as a researcher, to reevaluate the 21-day moving average at approximately $4.875.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-25 16:56