As a seasoned researcher with a background in technology and finance, I find myself constantly astounded by the dynamic nature of the global crypto market. Last week was no exception as we witnessed a surge that added another $100 billion to the market, bringing it to a close at $2.2 trillion.

Over the past week, the worldwide cryptocurrency market, which had been gaining momentum for the last fortnight, managed to regain another $100 billion, ending the week with a total value of approximately $2.2 trillion.

In simple terms, Bitcoin (BTC) took the lead, temporarily regaining the $64,000 mark. This surge in positive sentiment resulted in significant increases across many alternative coins (altcoins).

Here are some of the most noteworthy performers from last week:

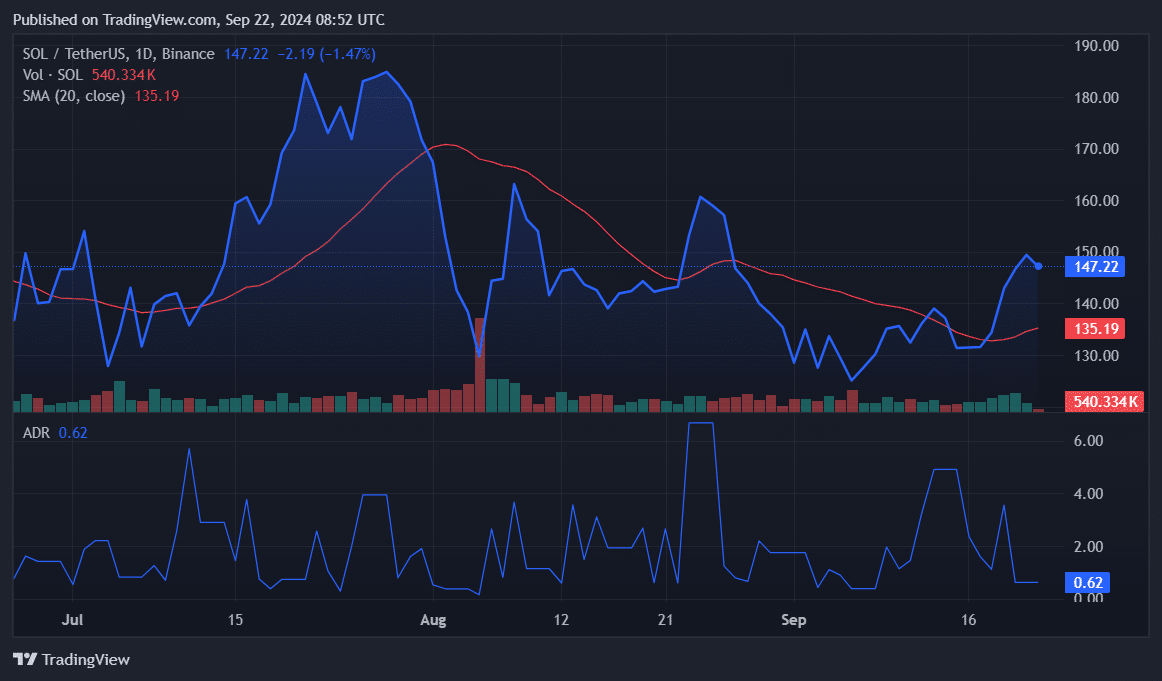

Solana breaches 20-day SMA

At the onset of this week, Solana (SOL) saw a significant drop of about 4.21%. But after a phase of stability, it made a robust recovery, surging by approximately 13.01% between September 18 and 21.

The significant development was chiefly influenced by the favorable response in the cryptocurrency market following the Federal Reserve’s decision to reduce interest rates by 0.5%, which happened simultaneously with the introduction of Solana’s new smartphone, known as Solana Seeker.

Solana ended the week with an 8.76% gain at $149.41.

On September 19, the value of the asset surpassed its 20-day moving average (SMA). It’s been staying above this mark ever since. Yet, there’s been a decrease in trading volume since it peaked at 4.493 million SOL on September 20. This suggests that the upward momentum might be weakening.

If the trading volume continues to be subdued, it may indicate waning investor enthusiasm, potentially setting the stage for a price shift. This week, keep an eye on two key levels: the support around $135 (equivalent to the 20-day Simple Moving Average) and resistance close to $150.

Solana was established by Anatoly Yakovenko, who used to work at Qualcomm. Together with his fellow Qualcomm colleague and co-founder Greg Fitzgerald, he launched Solana Labs in the year 2017.

Raj Gokal and a team of developers also helped launch Solana’s blockchain in March 2020.

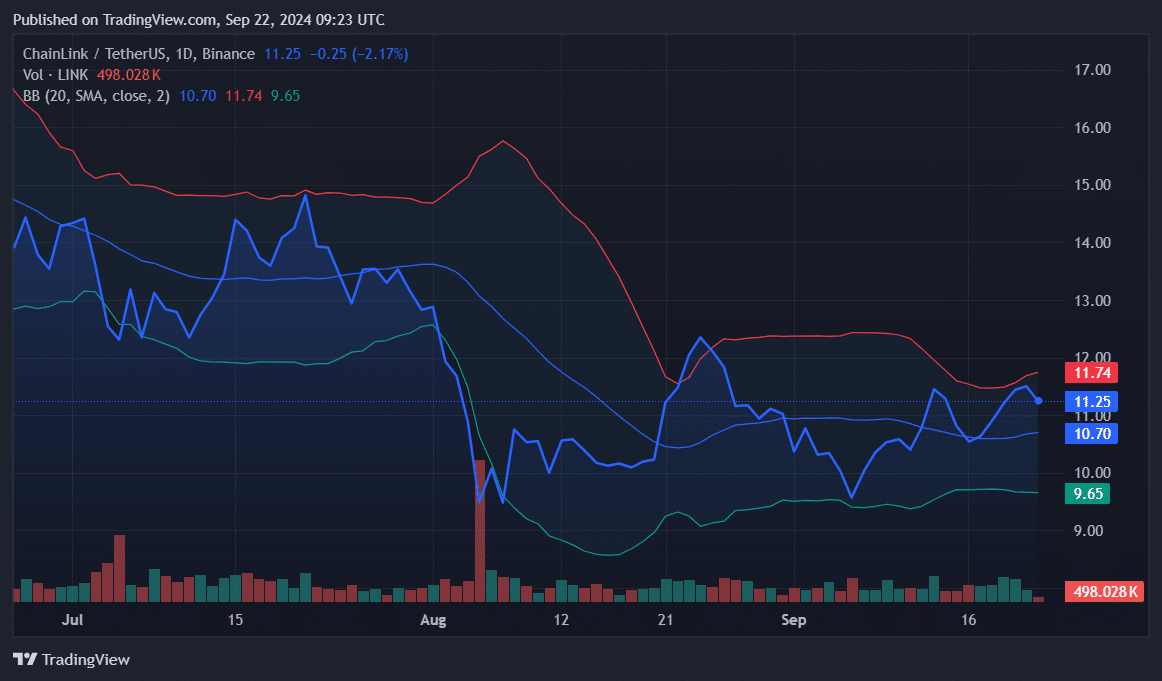

Chainlink targets $12

To begin the week, Chainlink (LINK) followed the general market downward trend, but soon bounced back and reached its highest point for the month at $11.74 on September 20th.

As a researcher, I observed that my studied link experienced a slight retreat this week, yet it concluded with a modest 1.76% growth. Interestingly, this token was among the week’s underperforming assets, despite establishing a partnership with Fireblocks for stablecoin issuance.

At present, LINK‘s trading price hovers near its upper Bollinger Band (around $11.74), having already surpassed the middle band ($10.70). If the price breaks through the current resistance at the upper band, it might provide the bulls with sufficient momentum to push the price back towards $12.

Keep an eye on the price movement this week. A surge over $11.74 might indicate a continuation of the uptrend. Conversely, falling below the midpoint at $10.70 could lead to the support level at $9.65 becoming active.

In the year 2017, Sergey Nazarov and Steve Ellis developed Chainlink. This cryptocurrency was initially conceived as a decentralized system for bridging smart contracts with actual world data sources.

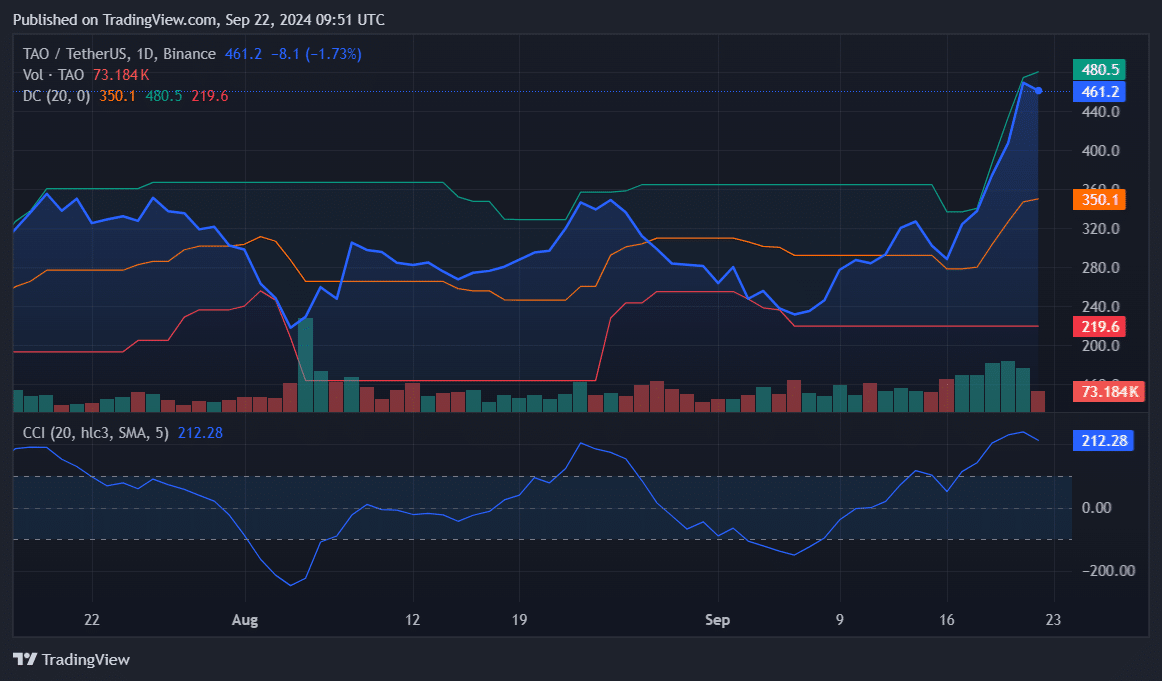

Bittensor rallies 43%

Last week, I observed an impressive surge – a whopping 43% increase – in the value of Bittensor (TAO), a cutting-edge, open-source protocol that’s decentralized. This remarkable climb placed it among the top performers in the digital currency market.

The rally pushed TAO to retest $480 for the first time since May, although it faced resistance at this level. Despite a slight drop, TAO is trading at a four-month high.

In the Donchian Channels, TAO currently sits above both the lower and middle lines (at $219.6 and $350.1 respectively), but it’s close to crossing over the upper line ($480.5). This indicates that while there’s strong bullish movement, potential for additional growth might be capped unless TAO manages to surpass $480.5.

As a crypto investor, I’ve noticed an interesting development with the TAO token. The Commodity Channel Index has soared to 212.28, marking its highest point since January. This suggests that TAO might be overbought at the moment. If this trend continues, there could potentially be a temporary correction or pullback in the short term. However, if strong buying pressure persists, it may counteract this and maintain the current upward momentum.

Bittensor strives to establish a market where AI and machine learning models can be traded. This platform, developed by Shen-Juan Ting and Kei Kreutler, facilitates interaction between AI models, enables data sharing, and encourages participation using TAO tokens.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD CNY PREDICTION

- USD JPY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-09-22 15:04