As a seasoned cryptocurrency analyst with over a decade of experience in the financial markets, I have witnessed numerous market trends and recovered from several bearish phases. Last week’s cryptocurrency market recovery was particularly noteworthy due to Bitcoin’s surge past $66,000 and the subsequent increase in the global crypto market cap.

Last week, the cryptocurrency market showed strong signs of bounce-back. Leading the charge was Bitcoin, which broke through various significant milestones and reached an unprecedented price of over $66,000 within the past few weeks.

Over the past week, the global crypto market cap experienced a significant surge of $255 billion due to a bullish trend that was adopted by the remainder of the market. This growth represented a noteworthy 11.95% rise, with various altcoins contributing to this upward momentum.

Based on their impressive showings the previous week, here is a list of our preferred cryptocurrencies to keep an eye on this coming week.

SOL hits six-week high

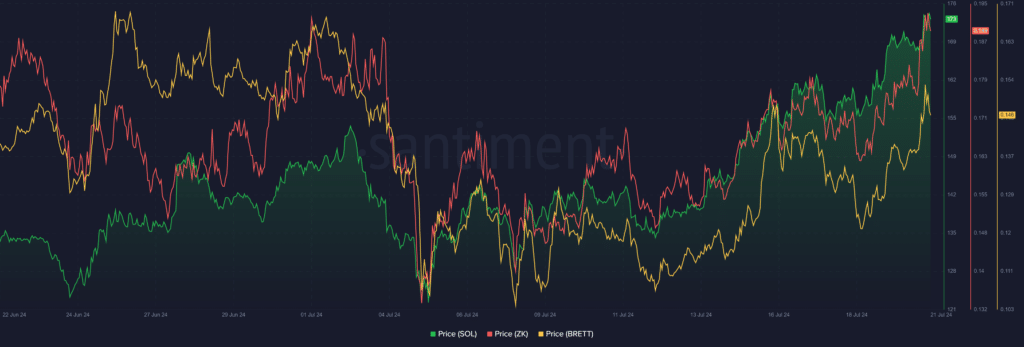

Last week, Solana (SOL) stood out among the cryptocurrencies with significant price increases. For a full week, SOL experienced uninterrupted growth, during which it rose for six consecutive days. The digital asset surpassed the $175 mark for the first time in over five weeks before encountering an obstacle.

Last week, I observed a robust uptrend in Solana’s price action. The cryptocurrency surged by an impressive 22.35% from a level of $141 to reach $172. A closer examination of the daily chart reveals a clear pattern of successive higher highs and higher lows, which serves as a testament to the escalating buying pressure.

Significantly, the Accumulation/Distribution line, having hit a level of 297.488 million, underscores the prevailing uptrend in buying activity.

Based on my extensive experience in financial markets analysis and having closely monitored the Klinger Oscillator for several years, I can tell you that a recent positive crossover at a reading of 125.642K is an encouraging sign. This event indicates that buying volume has surpassed selling volume, which is typically a bullish indicator.

ZK rallies 18% in a week

As a researcher studying the cryptocurrency market trends, I’ve observed that ZkSync (ZK) experienced a significant surge in value during the past week. Leveraging the market rebound and riding on its momentum, ZkSync managed to increase by an impressive 18.9%. Its price rose from $0.1596 to a new high of $0.1897.

Recently, ZK reached a roadblock at the $0.1918 mark, which represents a 23.6% retracement. This level might function as short-term resistance if the price remains below it. A break above this barrier could be taken as a sign of more upward momentum to come.

If zkSync’s price were to retreat, the levels at $0.1844 (representing a 38.2% retracement) and $0.1784 (signifying a 50% retracement) could potentially act as supportive points for the cryptocurrency.

The On-Balance Volume (OBV) indicator is currently at 2.826 billion, showing a rising trend, and suggesting an increase in buying volume. This surge in OBV supports the bullish price movement and indicates strong accumulation.

BRETT records largest intraday gain in seven weeks

Brett observed a comparable surge in value, yet its price experienced heightened fluctuations. The token commenced the week with vigor, achieving an intraday increase of 20.57% on July 15 – its most substantial daily gain in seven weeks. However, over the subsequent three days, Brett plummeted by 11%.

The Bull Bear Power (BBP) level for BRETT hovers around 0.02847, reflecting a blend of bull and bear market sentiments. Nevertheless, a noteworthy uptrend toward the week’s close suggests growing bullish energy, contributing to a substantial 27% gain for BRETT by the end of the week.

In the context of the MACD (Moving Average Convergence Divergence) indicator, when the MACD line sits marginally higher than the signal line, specifically at 0.00232 and 0.00119 respectively, this event, despite being subtle, usually signifies a potential buying opportunity.

If the MACD line persists in climbing higher and the BBP stays positive, this might be an indication of a bullish outlook for BRETT in the upcoming week. However, it’s crucial to keep an eye on strong volume and continued momentum to validate this potential upward trend.

Read More

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-07-21 18:06