As a seasoned researcher with over two decades of experience in the financial markets, I can confidently say that the potential launch of a spot ETF based on Solana (SOL) is a significant development worth watching. The insights shared by Matt Sigel and Daniel Cheung, along with the current momentum of Solana, suggest a promising future for this blockchain platform.

The recent surge in wealth within the cryptocurrency sector might make it more likely that a Solana-based exchange-traded fund (ETF) will be created, potentially enhancing its value and accessibility.

According to Matt Sigel, who leads digital asset research at VanEck, there’s a strong possibility that an Exchange Traded Fund (ETF) directly tied to Solana (SOL) might become available for trading as early as the last year of 2025.

During a conversation with Financial Times, Sigel pointed out that under the guidance of the present chairperson of the U.S. Securities and Exchange Commission (SEC), Gary Gensler, the commission appears to be shifting from its conventional methods of engaging with businesses.

Sigel emphasized the importance of reverting to a disclosure-centric system, thereby opening up fresh avenues for expansion in the cryptocurrency sector.

In June 2024, VanEck submitted an application for a Solana ETF, characterizing this move as “placing a wager on Donald Trump’s victory.” Sigel posits that the incoming administration will foster the crypto sector and encourage investment in digital assets. Moreover, he hinted at the likelihood of more spot ETFs emerging, with the VanEck team currently evaluating opportunities to introduce various asset classes.

Nevertheless, it was pointed out by the SEC officials that under the leadership of the former chair, Jay Clayton – who was appointed during the Trump administration – approximately 80 legal actions were taken against cryptocurrency firms, and every request for a spot Bitcoin ETF was denied.

As an analyst, I find myself reflecting on a notable shift in approach by the SEC under Gary Gensler’s leadership. Instead of adhering to traditional disclosure-based regulations, they have chosen a rules-guided process backed by enforcement actions. A return to the conventional ways might open up room for greater innovation within this sphere.

Matt Sigel, head of digital asset research at VanEck

The launch of a spot ETF on Solana may happen even earlier

Daniel Cheung, a partner at Syncracy Capital hedge fund, anticipates that the cryptocurrency sector could potentially introduce spot ETFs on Solana before Siegel’s projected timeline.

Cheung anticipates that Solana Exchange-Traded Funds (ETFs) might debut on the market around Q1 2025. If so, this development could propel Solana’s growth faster than Ethereum (ETH), potentially pushing its value up to $1000 or more.

In my opinion, cryptocurrency could be experiencing a monumental bull run in the next few months, even surpassing the heights of 2021. Here’s a perspective on the current market landscape under a Trump Administration:

— Daniel Cheung (@HighCoinviction) November 6, 2024

Simultaneously, he attributed the fund’s approval primarily to the “four-year option on the Bitcoin market during Trump’s presidency.” He also mentioned that the incoming president had pledged to recognize Bitcoin as a reserve asset and highlighted his prediction of Chair Gensler stepping down from office.

The Solana ecosystem is experiencing a new boom

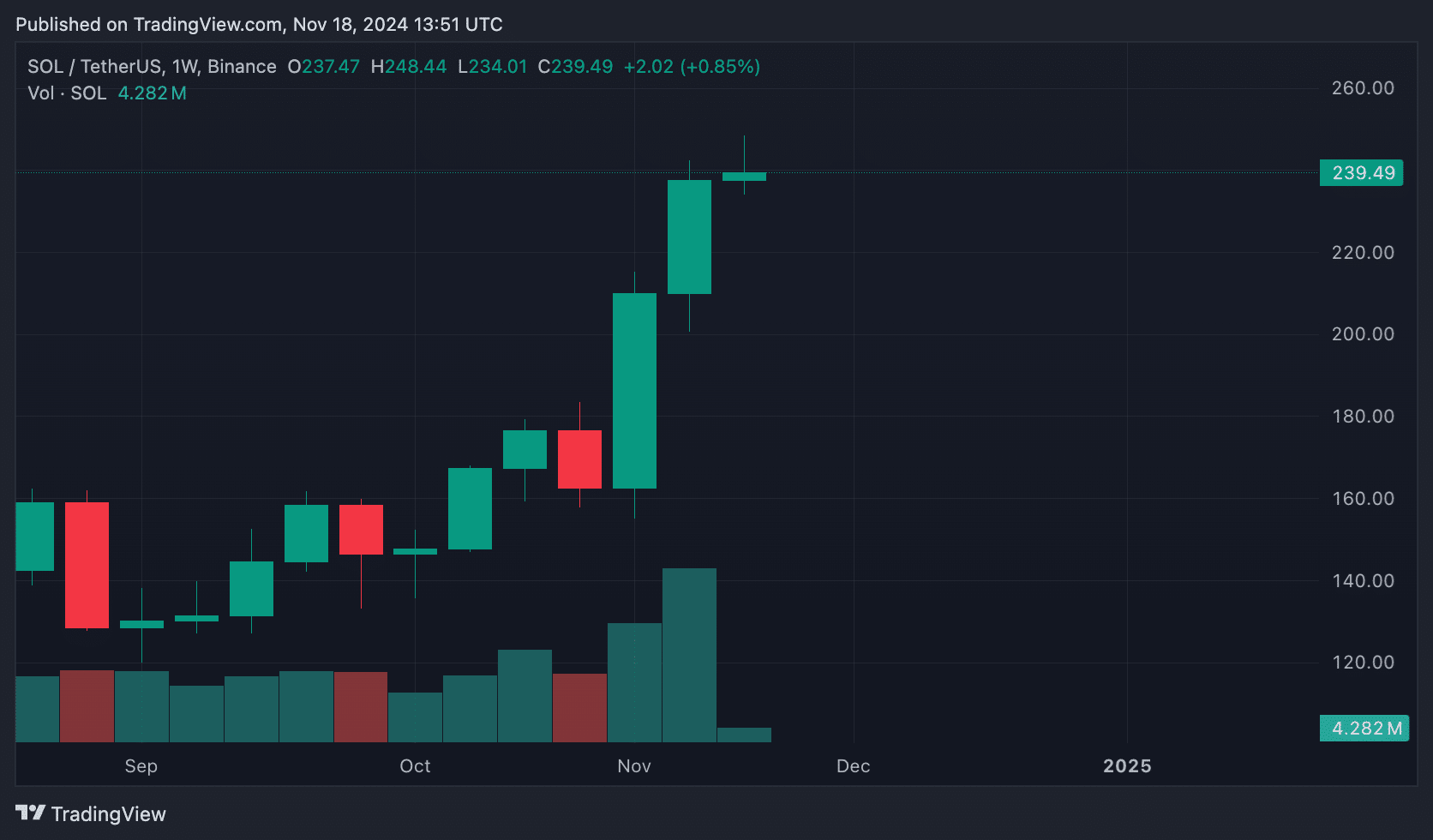

Over the last seven days, Solana has noticeably boosted the crypto market, moving closer to its all-time high. Right now, the coin is being exchanged at about $240, representing a 10% increase compared to its price a week ago.

Solana’s market value has surpassed $112 billion, marking a 44% increase from its previous peak of $77 billion, which was reached on November 6, 2021.

1) The rising market value is primarily because of the expanding number of Solana tokens being distributed on an inflationary basis, which in turn compensates stakers with fresh SOL tokens. Moreover, Solana-centric applications have experienced unprecedented transaction fees and income within the last 24 hours, largely fueled by renewed enthusiasm for meme coins.

As per information shared by analyst Patrick Scott on Platform X, it’s been revealed that five out of the top ten protocols by fee collection over the past 24 hours were based on Solana. On November 17th, Raydium, an automated market maker, broke a record by amassing $11.31 million in fees. Meanwhile, Jito, a liquid staking protocol, collected the third-largest daily fee of $9.87 million on the same day.

Over the last 24 hours, it appears that half of the cryptocurrency protocols with the highest transaction fees have been based on Solana. This could indicate a significant trend in the market or a surge in popularity for meme coins.

— Patrick Scott | Dynamo DeFi (@Dynamo_Patrick) November 17, 2024

Moreover, the meme coin startup platform pump.fun noted a significant income of around $1.65 million through fees, making it one of its top seven earners. The Solana meme coin trading bot named Photon contributed significantly to this income, being responsible for the fifth-largest daily fee withdrawal worth approximately $2.36 million.

What’s driving Solana’s growth?

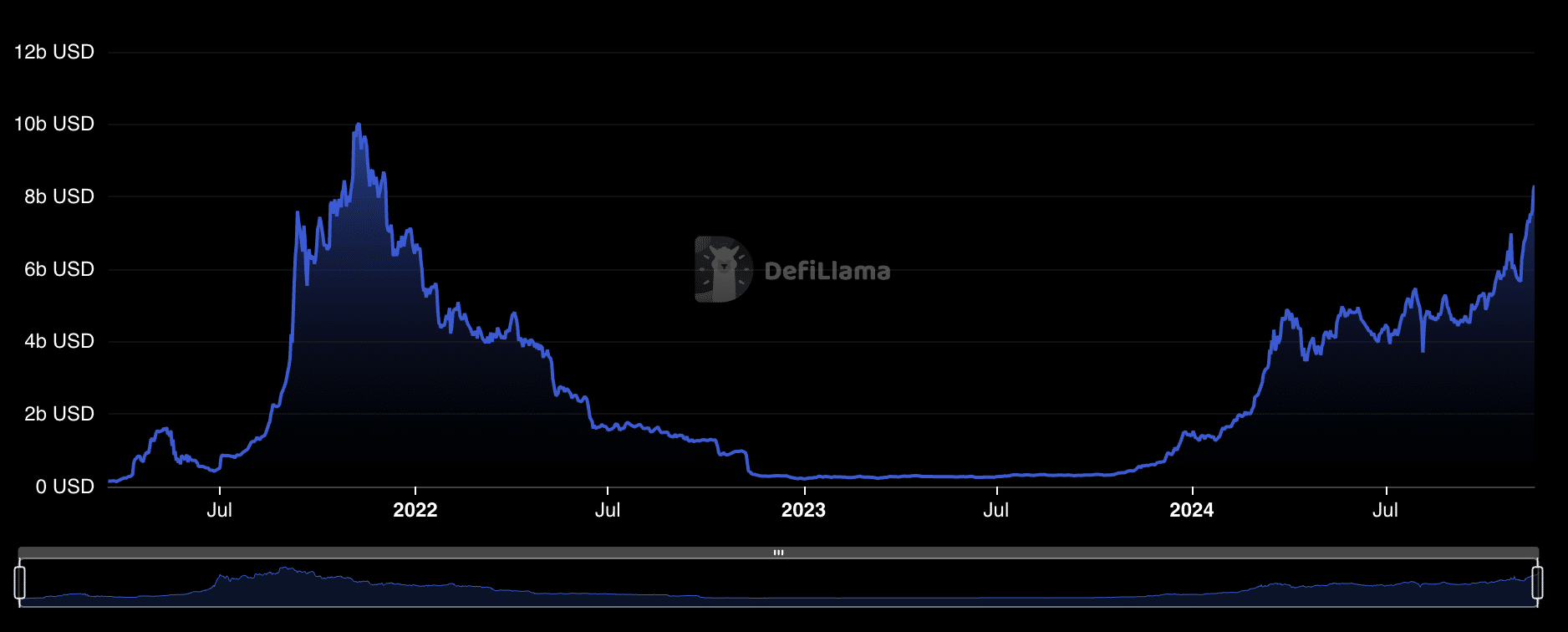

The strong performance of Solana can be attributed to a surge in user engagement with meme coins. As reported by DeFiLlama, the blockchain’s total value locked (TVL) has reached its peak since 2021, exceeding $8.3 billion.

According to a report from the exchange’s research team, due to their fast development and high levels of speculation, meme coins offer the possibility for substantial returns as an investment opportunity.

Some analysts believe that one factor driving the surge in interest towards high-risk assets is investor’s growing disillusionment with traditional finance. This financial disillusionment arises due to the price increases (inflation) brought on by “helicopter” money during the COVID-19 pandemic, which has made conventional investments like real estate less appealing as a safe place for capital because they are now vulnerable to inflation.

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Brent Oil Forecast

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Pi Network (PI) Price Prediction for 2025

2024-11-18 20:28