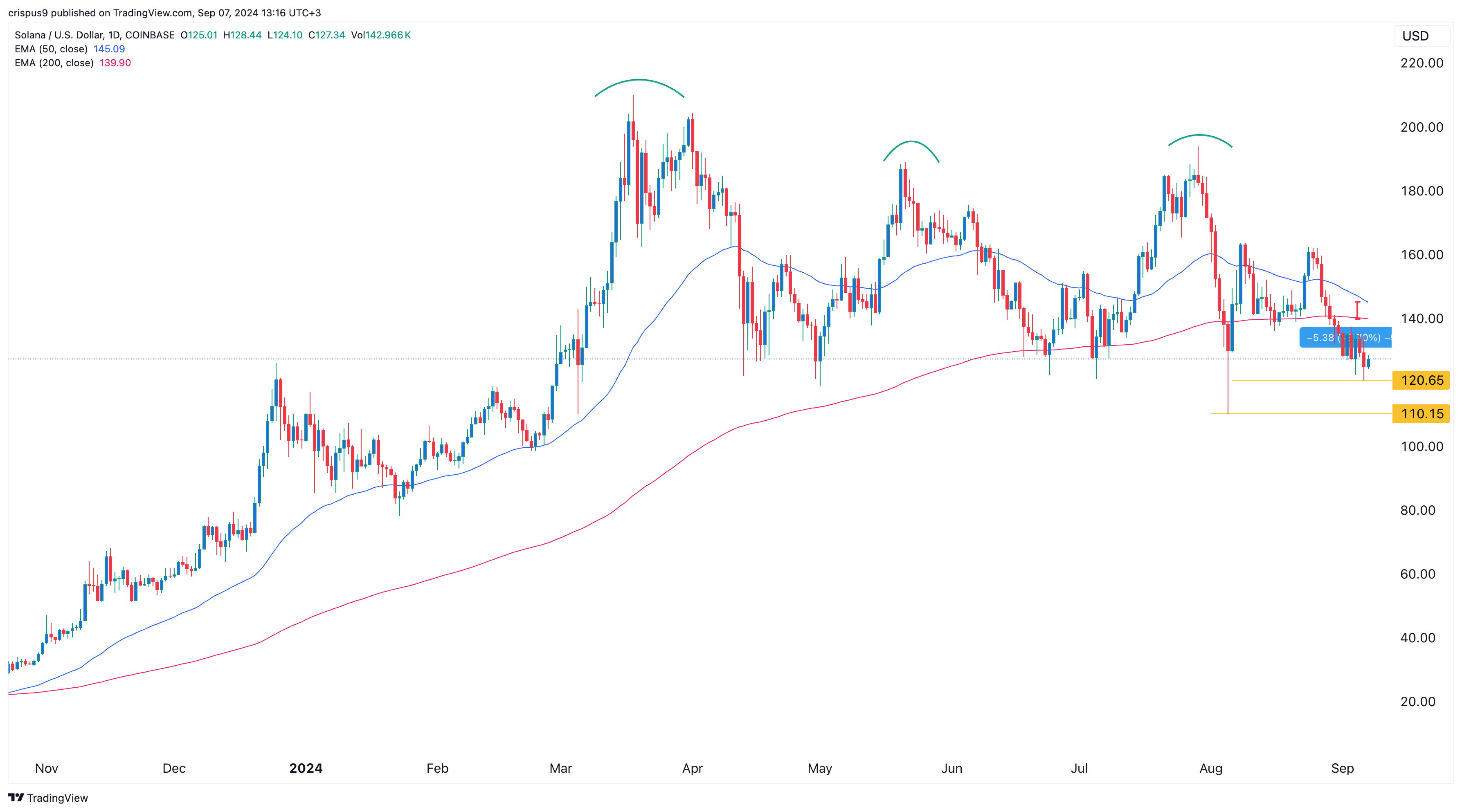

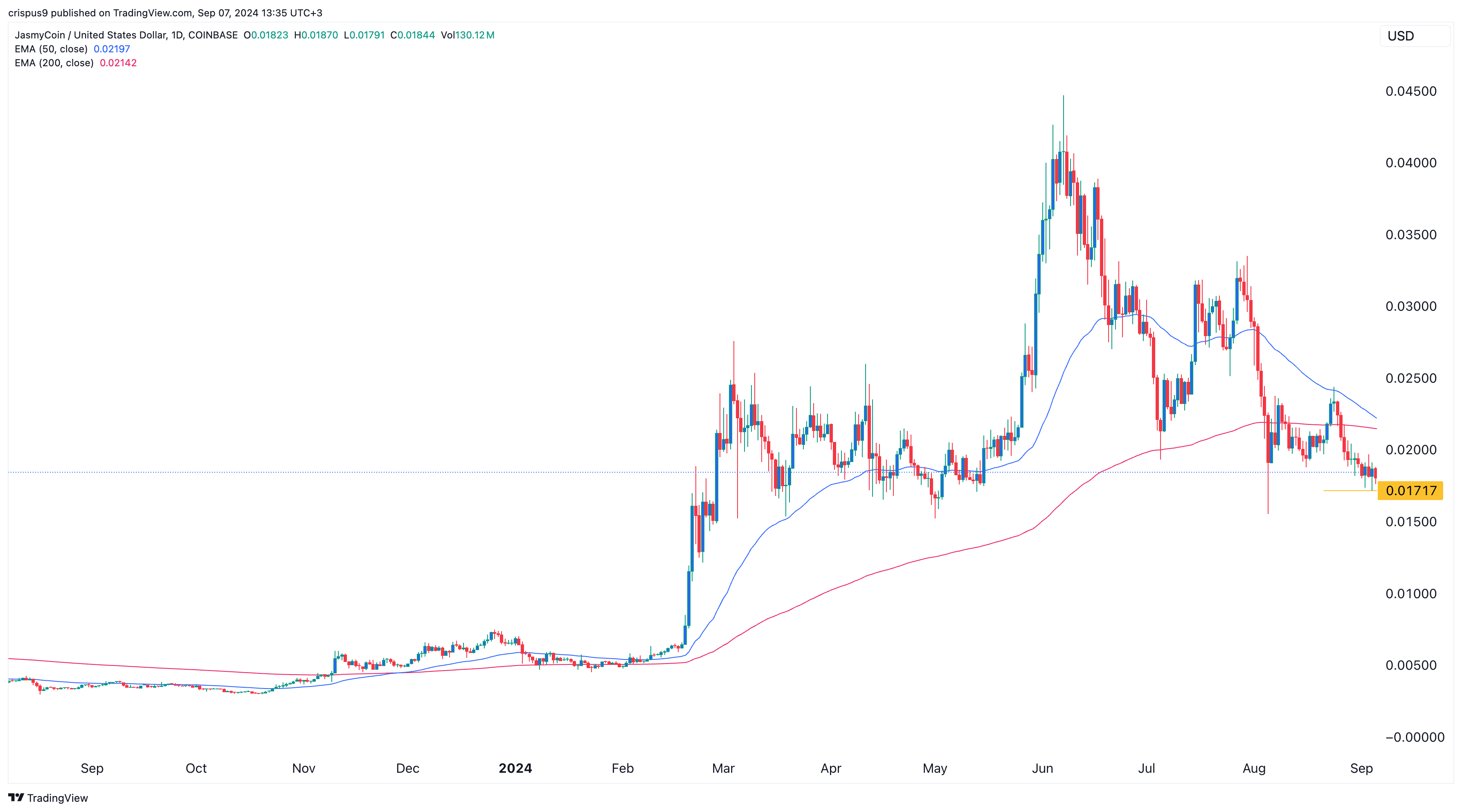

As a seasoned researcher with years of experience navigating the volatile crypto market, I can confidently say that these recent developments in Solana (SOL) and JasmyCoin (JASMY) are cause for concern. The sell-off we’ve seen this week is reminiscent of a bear market, and both tokens appear to be forming ominous chart patterns – the triple-top for Solana and the impending death cross for Jasmy.

This week saw a persistent decline in value for coins like Solana, JasmyCoin, and various other altcoins, as the Crypto Fear and Greed Index dipped.

Solana and Jasmy are in a bear market

JasmyCoin’s value dipped to $0.01717, representing a decrease of more than 58% from its peak this year, which has now lowered its total market value to approximately $908 million.

In simpler terms, after being the fifth largest cryptocurrency, Solana (SOL) dropped down to a level of around $120, which is significantly lower than its peak this year at $209.

As an analyst, I’ve observed a striking resemblance between the recent market sell-off and the fluctuations in Bitcoin‘s price. Just a few months ago, Bitcoin was trading at around $73,800, but now it’s hovering near $54,000 – a significant drop in value.

Solana’s decline in value is occurring due to some difficulties within its ecosystem. On the other hand, Pump.fun, its meme coin generator, faces strong competition from the newly launched SunPump. It appears that SunPump has amassed approximately $25 million in fees just a few weeks after launch, while the total value of tokens within its ecosystem currently exceeds $428 million.

The tokens from Pump.fun boast a market capitalization exceeding $487 million, while the ecosystem has accumulated more than $140 million in fees since its debut nine months ago. Essentially, this suggests that Tron is starting to match its momentum.

In the realm of DeFi, Tron now surpasses Solana in terms of total value locked, boasting a whopping $7.69 billion in assets compared to Solana’s $4.60 billion. Interestingly, while Solana holds more than $3.6 billion in stablecoins, Tron dwarfs this figure with an impressive $60 billion. The majority of Solana’s stablecoins are USD Coin (USDC).

Based on recent developments, it appears that Solana may be slowing down. This assumption is supported by the formation of a triple-top chart pattern, which is often seen as a bearish indicator.

To put it simply, we’re on the verge of seeing a “death cross” chart formation. This happens when the 200-day moving average (a longer-term trend) and the 50-day moving average (a shorter-term trend) intersect, which is often associated with a bearish or negative outlook in financial markets.

The spread between the two moving averages has narrowed from 13% in August to just 3.70%. Such a pattern will likely lead to more downside, with the initial target being last month’s low of $110.

Jasmy is also about to form a death cross

Despite the announcement that Mitsubishi UFJ, Mizuho, and SMBC are entering the crypto industry by testing stablecoin transfers, Jasmy, a Japanese cryptocurrency, experienced a setback instead.

In most periods, Jasmy rises when there is a major crypto-related news from Japan.

Similar to Solana, the gap between its 200-day and 50-day moving averages has become smaller, hinting at the potential development of what’s known as a “death cross” formation.

In November 2023, Jasmy created what’s known as a “golden cross” instead of a “death cross,” which led to an impressive surge of 788%. However, if a “death cross” occurs in the future, there might be potential for the token to keep declining in the upcoming months.

One potential danger for Solana, Jasmy, and other alternative cryptocurrencies is the possibility of entering another extended period of crypto winter, which could linger. The previous winter spanned from November 2021 to January 2023.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

2024-09-07 16:40