As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of bull runs and bear markets. However, Solana’s current performance is truly impressive, especially considering its meteoric rise amidst the turbulent market conditions this year.

The surge in Solana’s price picked up pace as its network and on-chain statistics remained robust and impressive.

The Solana (SOL) token experienced a rise and recently re-evaluated a crucial resistance level at $180, marking its highest price since July 31. This surge represents a 60% increase from its lowest point on Aug. 8, during which many assets declined due to the unwinding of the Japanese yen carry trade.

Compared to its main rival, Ethereum (ETH), Solana has shown superior performance, surging by a notable 20% since its lowest point in August.

The strong showing of this performance can primarily be attributed to Solana’s achievements within the meme coin sector. As per CoinGecko, the combined market capitalization of all Solana-based meme coins surpasses $11.7 billion.

As an analyst, I find myself observing the impressive growth within the Solana meme coin landscape. Specifically, Dogwifhat, the leading player, boasts a market capitalization of approximately $2.5 billion. Not far behind, both Bonk and Popcat have surpassed the $1 billion mark in market cap. Lastly, Cat in a Dog’s World is rapidly approaching this significant milestone.

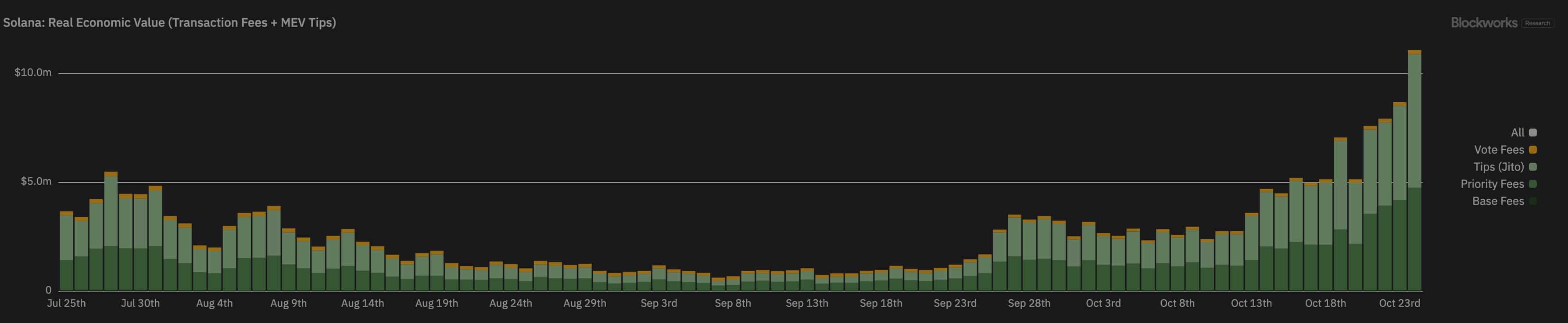

Meanwhile, data from Blockworks Research shows that Solana’s Real Economic Value, which consists of transaction fees and maximal extractable value, reached a record high on Oct. 25.

As a researcher delving into the blockchain landscape, I’ve noticed an intriguing trend over the past month. The Solana ecosystem seems to be flourishing more than expected, as per DeFi Llama’s data. In just 30 days, the Total Value Locked (TVL) has swelled by a substantial 23%, reaching a staggering $6.4 billion. On the other hand, the TVL for Ethereum and Tron have witnessed a slight dip, with Ethereum’s TVL decreasing by 2.1% and Tron’s TVL dropping by a more significant 11.5%.

This month, Solana has emerged as the leading force in the decentralized exchange sector. The value of tokens processed through its DEX networks, particularly Raydium, has exceeded a staggering $16 billion – a figure that outperforms both Ethereum and Base combined. In terms of monthly trading volume, Solana recorded an impressive $41.7 billion, surpassing Ethereum’s $32 billion.

Over the past week, a pattern resembling this has emerged in the derivatives market. Specifically, decentralized apps on the Solana platform have managed transactions involving a total of $4.6 billion worth of tokens.

Developers tend to prefer Solana because of its remarkable speed and affordable transaction fees. As per recent data from Dune, a massive number of around 200,000 individuals have utilized Solana’s network over the past two weeks, which is noticeably greater than Ethereum’s 52,000 users during the same period.

Solana chart points to more gains

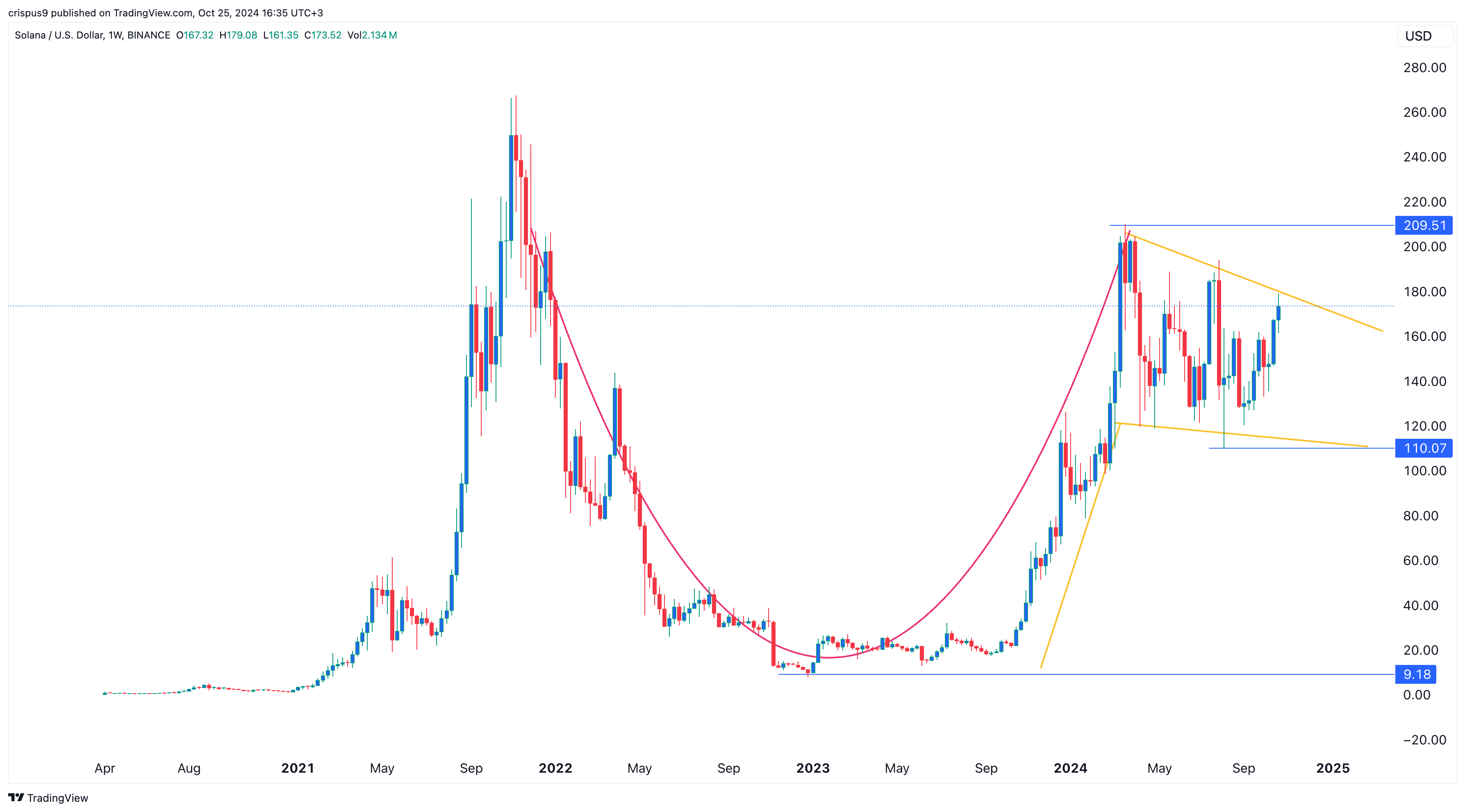

Over the past three weeks, the SOL token graph indicates a steady increase, reflecting robust expansion within its ecosystem.

As an analyst, I recently observed a test at the upper boundary of the downward trendline connecting the highest price peaks since March.

Solana appears to have developed a bullish flag formation, a pattern that historically signals more upward momentum. Moreover, it’s maintained its position above its 50-week moving average and exhibited a rounded bottom or cup and handle structure.

Consequently, it seems reasonable to anticipate that the Solana token may experience a strong upward trend, potentially reaching $210 – around a 20% increase from its current value.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-10-25 17:09