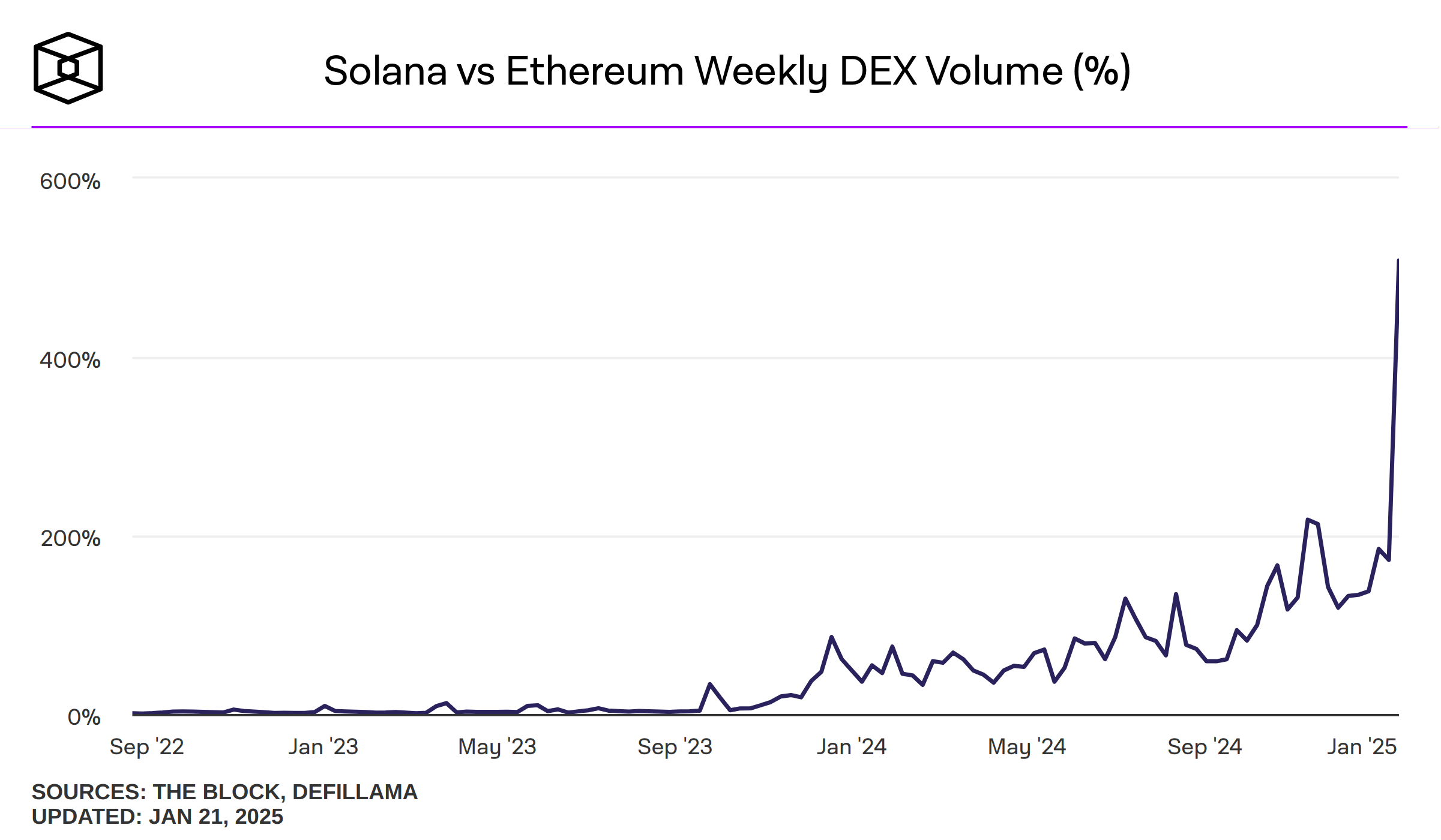

As of the 21st day of January, in the year of our blockchain 2025, Solana, that sprightly upstart, has galloped into the DEX trading arena with a staggering $120.6 billion in volume. That’s a 323.3% increase, which is rather like finding a dragon in your backyard—unexpected and a bit alarming! Now, the wise sages (also known as analysts) are scratching their heads, pondering whether Solana can actually give Ethereum a run for its money and claim the title of the top Layer 1 blockchain. 🏆

Meanwhile, Ethereum, the grand old dame of the blockchain world, has seen its weekly DEX trading volume swell to $24.7 billion, a modest uptick of 47.58%. This surge, largely thanks to the ever-popular Uniswap, which has been hogging over 73.7% of the trading volume like a cat on a sunny windowsill, contributed a hefty $17.46 billion to Ethereum’s DEX escapades.

On the flip side of this digital coin, Solana’s top DEX, Raydium (RAY), has been on a wild ride, boasting a 236% weekly change and handling a jaw-dropping $52 billion last week. And just when you thought it couldn’t get any wilder, Meteora decided to join the party, adding a mind-boggling 13,379% to Layer 1’s weekly volume. Talk about a growth spurt! 🎉

According to the ever-astute analyst Knox Ridley of I/O Fund, Solana seems to be on the brink of a DEX revolution, gaining the attention of traders faster than a cat can knock over a glass of water.

Will Solana overtake Ethereum as the top Layer 1?

Ridley is convinced that Solana’s rather unique “proof of history” protocol will catapult it to market leader status. With a throughput of 65,000 transactions per second (TPS) without needing second layers, it’s like comparing a cheetah to a tortoise—if the tortoise had a very nice shell but was still a bit slow on the uptake. Ethereum’s proof of stake, bless its heart, manages a maximum recorded TPS of 62.34, which is like watching paint dry in comparison.

Solana’s burgeoning ecosystem of assets, applications, businesses, and users is morphing into a compounding superstructure, positioning Solana as a potential secular winner in the cryptoeconomy.

This is becoming evident in the data which shows Solana rivaling Ethereum in value creation.

— Ryan Watkins (@RyanWatkins_) November 12, 2024

In addition, Solana’s latest update, whimsically named Firedancer (because why not?), crafted by the wizards at Jump Crypto, aims to bootstrap development on Layer 1 by enhancing scalability and fortifying the network against bugs and attacks. It’s like giving Solana a shiny new suit of armor for its digital jousts.

These technical advantages are believed to allow Solana to strut its stuff as a more scalable and secure Layer 1 Blockchain—a true contender to Ethereum, especially in scenarios where speed and efficiency are the name of the game, according to Ridley.

Another feather in Solana’s cap is its stablecoin infrastructure. While Ethereum still reigns supreme in the stablecoin kingdom, Solana is making strides, boasting a 67.48% gain in its stablecoin market cap, now sitting at a respectable $9.8 billion as of January 21, 2025. Not too shabby for a blockchain that’s still finding its feet!

Solana’s volume-to-market cap ratio exceeds Ethereum

Interestingly, Solana’s (SOL) volume-to-market cap ratio of 13.13% suggests it’s experiencing a trading activity surge that would make even the most seasoned trader raise an eyebrow, especially when compared to Ethereum’s (ETH) 10% ratio. It’s like watching a sprightly rabbit outpace a rather confused tortoise.

This activity underpins Solana’s growth, with DEXes like Raydium and Meteora validating this upward trend, driving high liquidity. In contrast, Ethereum’s lower ratio indicates a slower growth trajectory, which is a bit like watching a snail race a hare—entertaining,

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2025-01-27 09:59