As a seasoned crypto investor, I’ve witnessed my fair share of market volatility and ETF inflows and outflows. The recent capital outflow of $563.77 million from the U.S. spot Bitcoin ETF sector on May 1, 2024, is a reminder that even the most successful products experience ups and downs.

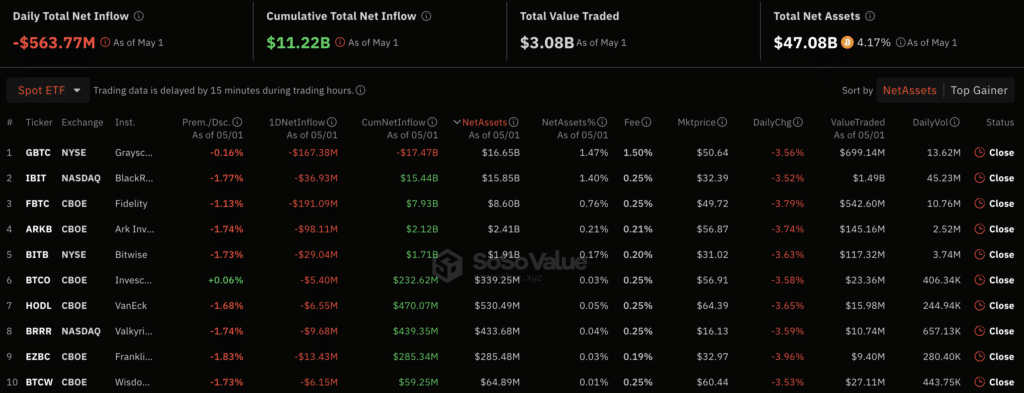

On May 1, the U.S. spot Bitcoin ETF sector recorded a record capital outflow of $563.77 million.

Based on SoSo Value’s report, the sector experienced a sixth consecutive day of fund outflows with the largest capital withdrawal occurring on May 1st. This is the most significant outflow since the US Securities and Exchange Commission (SEC) gave its approval for spot Bitcoin ETFs.

Over ten different products experienced capital outflows, with the Fidelity Wise Origin Bitcoin Fund (FBTC) suffering the most significant withdrawal at approximately $191.09 million.

As a crypto investor, I’ve noticed an interesting development with the iShares Bitcoin Trust (IBIT) managed by BlackRock. Up until April 30, there had been a consistent inflow of capital into the fund for an impressive streak of 70 days in a row. However, starting May 1, there was a reversal of this trend as an outflow of funds was observed.

Nate Geraci, the chief executive of The ETF Store, made a comparison between IBIT’s performance and another BlackRock exchange-traded fund, specifically the iShares Gold ETF. During this analysis, Geraci highlighted that the latter product experienced a loss exceeding $1 billion within a single year.

The iShares Bitcoin ETF experienced net outflows of approximately $37 million on its first day, despite accumulating over $15 billion in assets this year. For comparison, the iShares Gold ETF has seen outflows totaling around $1 billion this year, while SPDR Gold ETF has experienced $3 billion in outflows. Notably, gold has risen by 16% during the same period. This is a normal occurrence for Exchange-Traded Funds (ETFs); inflows do not always increase at a consistent rate.

— Nate Geraci (@NateGeraci) May 2, 2024

James Seyffart of Bloomberg Intelligence endorsed Geraci’s viewpoint. He explained that instability in ETFs is typical and to be expected.

It would be beneficial to include — These ETFs function efficiently in all aspects. Normal market activity, characterized by inflows and outflows, is a regular occurrence for them.

James Seyffart, Bloomberg Intelligence analyst

On May 1, the amount of capital leaving an entity was greater than the total losses suffered by funds during the preceding month of April, which experienced outflows of merely $345.88 million.

As a crypto investor, I’ve noticed a significant withdrawal of funds from Bitcoin (BTC) markets recently, which occurred amidst a price drop below the $57,000 mark. This downturn followed the news of Binance founder Changpeng Zhao receiving a four-month prison sentence.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-05-02 17:04