As an experienced analyst, I’ve closely followed the cryptocurrency market for several years. The recent developments surrounding Ethereum (ETH) and potential spot Ethereum exchange-traded funds (ETFs) have piqued my interest.

Experts at cryptocurrency trading firm QCP Capital predict that the surprise acceptance of Ethereum Spot ETFs might push Ethereum’s price up to $5,000 by the end of the year.

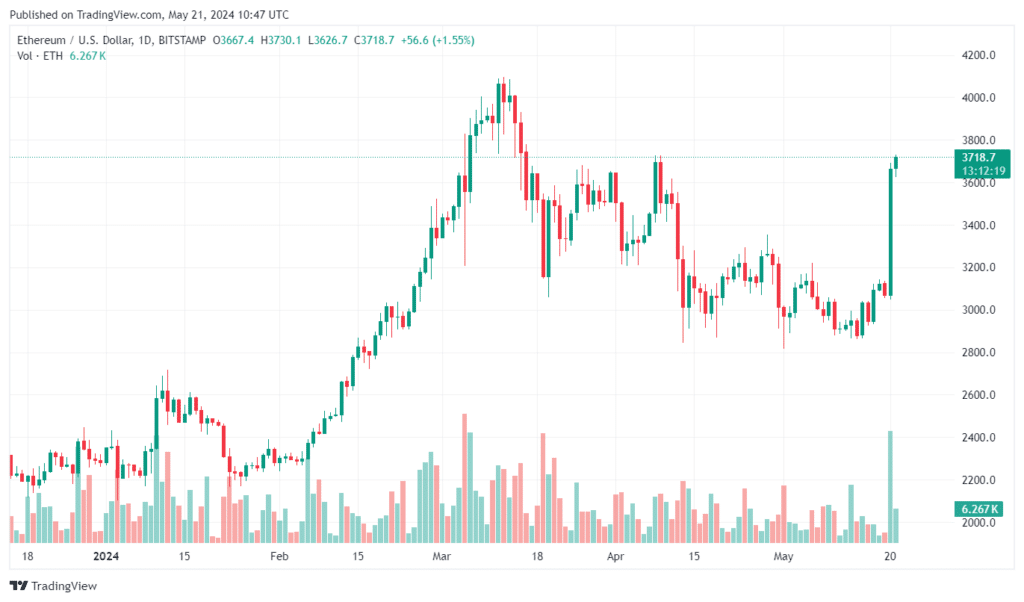

If approved by the SEC, Ethereum’s ETH cryptocurrency could potentially reach $4,000 as a near-term goal.

On May 21, analysts from a Singapore-based trading firm released an in-depth analysis, predicting that Ethereum, the second largest cryptocurrency by market value, could potentially reach $5,000 this year if the Securities and Exchange Commission (SEC) unexpectedly approves ETFs. Conversely, should the SEC deny ETF applications, investors might brace for a significant downturn towards the strong support level of $3,000, which Ethereum has consistently demonstrated throughout various occasions at approximately $2,900.

As a crypto investor, I’ve noticed that the current state of uncertainty in the market has led to increased volatility. However, instead of trying to time the markets and make spot trades, I believe considering the spot-futures basis could be a more profitable approach right now. This strategy is once again offering yields above 10%.

QCP Capital

Based on rumors swirling around a possible approval, Ethereum’s price experienced a significant jump of almost 20%, peaking at $3,650 on Tuesday. QCP Capital had previously issued a warning that the subdued market sentiment and approval of spot Ethereum Exchange-Traded Funds (ETFs) could potentially propel ETH back to its previous peak. However, they added a note of caution, suggesting that an unexpected approval might lead to a short squeeze, sending ETH soaring to unprecedented heights.

The SEC might have a hidden move by making a fine distinction between Ethereum and staked Ethereum, categorizing the latter as a security. As per Alex Thorn, the head of research at Galaxy Digital, this approach would conform to the SEC’s ongoing lawsuits and probes, enabling the commission to endorse Ethereum ETFs while preserving its existing regulatory standpoint.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD MXN PREDICTION

- USD CNY PREDICTION

- USD JPY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-05-21 13:58