As a seasoned analyst with over two decades of experience in the financial markets, I have seen countless trends and cycles come and go. The recent surge in stablecoin inflows into centralized exchanges is reminiscent of bullish momentum we’ve witnessed before significant price rallies in Bitcoin and altcoins.

It appears that people investing in cryptocurrencies are transferring stable digital currencies into centralized trading platforms. This move could indicate a growing optimism or upward trend for Bitcoin and other alternative coins.

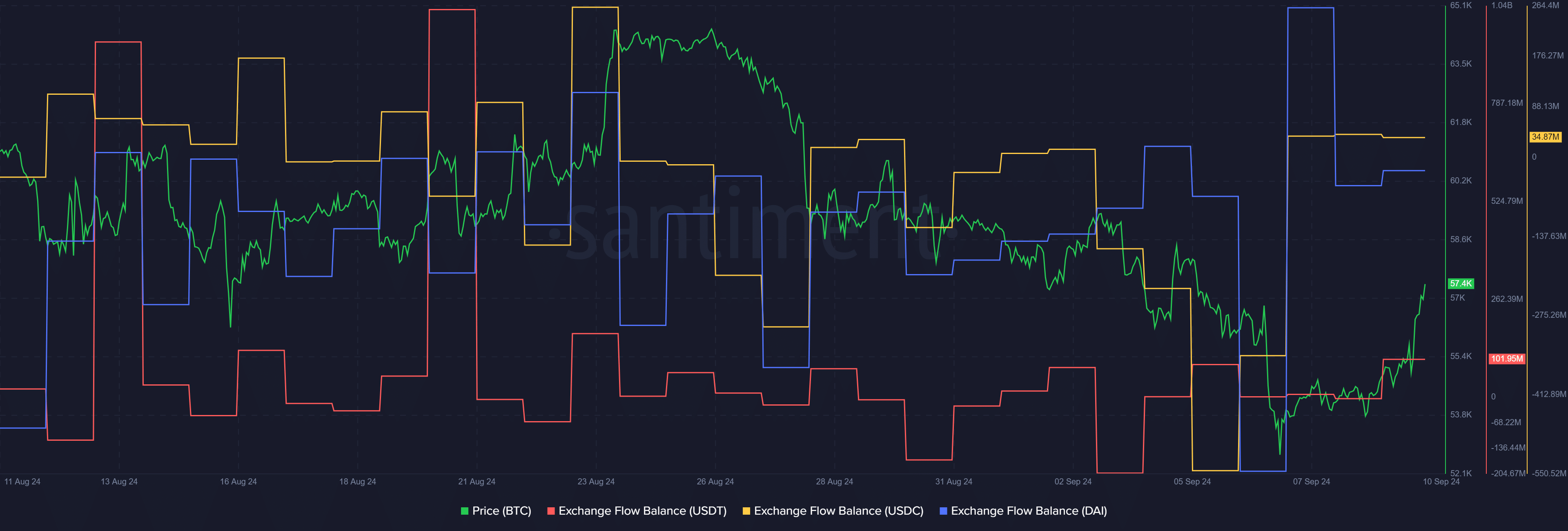

Based on information from Santiment, the combined net inflow into the top three stablecoins – Tether (USDT), USD Coin (USDC), and Dai (DAI) – amounted to approximately $141.2 million over the last 24 hours.

According to data from Santiment, it was USDT that experienced a significant influx of approximately $101.95 million, followed closely by USDC with a net inflow of around $34.87 million. DAI, the third-largest stablecoin in terms of market cap, also witnessed an exchange inflow amounting to nearly $4.24 million.

The surge in the stablecoin exchange net flows shows increased buyer optimism.

As a crypto investor, I’ve noticed a striking resemblance to an event that unfolded on August 22nd. The price of Bitcoin soared past the $64,000 milestone, while the collective value of all cryptocurrencies reached a local peak of $2.36 trillion, setting a new high for the global market capitalization.

The total value of the global cryptocurrency market has soared to an impressive $2.09 trillion, as per information from CoinGecko. Meanwhile, the current market capitalization of stablecoins stands at a substantial $170.9 billion. Additionally, the daily trading volume within this sector has exceeded $60 billion due to the ongoing bullish trends.

As an analyst, I’m observing a notable increase in Bitcoin (BTC) value today – it has risen by 3.8% within the past 24 hours, currently trading at approximately $57,250. According to a recent report from crypto.news, it seems that large investors, or “whales,” are actively amassing more BTC and transferring their holdings into self-managed wallets.

One significant factor driving the overall market optimism is the unveiling of the latest U.S. Consumer Price Index, revealing the nation’s inflation rate for the month of August.

Significantly, the market may shift directions if the inflation rate exceeds the predicted 2.6%. In other words, there’s a possibility that the market trend might reverse if inflation surpasses the anticipated figure.

Read More

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-09-10 11:52