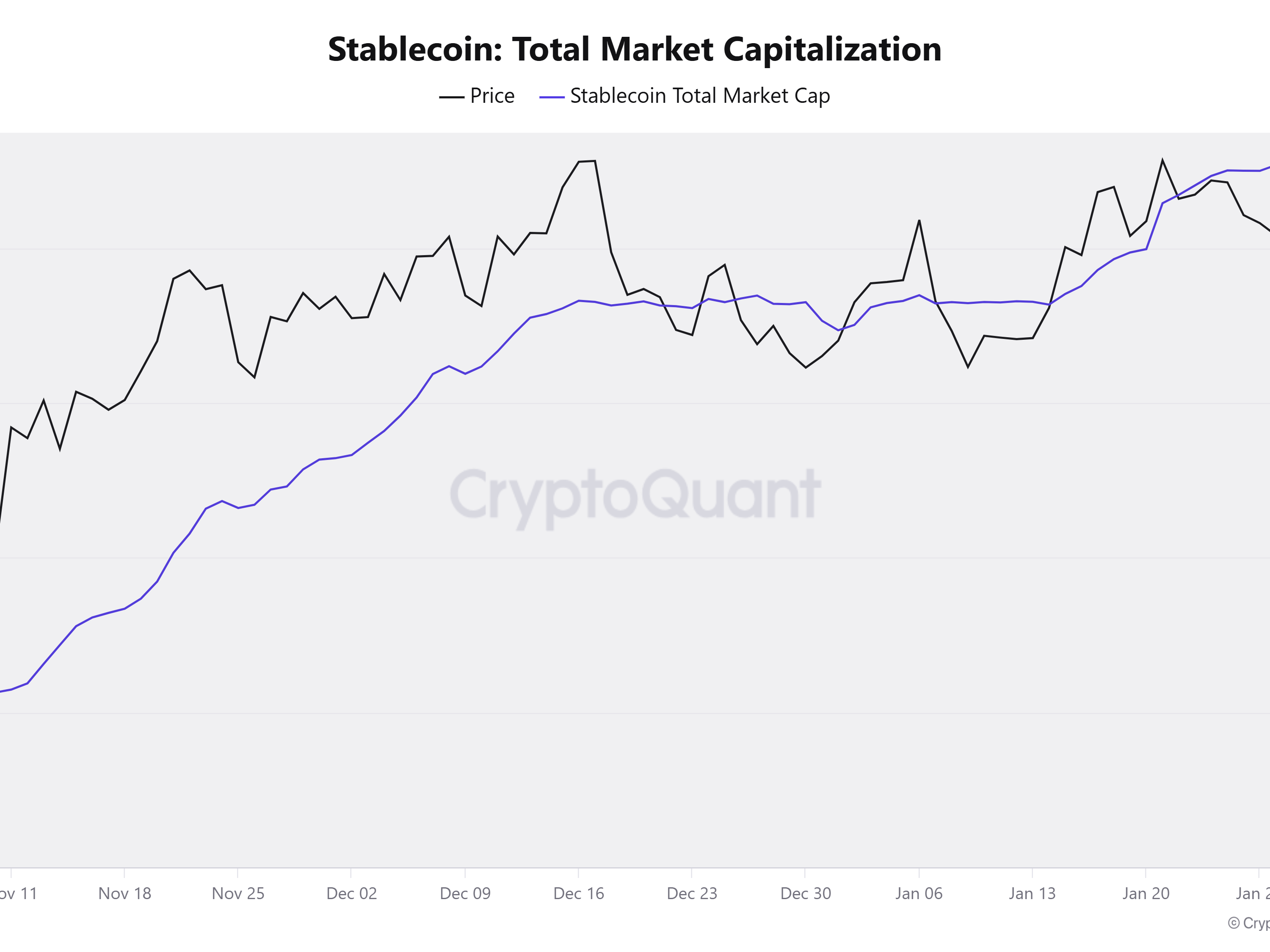

In a twist of fate that even the most seasoned fortune-teller couldn’t predict, the market capitalization of stablecoins has leaped by a staggering $37.6 billion since the day Donald Trump donned the presidential crown in November. Who knew politics could be so profitable? 🎩💸

According to a fresh-off-the-press report from the oracle of on-chain analytics, CryptoQuant, the total value of USD-denominated stablecoins has reached dizzying heights, setting a new record since the fateful announcement on November 6. It’s like watching a balloon float higher and higher, until—pop! 🎈

The report, which meticulously tracks the market cap of Tether (USDT), USD Coin, Binance USD, True USD, Pax Dollar, and DAI, reveals that these digital darlings have collectively soared to a whopping $204 billion. That’s a 22 percent rise in value over a mere 86 days since Trump’s victory. Talk about a political power play! 📈

Now, let’s talk Tether. The liquidity of stablecoins has been largely driven by Tether deposits on centralized exchanges, which have ballooned by 41 percent from $30.5 billion on November 4 to a jaw-dropping $43 billion by January 31. It’s like watching a toddler with a cookie jar—impressive, yet slightly concerning! 🍪

But wait, there’s more! The stablecoin market cap is not just a number; it’s the lifeblood of market activity, acting as a crucial source of liquidity for trading on exchanges. Its growth usually signals a rise in crypto prices, which, let’s be honest, gets retail traders all hot and bothered. 🔥

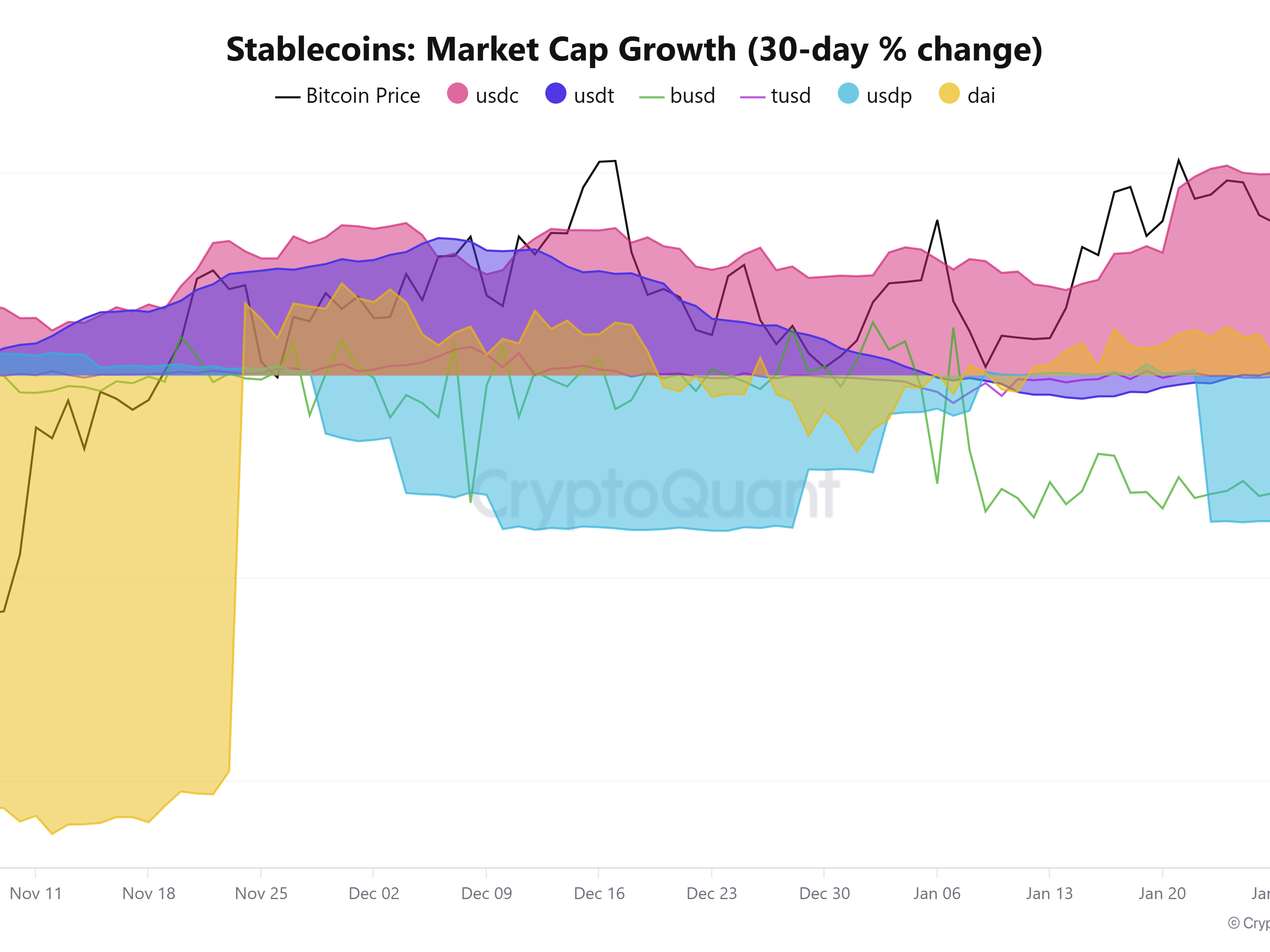

The expansion of liquidity via stablecoins continues to be driven by Tether’s USDT, but Circle’s USDC has regained traction. The market capitalization of USDT is $139 billion today, up by $19 billion (15%) since November 4. Meanwhile, USDC’s market capitalization has started to increase significantly again, rising by $17 billion (48%) over the same period. USDC’s market capitalization is now $52.5 billion.

CryptoQuant analysts are buzzing with excitement, believing that this booming stablecoin market could be the harbinger of the next significant upward movement for Bitcoin and crypto prices. It’s like waiting for the next season of your favorite show—will it be a cliffhanger or a happy ending? 📺✨

The liquidity impulse, which measures the 30-day percentage change in market capitalization, is now a roaring 20 percent for USDC, while USDT is slightly positive after a brief contraction at the start of 2024. Buckle up, folks; it’s going to be a bumpy ride! 🎢

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD JPY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-01-31 21:32