As a researcher with a background in blockchain technology and experience studying market trends in Latin America (LATAM), I find the data on crypto trading in the region quite intriguing. The growing popularity of stablecoins like USDT and the waning interest in Bitcoin are noteworthy developments.

Approximately 40% of cryptocurrency transactions in Latin America involve the USDT stablecoin, indicating a decreasing preference for Bitcoin and even surpassed by XRP in the most frequently traded crypto pairings within the region.

In Latin America (LATAM), the preference for stablecoins over Bitcoin is evident as over 60% of the top 10 trading volume involves pairing stablecoins with fiat currency, based on statistics gathered by Kaiko, a reputable blockchain data analysis company.

According to data from Kaiko, USDT, which is issued by Tether, is extremely preferred among Latin American traders over Bitcoin, representing more than 40% of all transactions in the region. This surge in popularity for stablecoins has led central banks within the area to ponder the possibility of launching their own digital currencies (CBDCs). However, it remains a question if they will be able to match the effectiveness of stablecoins in attracting traders.

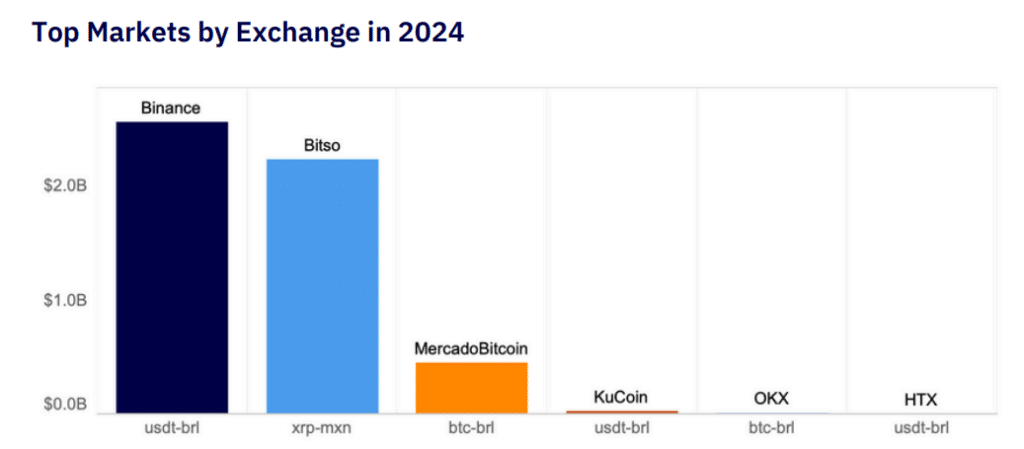

In an unexpected turn of events, Bitcoin trails behind XRP, a token created by Ripple, in trading volume within the LATAM (Latin America and Caribbean) region. According to recent data, the XRP/MXN (Mexican Peso) market surpasses the BTC/BRL (Brazilian Real) market in trading volume by over a billion dollars. Notably, Kaiko, a leading crypto analytics firm, attributes XRP’s popularity in this region primarily to its collaboration with Bitso, the prominent crypto exchange in Latin America.

Binance remains the undisputed leader in global market turnover, especially for stablecoin transactions, as reported by Kaiko. Notably, the crypto market in Brazil has experienced remarkable expansion, with an average of $1.3 billion in BRL trade volumes each month in 2024 – a significant increase from the $0.7 billion recorded in 2023. However, according to Kaiko, Binance’s dominance in the region is showing signs of decline. Mercado Bitcoin, Brazil’s leading crypto exchange, experienced a dramatic surge in trading volumes in 2024, with activity in both Bitcoin and altcoins driving this growth.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-06-21 14:45