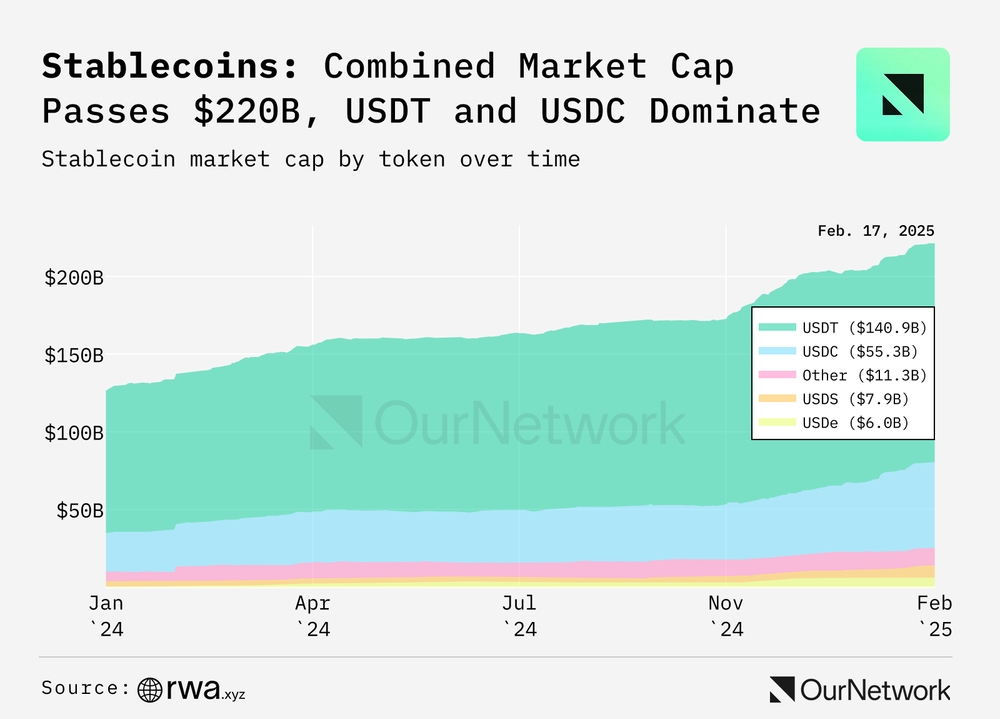

Well, hold onto your wallets, folks! The total stablecoin supply has now galloped past a staggering $221 billion, which, believe it or not, is more than 1% of the U.S. dollar M2 money supply. Yes, you heard that right—1%! That’s like finding a dollar bill in your couch cushions and realizing it’s actually a treasure trove! 💰

Once upon a time, stablecoins were the quirky cousins at the family reunion of finance, but now they’ve muscled their way into the spotlight, accounting for over 1% of the U.S. dollar M2. This broad measure of money includes everything from cash to deposits, and it seems stablecoins have been on a shopping spree, adding nearly $100 billion since 2024, according to the number-crunchers at OurNetwork. Who knew digital coins could be so… stable? 🤔

Now, let’s talk about the big players. Tether (USDT) has seen its market share drop from a hefty 73% to a mere 64%. Ouch! Meanwhile, Circle’s USDC is strutting its stuff, rising from 20% to 25%. Together, these two titans account for a whopping 89% of the total stablecoin market share. But wait! New contenders like Ethena’s USDe and Usual’s USD0 are crashing the party, and they’re not just here for the snacks!

Speaking of new players, synthetic dollar USDe has added a cool $5.9 billion to its coffers, while USD0 has managed to grow by $1.1 billion. And then there’s FDUSD, which initially gained traction through some flashy promotions but has since lost its luster as competition heated up. It’s like the kid who was the star of the soccer team until everyone else learned how to kick a ball. ⚽️

According to OutNetwork, USDC’s recent growth spurt has been largely fueled by its adoption beyond Ethereum’s mainnet. Analysts have noted “explosive growth” of over $7.7 billion worth of USDC on Solana, likely thanks to a meme coin trading frenzy. Who knew that memes could be so profitable? On top of that, USDC is also raking in gains on Ethereum’s layer-2 solutions like Coinbase’s Base and Arbitrum. Talk about a digital gold rush! 🏃♂️💨

Meanwhile, Circle CEO Jeremy Allaire is on a mission to solidify the company’s U.S. presence. He argues that issuers of dollar-pegged tokens should be required to register in the country. “There shouldn’t be a free pass for stablecoin issuers in the U.S.,” he insists, which could make it trickier for rival Tether to expand after its recent move to El Salvador. It’s like a game of Monopoly, but with real money and fewer top hats! 🎩

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2025-02-26 16:07