As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed countless market cycles, bull runs, and bearish corrections. The recent rise in altcoins like Floki, Stacks, Bonk, and Solana has caught my attention, given the current economic climate and the technical indicators at play.

Cryptocurrencies other than Bitcoin, such as Stacks, Floki, Bonk, and Solana, have been regaining strength in a recent uptick. This is due to traders snapping up discounted prices (the dip), and as the crypto market’s fear and greed index has shifted towards a balanced state.

Floki, Stacks, Bonk, and other tokens are rising

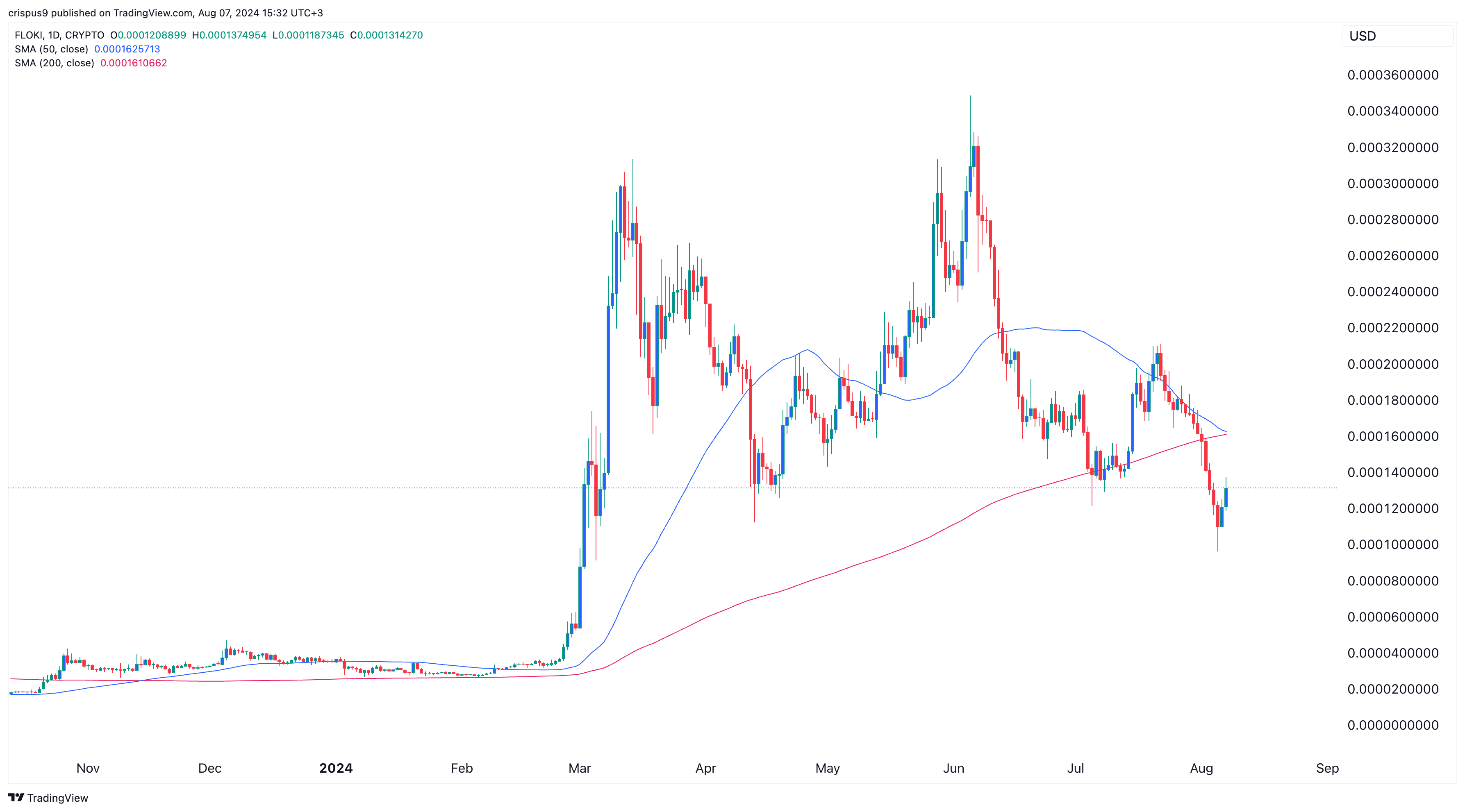

On August 7th, Wednesday, the value of FLOKI token increased to $0.0001370, marking a 42% rise from its lowest point this week. Meanwhile, Solana (SOL) soared to $154, representing a 41% boost over its weekly low of $110. Additionally, Stacks climbed to $1.4420. Notably, other significant gainers among altcoins included Popcat (POPCAT), Dogwifhat (WIF), and Bonk (BONK), which saw a 7% increase.

1) As investor apprehension about stocks and cryptocurrencies lessened recently, these tokens experienced an increase in value. The Crypto Fear & Greed Index climbed to a neutral 43 from this week’s minimum of 38, while the VIX index, Wall Street’s fear indicator, receded.

Over the past two days, there has been a significant recovery across various stock markets, including those based in America, Europe, and Asia. The Dow Jones experienced a surge of 294 points on Tuesday, with an additional 300 points predicted for tomorrow in the futures market. Similarly, the S&P 500 and Nasdaq 100 futures showed impressive gains, rising by 51 and 217 points respectively.

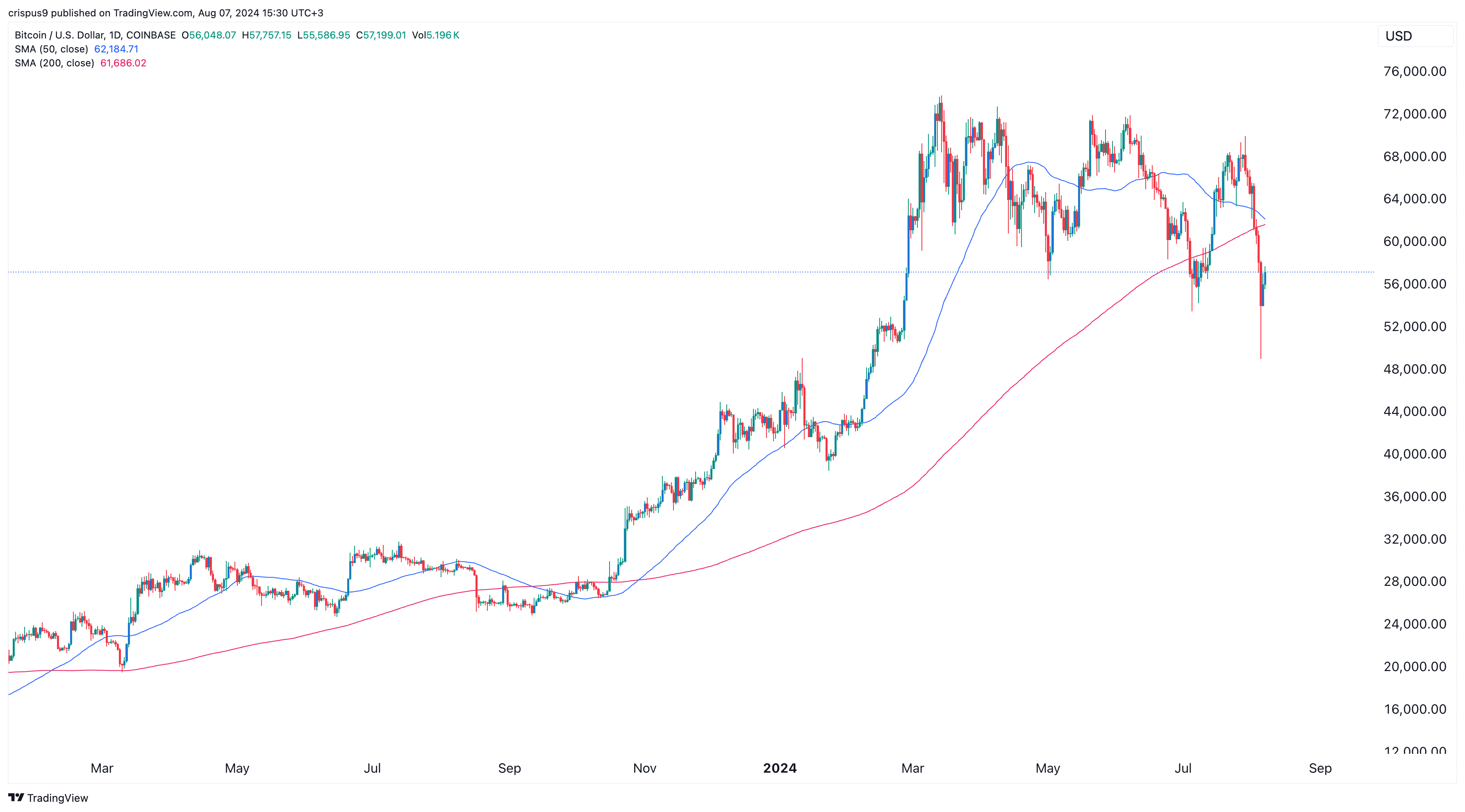

Bitcoin price death cross is a big risk

The costs of Floki, Stacks, and Bonk additionally increased due to Bitcoin’s robustness as it surged beyond $57,000. Additionally, it developed a hammer candlestick pattern and a falling broadening wedge formation, suggesting potential further growth in the future.

While there’s a potential technical risk for Bitcoin (BTC), it lies in the possibility of forming a “death cross.” This occurs when the 200-day and 50-day moving averages intersect, with the 200-day moving average falling below the 50-day one. A death cross often indicates that bearish sentiment is dominating, which may lead to further price declines.

The last instance where Bitcoin experienced a “golden cross,” which is when its short-term moving average surpasses the long-term one, was in October of the previous year. Following this event, the value of Bitcoin increased by more than 110%. However, in January of this year, Bitcoin formed a “death cross,” where the short-term average falls below the long-term one. This was followed by a significant decrease in Bitcoin’s price from approximately $48,000 to around $15,700 in 2022.

If the recent recovery fails to sustain, other cryptocurrencies besides Solana could potentially form a ‘death cross.’ Currently, Solana is trading at the intersection of its 50-day and 200-day moving averages, much like Floki may do in the near future.

If these coins appear to decline, it might signal that the current recovery is merely a temporary surge, often referred to as a “dead cat bounce” – a frequent occurrence in the world of falling cryptocurrencies.

Despite some uncertainties, there are several factors that could positively impact Bonk, Floki, and Stacks tokens. Essentially, these digital assets might gain traction due to the anticipated loosening of monetary policies, a scenario that the market is already factoring in. Analysts from Citi, JPMorgan, Wells Fargo, and Jefferies predict that the Federal Reserve could reduce rates by 0.50% in September. Additionally, Jefferies anticipates an emergency meeting this month to further lower interest rates.

Another potential trigger could be an increase in the number of businesses seeking to list on a Solana Exchange-Traded Fund (ETF). For instance, VanEck has already made an application, while Franklin Templeton has indicated its intention to do so. The creation of a Solana ETF might result in increased value for certain Solana tokens such as Bonk and WIF.

Read More

- Brent Oil Forecast

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- USD JPY PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- EUR CNY PREDICTION

2024-08-07 16:21