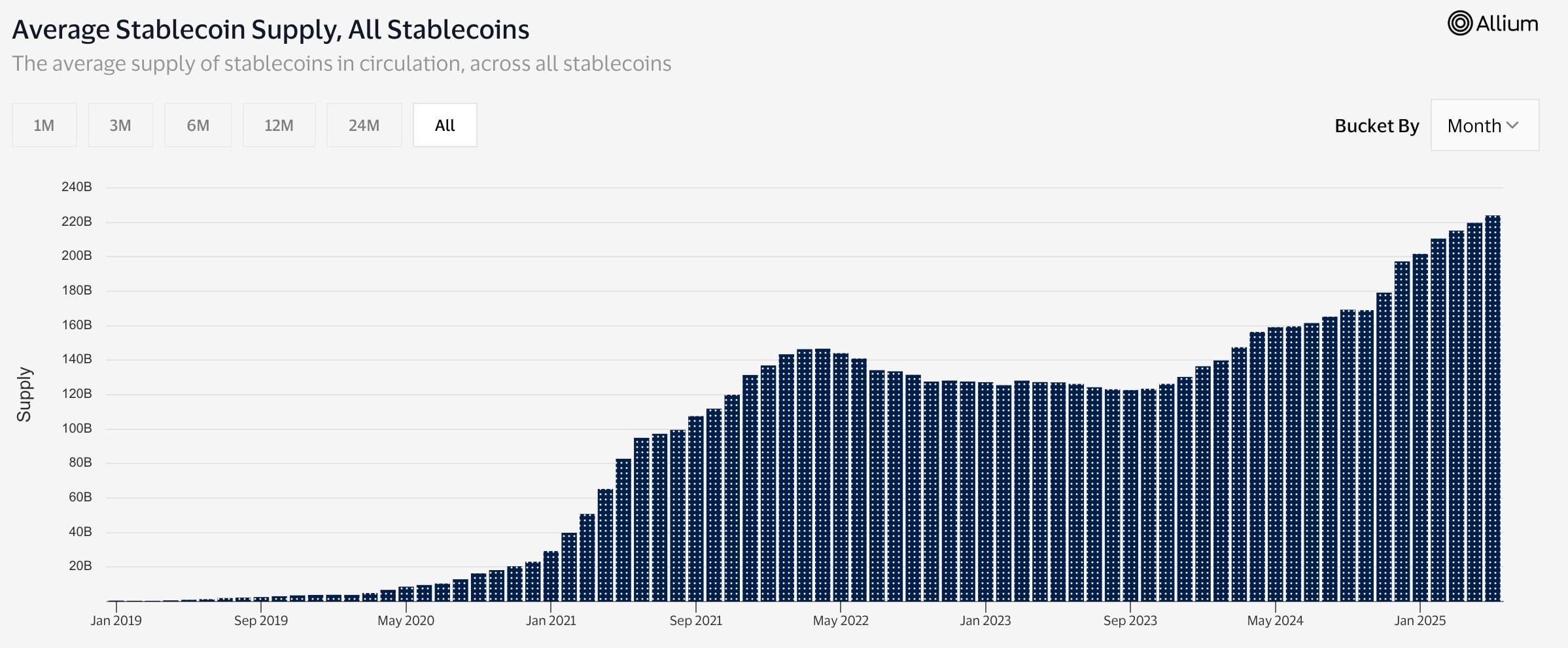

Oh, how the silly world of finance has turned into a digital carousel! This week, stablecoins—think of them as the stodgy old aunts of crypto—continued their relentless charm offensive, hitting a new high of $243.8 billion. Yes, darling, they’re swelling quicker than a souffle in a hot oven! 🥂

Since the start of the year, these trusty coins have added over $38 billion to their wardrobe—making their starting point at a mere $240 billion. Ever the overachievers! Tether (USDT) claims the throne with over $151 billion, grinning with a 62% market share and looking as confident as a gossip columnist at a party. 🍸

Not far behind is USD Coin (USDC), flaunting its $60.4 billion assets, and Ethena USDe (USDe), modestly holding close to $5 billion. Meanwhile, the freshly minted USD1 by Donald Trump’s World Liberty Financial has gained a_NOT_TOO_SHABBY $2.1 billion, most of which, one suspects, is tied up in a little something at Binance—because, darling, who doesn’t love a good investment hike? 📈

Other noteworthy stablecoins include Ripple USD (RLUSD)—the quiet achiever with $900 million—and PayPal’s PYUSD, the digital equivalent of a modest weekend retreat, with $313 million. Because, in the end, size isn’t everything, but a little sparkle never hurts. ✨

According to dear old Visa, more folks are flashing their stablecoins in daily life. Over 192.2 million addresses have dared to send, while a hearty 242.7 million have received—such a bustling little ecosystem! The total addresses now tip the scales at a chummy 250 million. 🎉

All this delightful fuss has lifted transaction counts to a staggering 5.8 billion—and a volume that shimmers at $33.6 trillion. Talk about making a splash in the digital pond! 💦

Stablecoins are the darling of the cost-conscious; transferring a mere $1,000 with PayPal costs an arm and a leg—well, 2.99% plus some odds and ends. But with stablecoins? A mere pittance—and faster than you can say “wire transfer!” 🏃♂️💨

Citi predicts these delightful little assets will continue their ascent, eyeing a possible worth of over $1.6 trillion by 2030. And Standard Chartered? They’re whispering about a glow-up to $2 trillion by 2028. Who knew stability could be so fashionable? 😉

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD JPY PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

2025-05-17 20:18