In the shadowy corridors of the cryptocurrency bazaar, the price of Stellar lumens has taken a nosedive for the third day running, as trepidation spreads like wildfire among the traders. Fear not, dear reader, for this is merely the market’s way of reminding us that volatility is its middle name! 😅

Stellar (XLM) has plummeted to a disheartening $0.2740, marking its lowest point since the fateful day of February 3. A staggering 57% below its November zenith, it seems our dear Stellar is in a bit of a pickle. 🥒

This unfortunate descent has coincided with a broader market malaise, as Bitcoin (BTC) and Ethereum (ETH) have decided to join the bear party. Who knew bears could be so popular? 🐻🎉

But wait, there’s more! Stellar finds itself in a precarious position as Ripple (XRP) has retreated, forming a rather ominous head and shoulders pattern. Yes, you heard it right! A head, two shoulders, and a neckline—sounds like a bad fashion choice, doesn’t it? 😆 This bearish chart pattern suggests that XRP might be preparing for a dive, and Stellar could be dragged down with it.

Historically, Stellar and Ripple have danced a closely choreographed waltz, given their intertwined origins. Jed McCaleb, the mastermind behind Stellar, was once a Ripple co-creator. Both networks are vying for the approval of their respective exchange-traded funds from the Securities and Exchange Commission. So, if Ripple stumbles, Stellar might just trip over its own feet! 🤦♂️

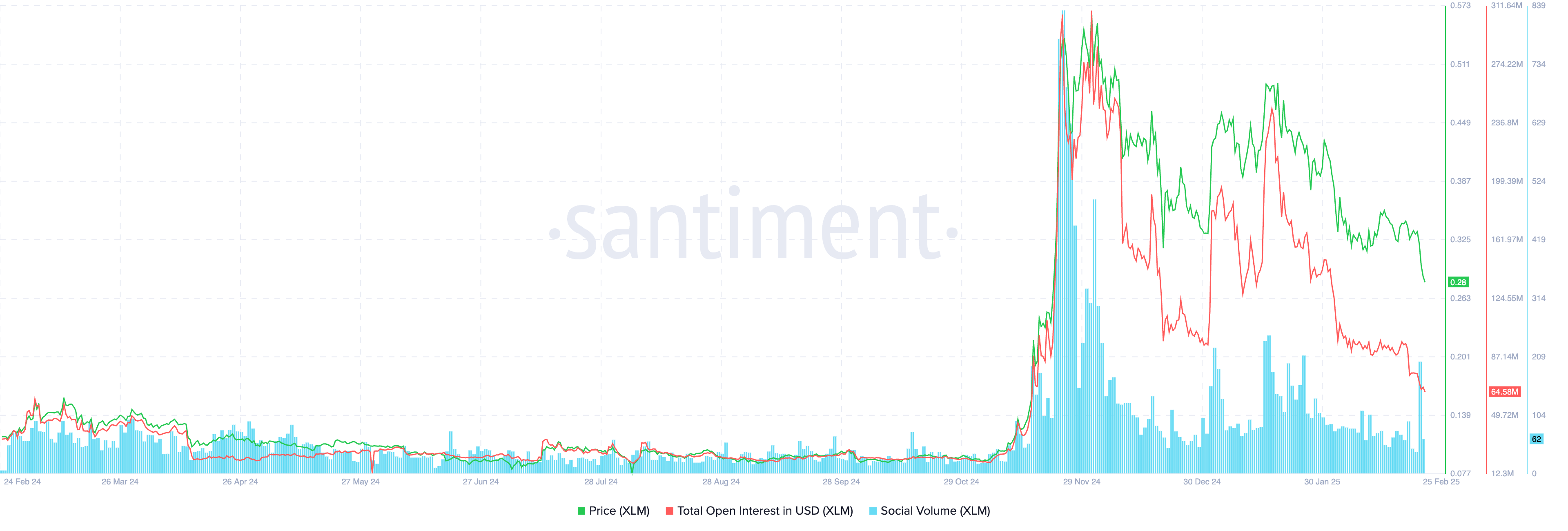

As we peer into the crystal ball of Stellar’s fundamentals, the outlook appears grim. Data from Santiment reveals that total open interest for Stellar has plummeted to 64.5 million, the lowest since November. It seems the crowd has lost interest—perhaps they’ve found a new hobby? 📉

Moreover, the social volume metric has dipped to 0.28, down from last year’s high of 0.55. This decline indicates that social media chatter has quieted, and we all know that when the Twitter birds stop chirping, the prices tend to follow suit. 🐦

XLM Price Analysis

Upon examining the daily chart, it becomes evident that Stellar has been on a downward spiral, forming a series of lower lows and lower highs. This has birthed a descending channel pattern, confirming the downward trend. It’s like watching a sad movie on repeat! 🎬

Stellar is also inching closer to a death cross—no, not a horror movie, but a technical term where the 50-day and 200-day moving averages intersect. Additionally, it has dipped below the 61.8% Fibonacci retracement level, a crucial zone where most pullbacks occur. Talk about a rough week! 😱

Given these ominous signs, the risk of further decline looms large, with the next level to watch being $0.2056, the 78.6% retracement point, which is a chilling 28% below the current level. Buckle up, folks! 🚀

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2025-02-26 19:51