So, Stripe – you know, the payment nerds who handle your online shopping sprees and hip startups’ cash flow – are finally diving into the world of stablecoins. After a “mere” ten years of daydreaming and maybe a bit of internal coffee-fueled obsession, they’re ready to play in the crypto playground.

On April 25, Patrick Collison, Stripe’s very own CEO and part-time visionary, spilled the beans that they’re cooking up a stablecoin product. It’s like they’ve been sitting on the idea through lunch breaks and board meetings, only now feeling brave enough to unleash it on the world.

Stripe’s Stablecoin Baby: Powered by Bridge’s Tech and Ten Years of Patience

Patrick hinted that this hasn’t been a sudden whim – more like that awkward plant you keep forgetting to water for a decade but still hope will bloom one day. Lucky for them, the stars (and probably some legal folks) have aligned, and Stripe’s ready to launch—starting with businesses outside the US, EU, and UK because, well, rules.

We’ve wanted to build this product for around a decade, and it’s now happening.

— Patrick Collison (@patrickc) April 25, 2025

Stripe didn’t just decide to jump on the stablecoin bandwagon overnight. They dropped a casual billion-dollar acquisition on Bridge back in February – yes, billion with a B – to snag some shiny stablecoin infrastructure tech. This is the mattress where Stripe’s new digital money dreams will rest.

Why all the fuss now? Because Stripe, busy handling more currencies than you have socks and trillions of dollars in online drawer reveals, sees stablecoins as the perfect next step to make cross-border payments zippier and cheaper. Imagine sending money faster than your latest binge-watch binge notification.

Of course, Stripe isn’t the only fintech kid trying to collect stablecoins like Pokémon cards. Big players like PayPal are also eyeballing this new sci-fi money market. It seems fintech’s new favorite party trick is “How Stablecoin-y Are You?”

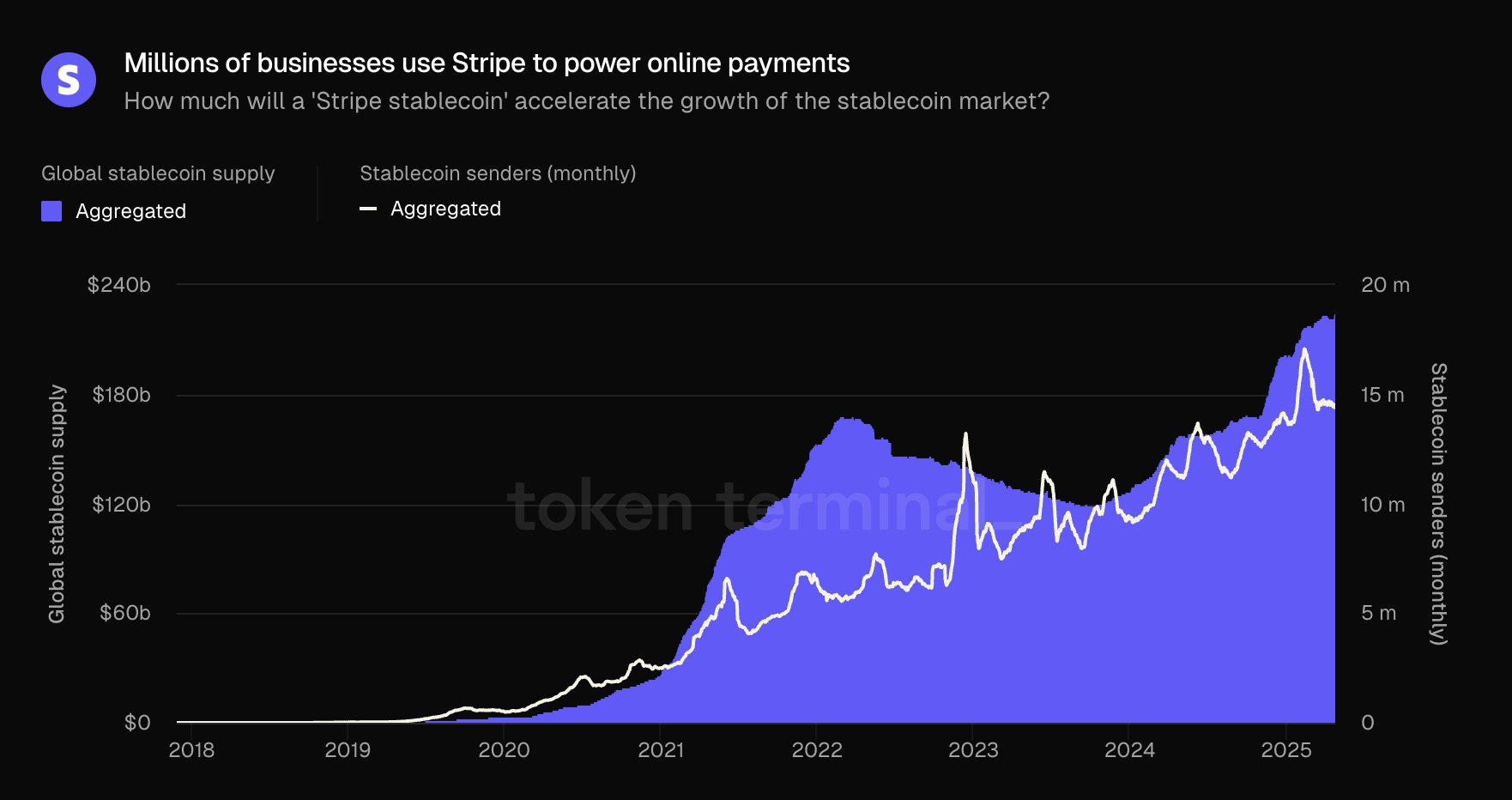

Right now, Tether (USDT) and Circle (USDC) run the stablecoin playground, but experts from fancy firms like Standard Chartered predict the market could balloon to over $2 trillion by 2028. That’s a lot of zeros. Regulation is finally crashing the party in Washington, with lawmakers drafting bills like the STABLE Act and the GENIUS Act – seriously, someone’s got a sense of humor – aiming to keep the crypto wild west from turning into a total rodeo.

Bottom line? Stripe’s stepping into the ring to wrestle with the future of money. Will they tame stablecoins or just add more drama to crypto’s ongoing soap opera? Stay tuned, popcorn ready. 🍿

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2025-04-26 17:41