As a seasoned crypto investor with a fair share of scars from past bear markets, I’ve learned to tread cautiously in the ever-changing landscape of digital assets. The recent report on GameFi projects has certainly caught my attention, and not in a good way. With an average failure rate of 93% and token prices plummeting by a staggering 95%, it’s hard not to feel a chill down my crypto-loving spine.

An analysis of over 3,200 GameFi projects shows 93% have failed, with token prices plummeting by an average of 95%.

The field integrating gaming and decentralized finance, known as GameFi, has experienced a significant drop following its early boom during the 2022 cryptocurrency market uptrend. A recent analysis reveals that an overwhelming majority, approximately 93%, of these projects have not been successful.

According to a study conducted jointly by ChainPlay and Storible on approximately 3,200 GameFi ventures, it was discovered that the majority of their associated tokens have experienced an average decline of 95% from their peak values. Furthermore, the research indicates that GameFi projects typically don’t last long, with an average lifespan of merely four months before they start to dwindle.

GameFi projects tend to have a shorter lifespan than most cryptocurrency initiatives, including memecoins which usually last for a year and typical crypto projects lasting three years. This suggests their increased volatility and difficulty in maintaining long-term success.

ChainPlay

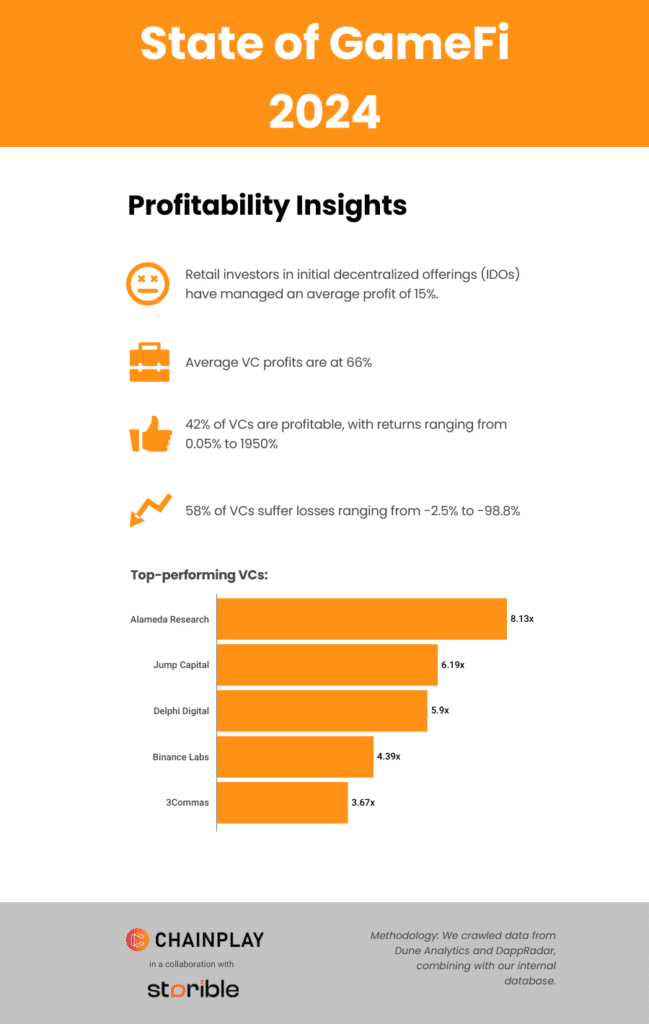

Interestingly, investment by venture capital in GameFi has been unpredictable. On one hand, 42% of investors have reported profits, with yields ranging from a small 0.05% to an impressive 1,950%. However, the remaining 58% have faced losses, some substantial ones reaching as high as 99%, according to data available. Despite the general trend indicating losses, prominent VCs like Alameda Research, among others, have managed to secure returns, albeit many other investors have encountered significant declines, as suggested by ChainPlay.

Despite GameFi experiencing a decline from its record highs in 2022, the industry remains an attractive destination for investors, albeit with increased caution. In 2024, VC funding for GameFi amounted to $859 million, marking a 13% decrease compared to 2023 and a significant 84.6% fall from its peak in 2022. ChainPlay posits that the key to success in the near future will likely be centered around providing engaging gameplay experiences and constructing robust, value-driven ecosystems.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- Brent Oil Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-12-05 12:53