As a seasoned crypto investor with over a decade of experience in this dynamic market, I must admit that the meteoric rise of SUI in September has caught my attention. Having witnessed the rollercoaster ride that is the cryptocurrency world, I’ve learned to keep a keen eye on projects showing such impressive growth.

SUI surged 115% in September, becoming the top-performing altcoin and reaching a five-month high.

Currently, SUI (SUI) is being exchanged for $1.77 per token, marking a 7% increase in its value today. This surge has pushed its market capitalization beyond $4.925 billion, reaching an all-time high. Additionally, the daily trading volume of this Layer-1 blockchain increased by 164%, amounting to approximately $1.06 billion over the past 24 hours.

As a crypto investor, I’ve been keeping a close eye on Sui, frequently compared to Solana. It’s been quite remarkable to witness the rapid growth this project has experienced, fueled by heightened interest from both users and developers. Glancing at DeFi Llama’s data, it’s clear that the total value locked within its ecosystem has skyrocketed to a record-breaking $1 billion – an impressive leap from the $383 million noted in August.

Among the standout Sui decentralized applications (dApps) experiencing substantial increases in Total Value Locked (TVL) are the NAVI protocol, Cetus, Suiland, and Scallop Lend, with each platform holding more than $165 million worth of assets.

The fact that Sui has been focusing on the blockchain gaming industry, a crucial aspect for blockchain acceptance, is a significant factor fueling its current growth spike.

Starting in early September, Mysten Labs – creators of the Sui blockchain – began accepting pre-orders for the SuiPlay0X1 portable gaming device. This innovative gadget combines Sui’s blockchain technology with a Linux operating system, making it compatible with both conventional PC games and those based on blockchain technology.

To generate anticipation, those who pre-ordered were offered the chance to design a personal wallet that would later be granted an exclusive NFT upon the device’s arrival.

A significant factor fueling SUI‘s surge in September was the move by Grayscale to make its Sui Trust accessible to accredited investors. This action enhances Sui’s credibility and sparks increased institutional interest in the cryptocurrency.

As a researcher, I find it noteworthy that Sui’s latest move to incorporate USDC within its system and forge an alliance with MoviePass, a prominent U.S. movie subscription service, has undeniably fueled the surge in positive sentiment.

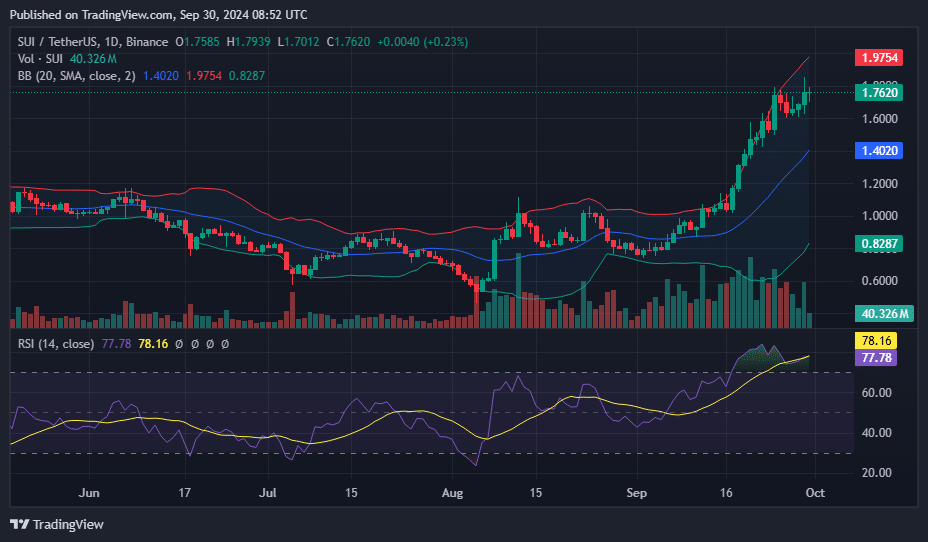

Technicals point to bullish momentum

On September 30th, Sui experienced a significant increase in the number of open contracts for future agreements, peaking at a record-breaking $485 million.

At the moment, the altcoin is being exchanged at prices that surpass both its 50-day and 200-day average price movements. On September 22, this created what’s known as a ‘golden cross’ – a significant bullish indicator in technical analysis.

As I was composing, the SUI‘s value approached the top of the Bollinger Band, reaching approximately $1.9754. Meanwhile, its Relative Strength Index climbed up to 77.

As a researcher, I am observing a robust bullish movement in Sui’s market, implying promising short-term returns could be on the horizon. If this momentum persists, the next significant resistance level to keep an eye on is approximately $2.1839, which corresponds to its March peak and represents a 24% increase from the current price.

On October 1st, there’s a potential for a price adjustment in SUI, as around 64.2 million SUI worth $108.5 million (accounting for about 2.4% of the total supply) will be unlocked, according to Token Unlocks. This could have an impact on the market value.

Approximately 61% of these allocated tokens are reserved for early investors who participated in the project’s Series A and B funding rounds. Should these investors choose to sell their holdings, there could be a notable increase in supply, which might counteract the current positive market trend.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Gold Rate Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-09-30 13:15