As a seasoned researcher with over a decade of experience in the cryptocurrency market, I have witnessed numerous bull runs and bear markets. The recent downturn of Sui (SUI) has been no exception, leaving me slightly concerned but also intrigued by its potential future prospects.

Sui token has suffered a harsh reversal, falling for three consecutive days, and erasing most of the gains made last week.

On August 27th, Tuesday, SUI dropped to $0.90, marking a decline of 20% from its peak last week, which has now lowered its total market capitalization to approximately $2.3 billion.

The decline occurred as Bitcoin (BTC) started to lose its pace and fell to $62,000. Similarly, other assets that surged following Jerome Powell’s dovish comments have also retreated. For instance, the Nasdaq 100, S&P 500, and Russell 2000 indices each dropped by more than 30 basis points on Monday.

Just like many tokens launched on Binance‘s pool, Sui hasn’t met expectations as it has plummeted nearly 60% from its peak this year, failing to maintain its initial excitement.

As a researcher delving into the realm of cryptocurrencies, I am convinced that this project has the potential to surpass Solana (SOL) in vital aspects such as market cap, the total value locked within its Decentralized Finance ecosystem, and overall developer engagement.

It’s been pointed out that the speed of Sui’s blockchain surpasses Solana’s considerably, and it also offers substantially reduced transaction fees.

Primarily, they argue that Sui is a superior choice over Solana, as Solana has experienced significant congestion due to its widespread adoption by DeFi, meme coin, and Decentralized Public Infrastructure (DePIN) developers. Notably, Tim Kravchunovsky, the inventor of Chirp – a DePIN for telecoms – recently advocated for Sui among DePIN developers.

Sui currently lags behind Solana, which boasts a market capitalization exceeding $71 billion as the fifth largest cryptocurrency. Data from DeFi Llama reveals that Solana holds more than $5.7 billion in DeFi assets and nearly $4 billion in stablecoins. Moreover, Solana ranks second in DEX volume, trailing only Ethereum (ETH).

Contrarily to Solana, Sui boasts a DeFi asset value of $652 million and only 38 dApps associated with it. In comparison, it holds significantly less stablecoins at $373 million compared to what Solana holds. Furthermore, the trading volume on Sui’s DEX within the last week was $222 million, whereas Solana’s was a whopping $5.96 billion over the same period.

It’s important to note that Sui, being a newer platform, debuted in 2023, whereas Solana has been active since 2020.

One point of discussion regarding Sui is that a larger proportion of its token supply remains locked. According to the data, Sui has a total supply cap of 10 billion $SUI tokens, with 25%, or approximately 2.6 million, already unlocked. On the other hand, 80% of Solana’s total supply (SOL) has been released, implying less potential future dilution in the future.

Reason 44 on why @SuiNetwork is the greatest Presenting FIXED SUPPLY WITH TRULY DEFLATIONARY PRIMITIVES BUILT INAs im sure we already know $SUI has a max supply of 10B tokens. That supply is fixed there will never be anymore than that in existence but what’s not common… — Cleanwater.Sui | 669.sui (@olympia__LB) August 27, 2024

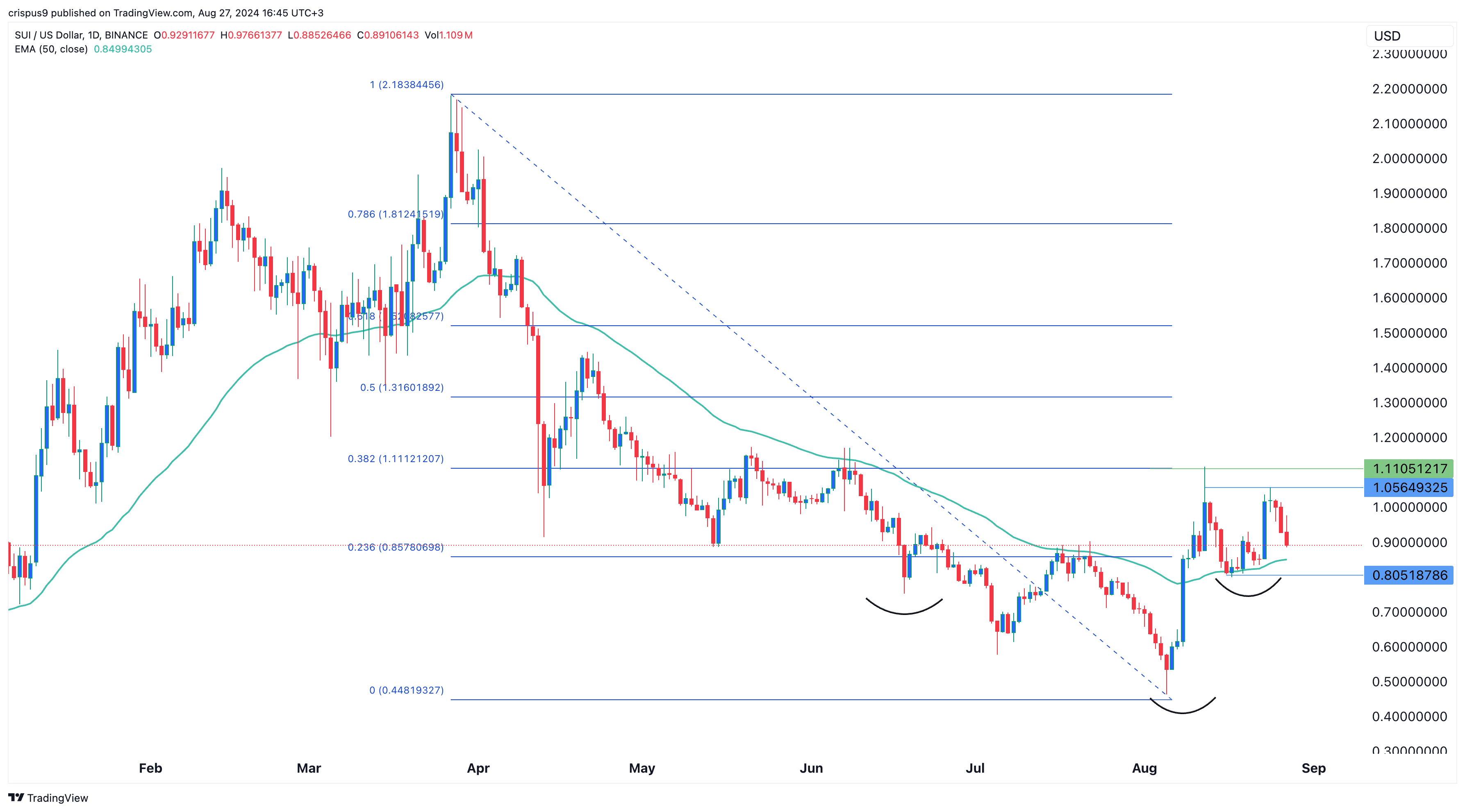

Sui price moved above the 50 EMA

Currently, the price of Sui token has retreated following its formation of a double-top chart pattern at $1.056, with the neckline situated at $0.8051. Typically, a double-top formation suggests a potential for a significant bearish trend, as it often leads to a powerful selloff.

From a favorable perspective, Sui’s token value consistently hovers above its 50-day moving average and exhibits an inverted head-and-shoulders chart formation. This pullback occurred following a test of the 23.6% resistance level.

From my perspective as an analyst, a potential bullish breakout isn’t something we can dismiss outright. This assumption could solidify if the price manages to surpass the resistance level set by the double top at roughly $1.056.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-27 17:14