As a seasoned crypto investor with a knack for recognizing market trends and patterns, I find myself somewhat wary of the recent surge and subsequent downturn of SuperRare (RARE). The token’s meteoric rise was indeed impressive, reminiscent of a firework soaring into the night sky, but its rapid descent is a stark reminder that even the most dazzling ascents can be followed by a harsh landing.

Due to investors cashing out, or “profit-taking,” SuperRare’s price saw a sudden drop following its massive surge of more than 500% from August 5 to August 15.

The price of the SuperRare (RARE) token dipped to $0.2280, marking a decrease of more than 34% from its peak on August 18th. This decline was largely triggered by investors cashing out, as the rapid rise didn’t have a strong underlying reason. Furthermore, the token’s value decreased following disclosure that the SuperRare Treasury moved 7.5 million tokens to Binance. Historically, transferring tokens to an exchange often indicates a plan to sell.

Just now, I noticed that the SuperRare Treasury moved approximately 7.5 million $RARE (around $1.8 million) to Binance through GSR. Interestingly, a transfer of a similar scale happened on May 15, following a surge in the price of $RARE.— Lookonchain (@lookonchain) August 19, 2024

Essentially, platforms such as SuperRare, OpenSea, and Rarible, which deal with Non-Fungible Tokens (NFTs), are facing challenges due to a consistent drop in trading activities.

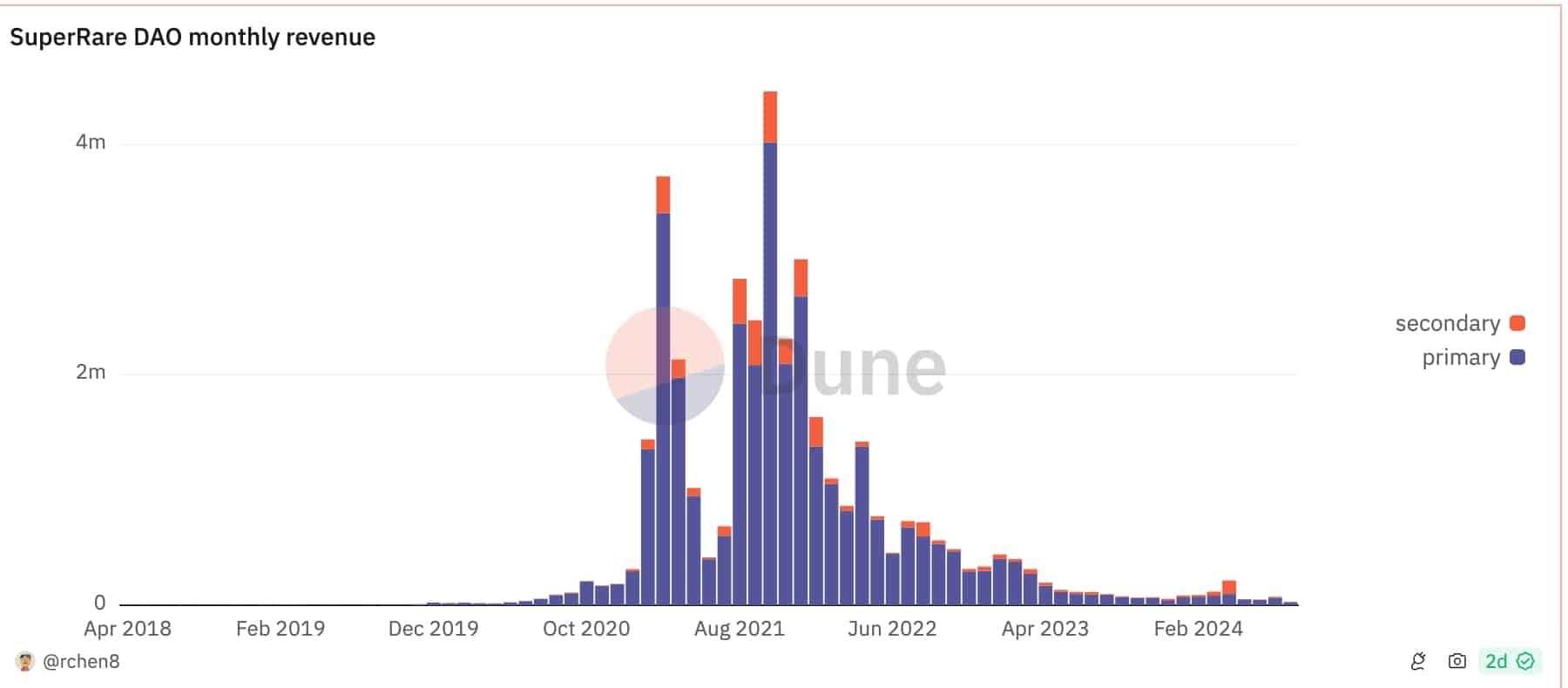

According to Dune Analytics, SuperRare’s monthly trading volume hit an all-time low. After peaking at approximately $36 million in August 2021, the volume dropped to around $1 million in July 2022. This downward trajectory over a two-year period culminated in SuperRare reducing its staff in 2023.

Similarly, OpenSea’s monthly volume dropped to $32 million in July from $643 million in Feb. 2023.

According to fresh stats from CryptoSlam, global sales volume of NFTs has dropped by about 37% over the last month, amounting to approximately $387 million. At its pinnacle, the industry was managing billions in weekly transactions, primarily fueled by sought-after collections such as Bored Ape Yacht Club, Azuki, Art Blocks, and CryptoPunks.

The spike in SuperRare’s pricing has led to an unprecedented peak in futures open interest, reaching a staggering $112 million. It’s worth noting that just a few days ago, there was no open interest in the futures market for SuperRare’s token.

SuperRare price analysis

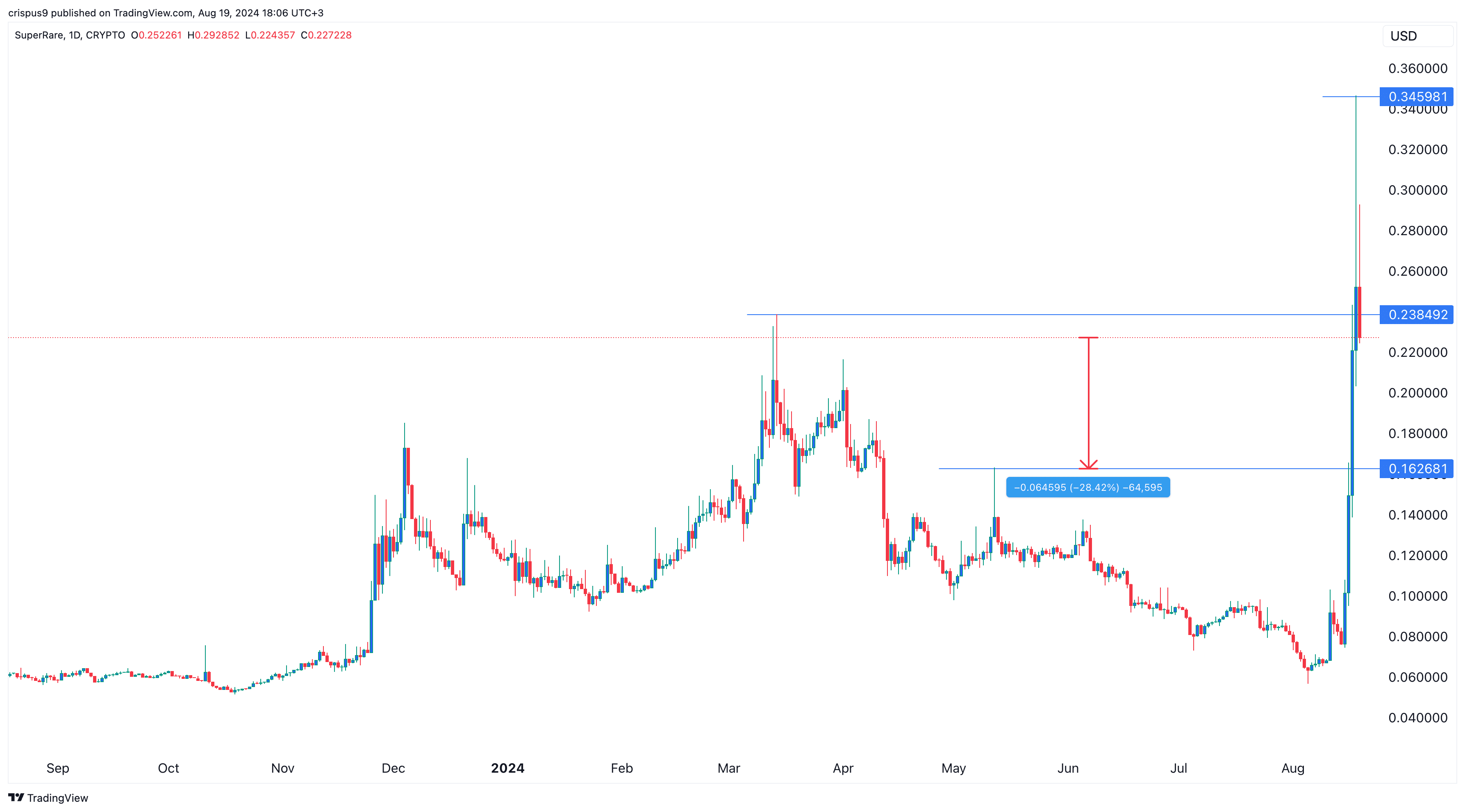

The daily chart shows that the RARE price went parabolic, trending on social media platforms like X and StockTwits. It peaked at $0.3460, the highest level since May 2022.

In my analysis, I observed a significant breakthrough as the token exceeded its highest swing for the year in March at $0.2384. Notably, it also climbed above the 50-day moving average, and simultaneously, the Money Flow Index reached an overbought state.

Considering these circumstances, the token’s forecast seems pessimistic since numerous traders might choose to sell off their holdings. If this pattern persists, there’s a possibility that the price could decline to the significant support level at $0.1626, which was its peak swing on both May 12th and 30%, or 30% lower than its August 19th lowest point.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-19 18:37