As a researcher with a background in business law and securities fraud, I find the ongoing legal battles surrounding Nvidia’s crypto-mining revenue to be a fascinating and complex issue. The potential impact on securities laws and shareholder rights is significant.

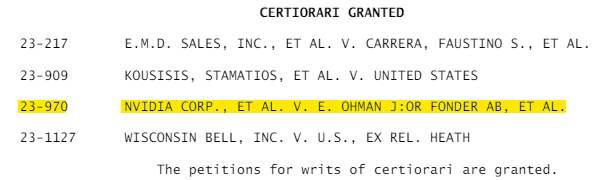

The US Supreme Court will consider a case concerning Nvidia Corporation’s cryptocurrency mining revenues, which could influence the legal framework for securities fraud claims brought by shareholders.

A class-action lawsuit filed by shareholders accuses Nvidia and its CEO, Jensen Huang, of making misleading statements about the importance of cryptocurrency revenue to the company’s earnings in the years 2017 and 2018.

As a researcher examining the details of this lawsuit, I’ve discovered an intriguing claim: Nvidia is accused of not revealing to investors and stakeholders the exact percentage of their sales derived from crypto mining activities. This concealment, it is alleged, has significantly influenced the company’s business operations – a fact that should have been disclosed for transparency.

Previously, a district court ruled in favor of Nvidia and dismissed the case in 2021. However, the 9th Circuit Court of Appeals overturned this decision and sent the case back for re-examination. The appeals court noted that there are credible claims suggesting Nvidia made deceitful or careless statements.

The corporation has requested a hearing before the Supreme Court, expressing worries over potential frivolous and manipulative lawsuits, in response to an investigation conducted in 2022 that led to a $5.5 million settlement for insufficient disclosure related to crypto mining’s effects on its gaming branch. This did not prevent ongoing litigation from shareholders.

As a researcher examining recent legal developments, I’ve discovered an intriguing situation: The Supreme Court has decided to review Nvidia’s case in the context of securities lawsuits against numerous corporations that have been brought forth by disgruntled shareholders.

As a crypto investor, I’m keeping an eye on the Meta Platforms Inc. case, where I, along with other shareholders, allege that the company misled us regarding data exploitation. This matter is set to be heard at the Supreme Court.

As a regulatory analysis expert, I can share that both the Federal Trade Commission (FTC) and the Department of Justice (DOJ) are currently scrutinizing the business practices of Nvidia, Microsoft, and OpenAI for potential antitrust concerns in relation to their dominance and impact on competition within the AI markets.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-06-18 08:20