As a seasoned crypto investor with a decade of experience under my belt, I can confidently say that the rising popularity and usage of stablecoins is nothing short of remarkable. The $3.7 trillion settled in 2023 and the projected $5.28 trillion by 2024 are numbers that speak volumes about their growing role in the global financial landscape.

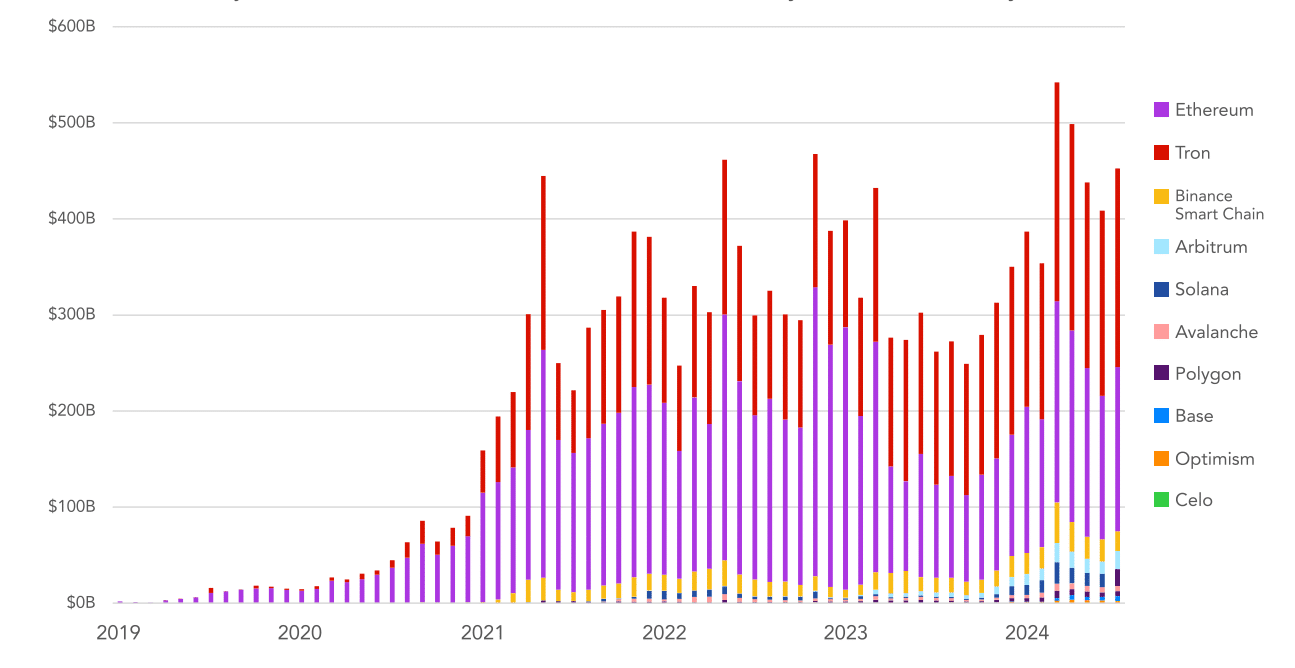

In the year 2023, stablecoins processed a whopping $3.7 trillion in transactions, and it’s predicted they will handle an impressive $5.28 trillion by 2024. Moreover, recent studies suggest that their use is expanding beyond just settlement on exchanges and into other areas as well.

In 2023, as per the “Stablecoins: The Evolution in Global Finance” study, co-sponsored by Visa and written by Castle Island Ventures and Brevan Howard Digital, it’s been observed that stablecoins have been increasingly important in the global financial system. By this year, transaction volumes had climbed up to a staggering $3.7 trillion.

In the first half of 2024, stablecoins exchanged a total worth of $2.62 trillion, suggesting they would reach approximately $5.28 trillion by the end of the year if this trend continues. Even amidst a cryptocurrency market downturn and reduced exchange activity over the last two years, transactions involving stablecoins have consistently increased, indicating their growing use beyond trading activities.

Nic Carter, a co-founder at Castle Island Ventures, clarified to crypto.news that the study’s purpose was to illustrate “the everyday applications of stablecoins among common users.

We aimed to prove through statistics that stablecoins serve purposes beyond just cryptocurrency trading and speculation. The data we presented, in my opinion, strongly supports this point.

Nic Carter, founding partner at Castle Island Ventures

The report identifies Ethereum (ETH), TRON (TRX), Arbitrum (ARB), Coinbase’s Base, BNB Chain (BNB), and Solana (SOL) as the most popular blockchains for stablecoin settlements, with Ethereum leading by a significant margin, while BNB Chain and Solana also feature prominently.

Emerging markets fuel stablecoin adoption

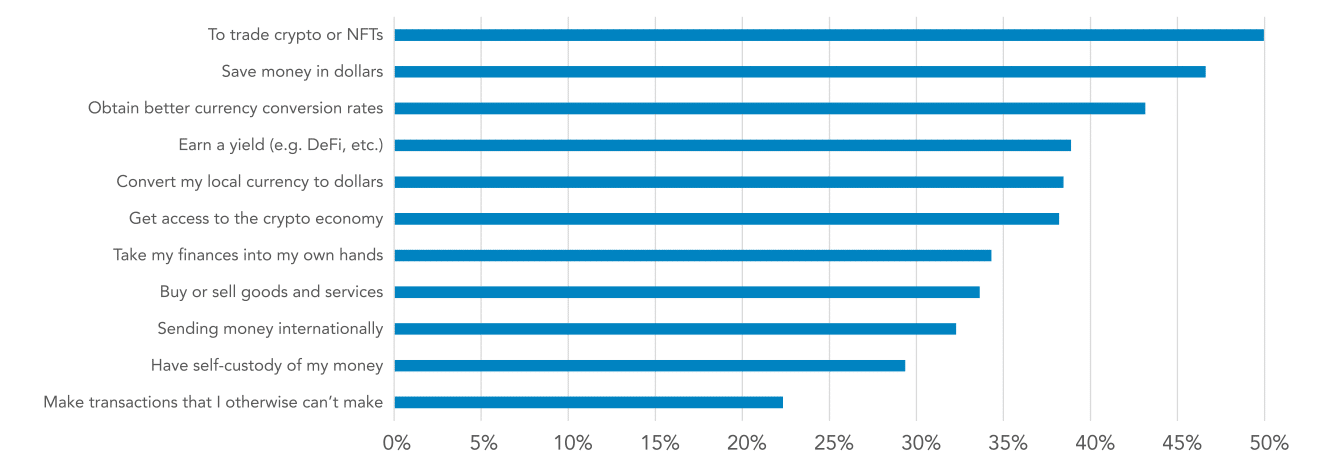

After examining responses from approximately 2,540 cryptocurrency users in Nigeria, Indonesia, Turkey, Brazil, and India, researchers discovered that using stablecoins primarily for trading cryptocurrencies or non-fungible tokens is the most prevalent practice. However, they also found that non-crypto uses are not insignificant either.

Approximately half (47%) of the survey participants mentioned saving in dollars as their main objective, while 43% emphasized the importance of improved exchange rates and nearly four out of ten (39%) placed an emphasis on earning returns. These results suggest that non-crypto activities play a substantial role in the use of stablecoins within these growing markets.

Approximately 57% of users have seen a rise in their use of stablecoins during the last year, and an impressive 72% anticipate further growth in their usage in the times ahead.

USDT (Tether) maintains its position as the most reliable and commonly used stablecoin due to factors such as user confidence, availability of funds, and its solid performance in comparison to other stablecoins, according to the report. In these markets, users often prefer stablecoins over U.S. banking systems because they offer higher returns, improved efficiency, and reduced risk of government intervention.

The study underscores that contrary to popular opinion, stablecoins are not solely employed for speculative cryptocurrency trading. Instead, it appears that their use has expanded significantly, transforming them from simple trading collateral into a versatile digital equivalent of the U.S. dollar in the surveyed countries.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-09-12 16:23