As a seasoned analyst with over two decades of experience navigating the complex world of finance and technology, I find Swift’s latest initiative both intriguing and promising. Having witnessed the evolution of digital currencies and their potential to revolutionize global transactions, I am particularly excited about Swift’s ambitious endeavor to connect disparate digital platforms into a unified network.

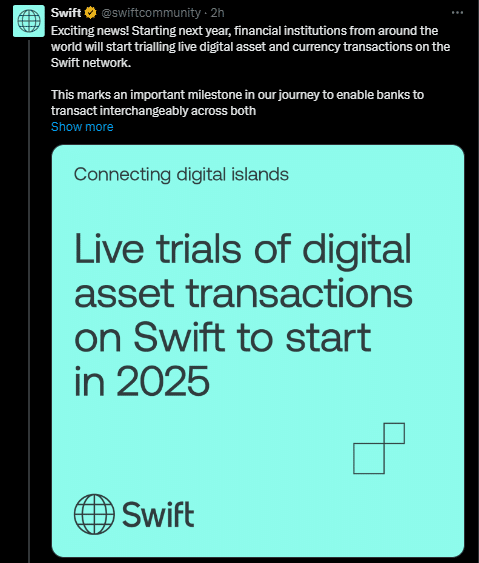

Swift, a global payments organization, plans to conduct extensive tests to allow central and business banks worldwide to utilize their network for transactions involving digital money and assets. The goal of these trials is to showcase Swift’s capacity to transfer value between over four billion accounts in approximately 200 nations.

Swift demonstrates its ability to move digitized assets seamlessly across both public and private blockchains, facilitate the global linking of central bank digital currencies (CBDCs), and combine various digital and physical currency systems.

In simpler terms, the upcoming tests aim to establish a unified platform for Swift, allowing financial institutions to manage multiple digital asset types and currencies through one connection. This could potentially streamline their incorporation within the wider financial infrastructure.

Initially, the tests will focus on payment processes, exchanging currencies, trading securities, and commerce deals. They aim to discover methods for implementing Multi-ledger Delivery-before-Payment (DvP) and Payment-before-Payment (PvP) systems.

With a rising interest in Central Bank Digital Currencies (CBDCs), as 134 countries are considering their introduction, it’s projected that the tokenized asset market will reach an impressive $16 trillion by 2030. Yet, the proliferation of separate digital platforms has resulted in a fragmented system, making global acceptance more challenging.

In a nutshell, Swift is attempting to link these platforms with traditional money systems (fiat currencies), enabling smooth transactions by utilizing the current infrastructures available.

According to Tom Zschach, Swift’s Chief Innovation Officer, for digital assets and currencies to be successful worldwide, it’s essential that they can effortlessly blend with conventional methods of finance.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- Brent Oil Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-10-03 15:01