As an experienced financial analyst with a background in traditional payment networks and emerging technologies like stablecoins, I find Visa’s recent study on the popularity of stablecoin transactions intriguing but also raise some concerns.

Visa, a leading international payments company, has recently released a report questioning the notion that the transaction volume of stablecoins is about to reach the numbers observed in conventional payment systems.

As a financial analyst, I’ve noticed Visa voicing apprehensions regarding the dependability of stablecoin transactions, challenging the prevailing notion that they are gaining equal popularity to traditional money transfer networks.

As a researcher studying stablecoin transactions across various blockchain networks, I’ve come across Cuy Sheffield’s insightful observation in a recent discussion on X thread. He pointed out that a substantial number of these transactions are influenced by considerable turbulence, which can primarily be attributed to automated bot activities.

As a crypto investor, I’ve noticed that analyzing stablecoin data can be quite challenging due to the diverse use cases they serve. Transactions involving stablecoins can be initiated not only manually by users but also automatically through bots. Consequently, it’s essential to filter out the noise in this data in order to gain accurate insights and make informed decisions.

— Cuy Sheffield (@cuysheffield) April 25, 2024

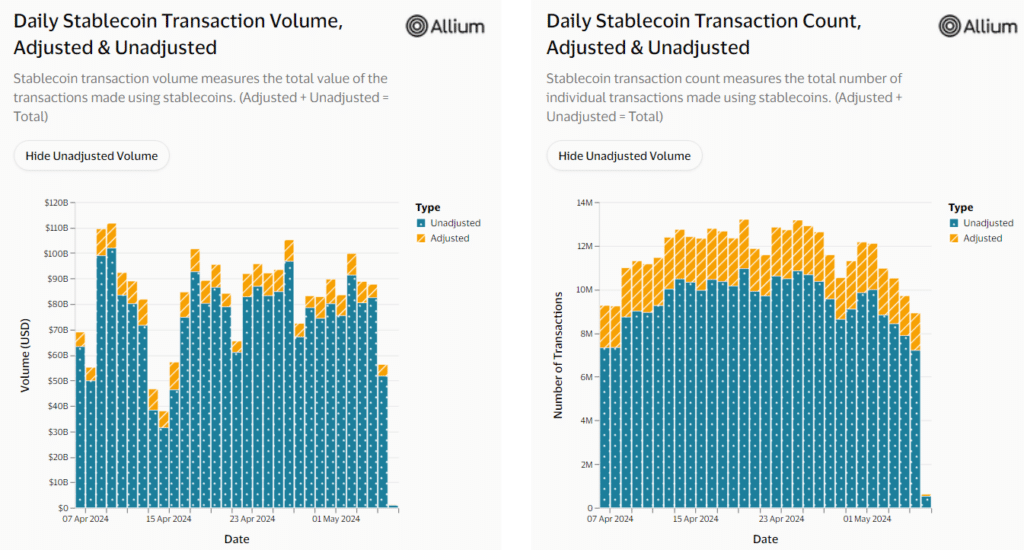

Visa identifies stablecoin transactions using two key measures. Initially, it considers only the biggest stablecoin transfer amount in a given transaction, disregarding smaller transfers that typically result from intricate smart contract engagements.

As an analyst, I would describe it this way: I’d like to add that the system utilizes an “inorganic user filtering mechanism.” This filter specifically focuses on transactions originating from accounts with fewer than 1,000 stablecoin transactions and a total transfer volume below $10 million.

“This filters out automated bot actions and deals made by large institutions, such as centralized exchanges.”

Visa

In a Bloomberg commentary, Pranav Sood, EMEA executive general manager at Airwallex’s payments platform, pointed out that data indicates stablecoins are in their early stages of development as financial instruments. He recommended that the market prioritize improving existing payment systems in both the short and medium terms.

As a crypto investor, I’ve noticed that not everyone shares Visa’s perspective on the risks associated with cryptocurrencies. For instance, Nick van Eck, co-founder of Agora, a stablecoin startup, has raised concerns about Visa’s methodology in a statement to DL News. He argues that the data does not make sense because it would include trading firms, which are legitimate businesses using these digital assets for their operations.

Read More

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- Capcom has revealed the full Monster Hunter Wilds version 1.011 update patch notes

2024-05-06 10:56