As a seasoned crypto investor with battle-hardened nerves and a portfolio that’s seen more ups and downs than a rollercoaster, I find myself cautiously optimistic about Terra Luna Classic (LUNC). The recent surge in price, driven by token burn activity and potential regulatory changes under the new U.S. administration, has certainly piqued my interest.

For the second day in a row, the price of Terra Luna Classic increased due to an increase in token burning activities this week.

Originally known as Terra Luna Classic (LUNC), the surviving component of the fallen Terra system, peaked at a daily high of 0.00009217 USD, boosting its total market value to an impressive half-billion dollars.

The surge in the rally could be attributed to the latest U.S. election outcomes, where Donald Trump secured a substantial victory. This triumph might pave the way for possible alterations in cryptocurrency regulation. Notably, Bitcoin (BTC) and many other cryptocurrencies experienced a resurgence, with BTC retesting its record high, and the combined market value of all coins soaring to approximately $2.5 trillion.

Cryptocurrency investors are hoping that President Trump will select individuals who are supportive of digital currencies to head the Securities and Exchange Commission (SEC). One name being tossed around is Hester Peirce, who is already affiliated with the SEC.

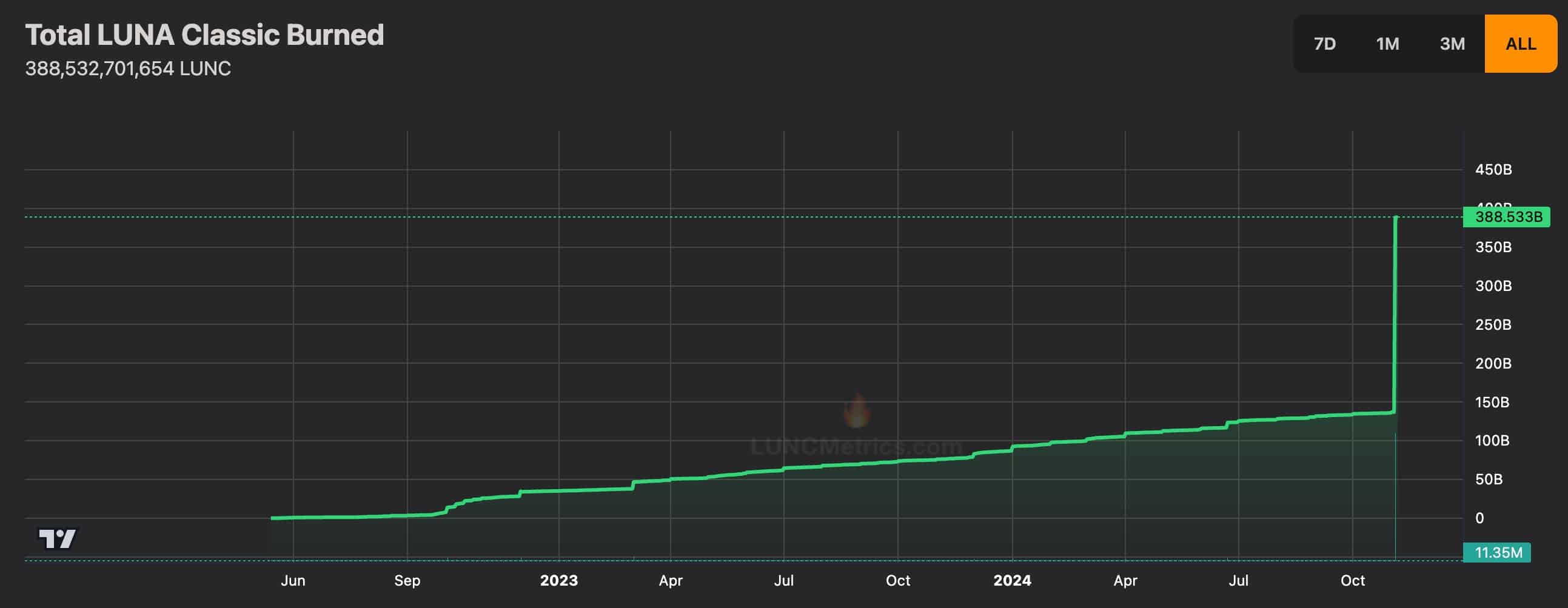

The cost of LUNC increased significantly after there was a significant rise in the number of tokens being destroyed, or ‘burned’. As reported by LUNCMetrics, the total amount of tokens burned soared to an impressive 388.533 billion, with a staggering 137 billion tokens being burned just this week.

After Terraform Labs announced they were closing the Shuttle Bridge in compliance with U.S. regulators during their Chapter 11 bankruptcy process, a surge occurred.

— Terra 🌍 Powered by LUNA 🌕 (@terra_money) November 5, 2024

Earlier, the Shuttle Bridge facilitated the transfer of LUNC and USTC tokens from Terra Luna Classic to Ethereum, BNB Chain, and Harmony, then back to Terra Luna Classic. Any leftover tokens were permanently destroyed by being moved to an unretrievable location.

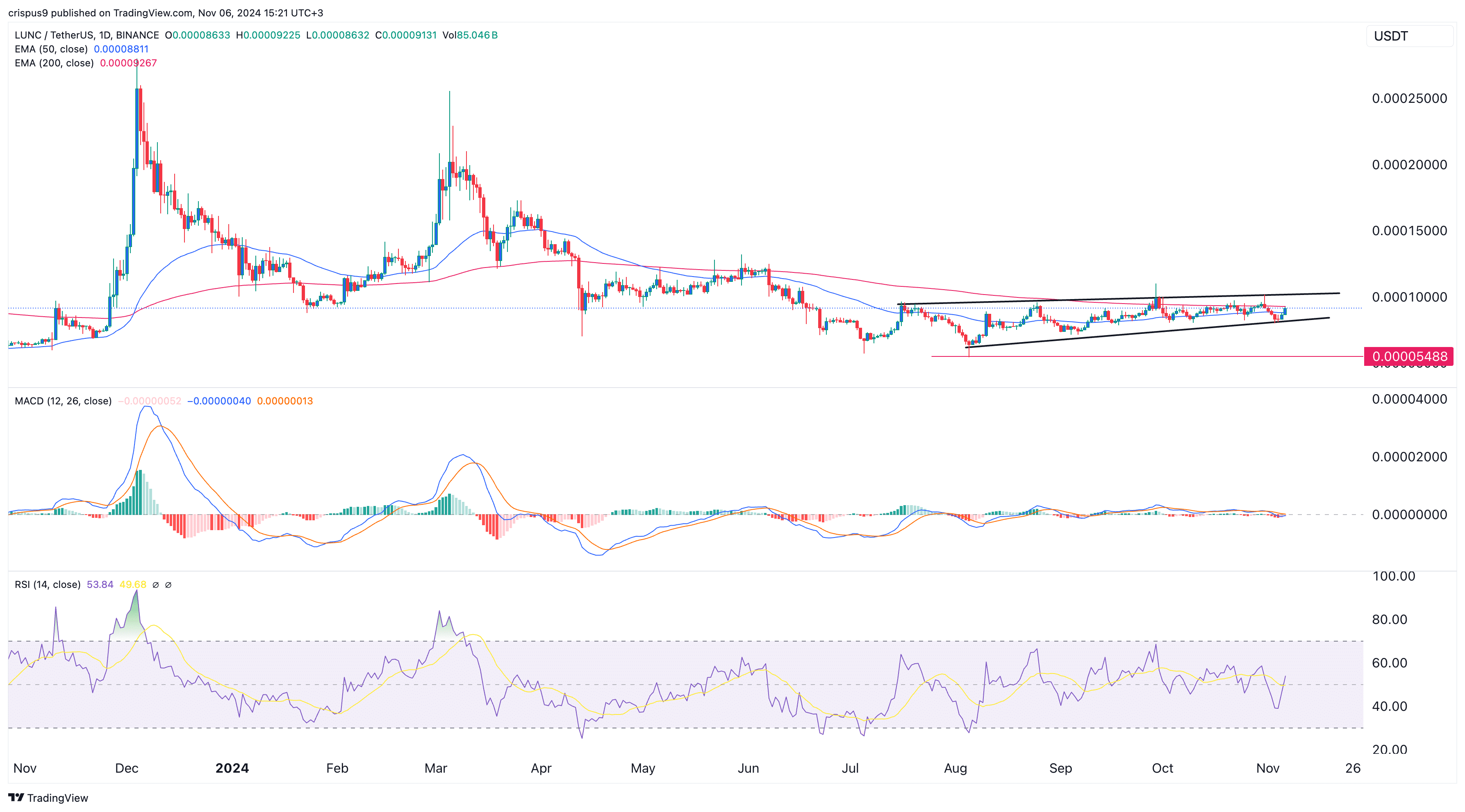

Terra Luna Classic has worrying technicals

Although LUNC has made progress lately, its technical signs show some ambiguity. On the day-to-day graph, a rising wedge formation – often seen as a bearish signal – has been created.

Currently, LUNC is trading slightly lower than its 50-day and 200-day Exponential Moving Averages. Additionally, the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) have both moved towards a neutral state.

As a crypto investor, I’ve noticed that LUNC has been shaping up into a bearish pennant pattern. This technical setup hints at a possible bearish breakout, which might drive the price down to around $0.000054, a level last seen on Aug. 5. On the flip side, if the price manages to surge above the crucial resistance at $0.00010, it could be a bullish sign indicating potential further growth.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-11-06 17:16