As a seasoned researcher with a keen interest in the dynamic world of cryptocurrencies, I find Tether’s recent surge in user growth particularly fascinating. The 9% average increase over the last 12 months is not just a statistic, but a testament to the growing acceptance and trust that stablecoins are earning in traditional finance markets.

In the past three months, the number of users for Tether’s USDT stablecoin experienced its strongest growth yet, averaging a rise of 9% over the previous year. This consistent growth may pave the way for Tether to venture further into conventional financial markets with confidence.

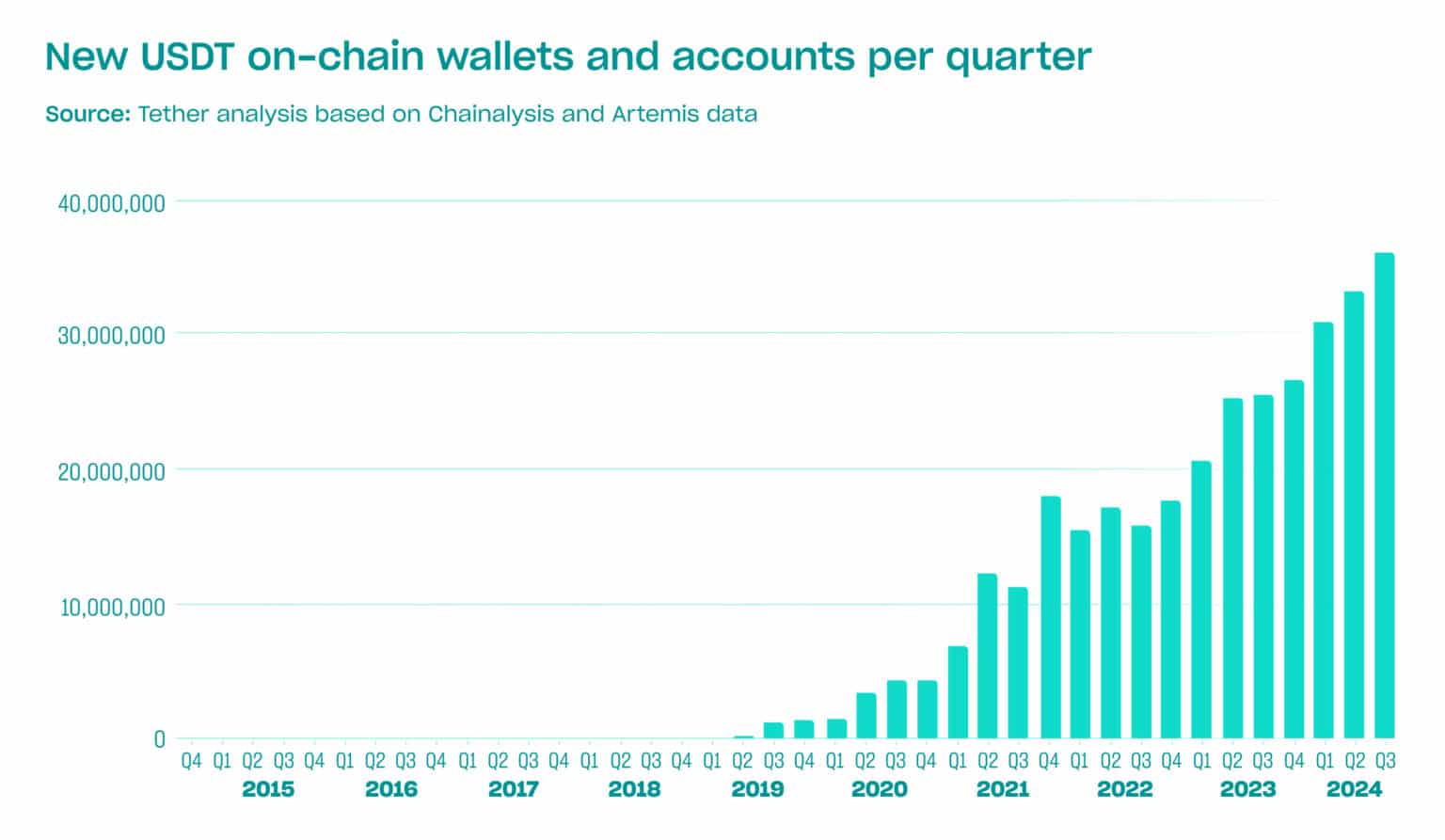

36.25 million new wallets and users interacted with the leading crypto stablecoin, USDT, during the third quarter of 2024, setting a new record for the digital payment leader. The organization managing USDT made it clear that off-chain users, who typically use platforms such as Binance or Coinbase, were not included in this analysis.

A recently published report on October 16th disclosed that approximately fifty million users worldwide employ USDT (Tether) across various centralized trading platforms and off-exchange locations, according to confidential information provided by Tether’s business partners.

In the last three months, the number of USDT wallets on the blockchain reached an unprecedented high, surpassing any previous record. Over 300 million unique addresses have held Tether’s stablecoin, which is nearly equivalent to the total population of the United States.

Ethereum L2s and Telegram’s TON driving Tether boom

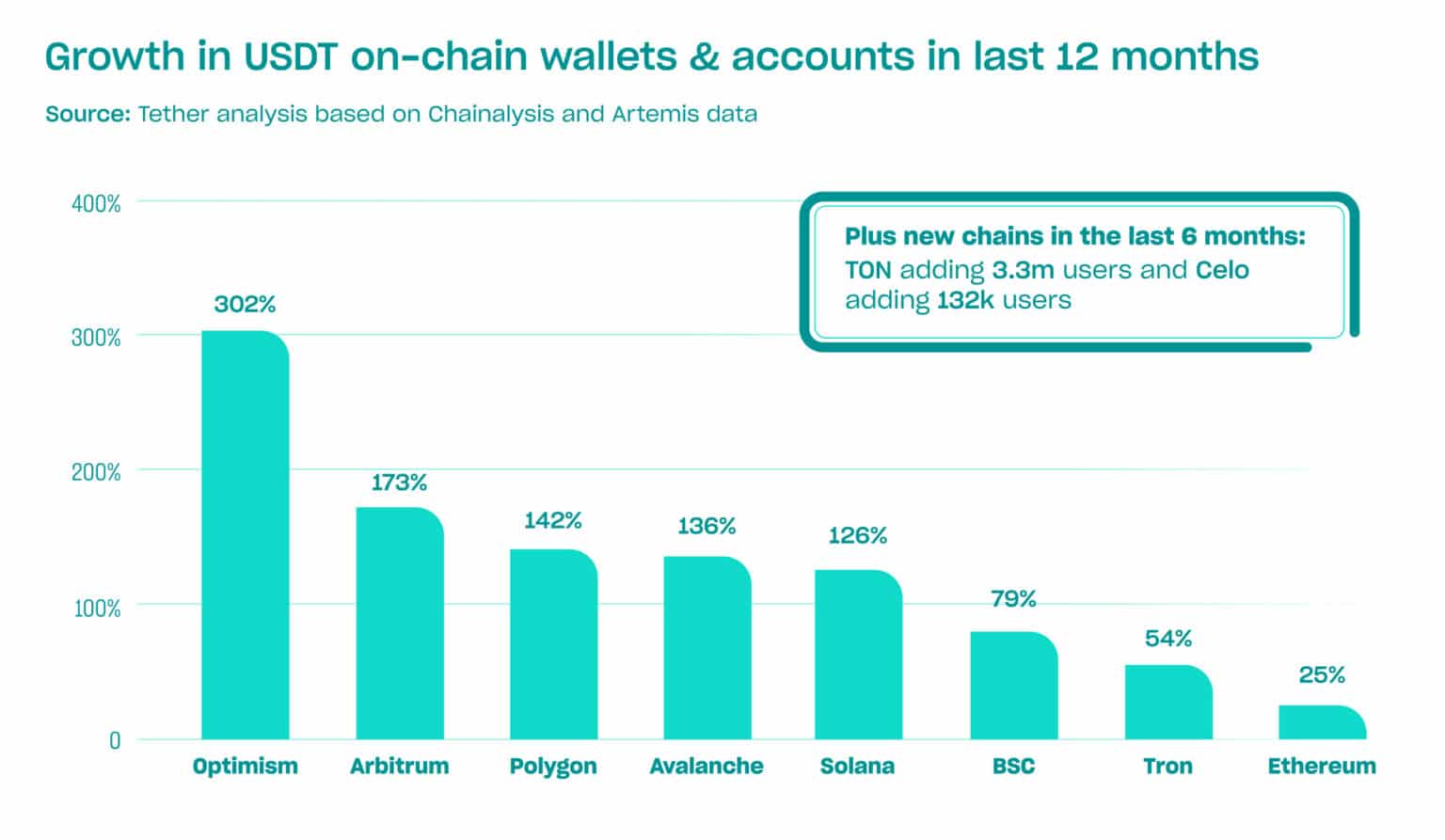

On the market, the most prominent stablecoin, USDT, is backed by several leading blockchain platforms such as Binance Smart Chain, Ethereum (ETH), and Tron (TRX). Tether mentioned that it was Ethereum-based layer-2 scaling networks that accounted for the majority of user growth for USDT during Q3.

Optimism (OP), Arbitrum (ARB), and Polygon (POL) onboarded the most USDT users in the last year. Avalanche (AVAX) and Solana (SOL) helped swell Tether accounts.

The company stated that The Open Network, accessible via Telegram, experienced rapid expansion since the launch of USDT on TON in April. In just half a year, TON has gained approximately 3.3 million new users, as reported by Philip Gradwell, who is the Head of Economics at Tether. At this point in time, TON makes up about 1% of all active USDT accounts on the blockchain.

As a researcher, I’m observing an intriguing development with the digital payment service provider whose USDT business is soaring to unprecedented heights. In light of this success, their investment arm is broadening their horizons, venturing into various other sectors. It’s being reported that they are considering using a substantial portion of their record profits to lend to established players in traditional finance and commodities trading industries.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-10-17 00:58