As an experienced financial analyst, I find Tether’s Q1 2024 performance quite impressive. The $4.5 billion net profit and the new highs in Treasury bills stockpile and total net equity are noteworthy indicators of their successful business model. Their diversified operations, with a significant portion of profits coming from holding U.S. Treasuries, demonstrate both stability and adaptability to market conditions.

As a financial analyst, I’m pleased to report that Tether, the issuer of USDT, achieved an unprecedented milestone during the first quarter of 2024. We recorded an impressive net profit of approximately $4.5 billion.

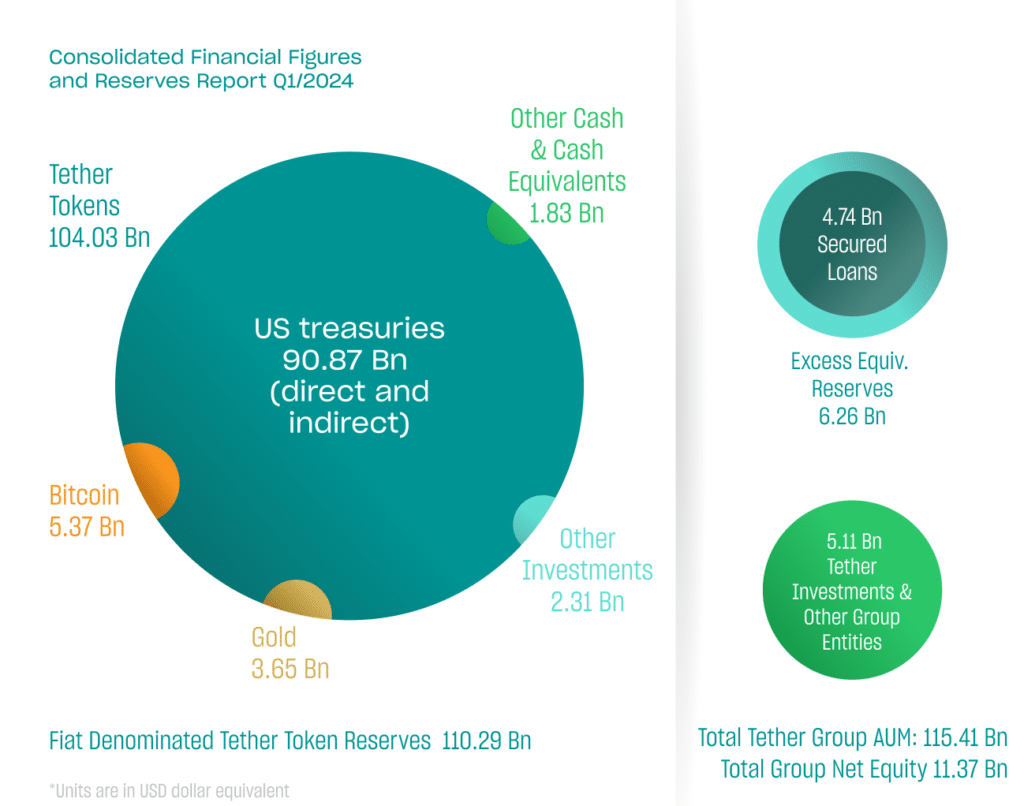

An BDO assessment report issued on May 1st revealed that Tether’s holdings of Treasury bills exceeded $90 billion, reaching a new peak, while its total net equity surpassed $11.3 billion as a result of various business activities.

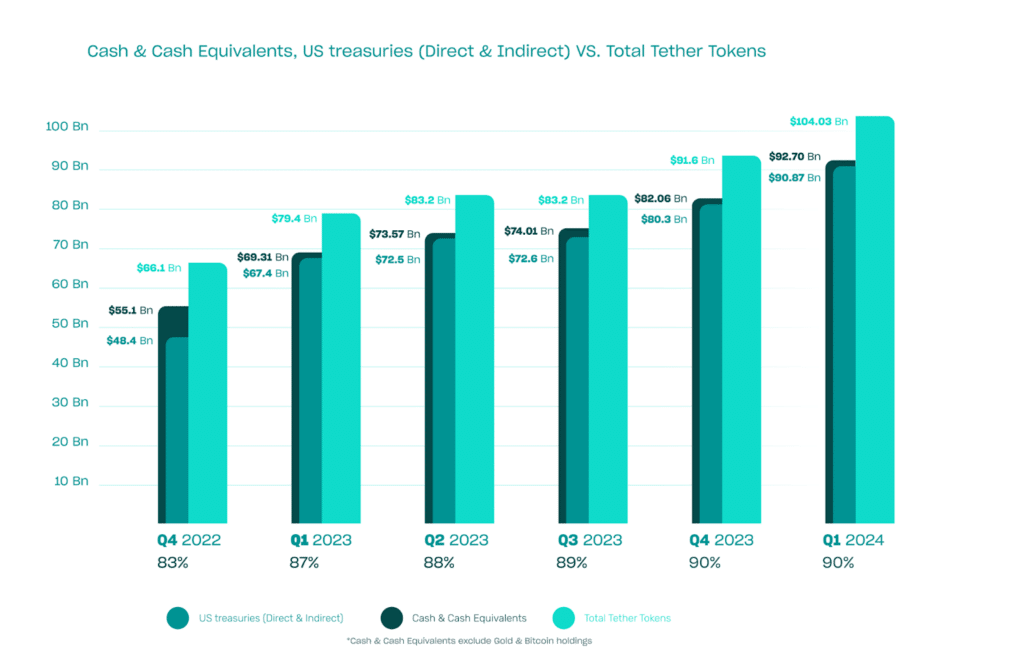

Based on the data from the past year, I’ve noticed that the ownership of U.S. Treasuries by USDT providers has increased significantly, from approximately $80 billion in Q4 2021 to the present day. Similarly, their net equity holdings have grown substantially, going from around $7 billion to a greater amount as of now.

The newly released data discloses that a significant portion, amounting to $1 billion, of the company’s unprecedented earnings stemmed from activities involving stablecoin issuance and reserve management. This translates to the majority of profits being generated through holding U.S. Treasuries, with the remainder derived from investments in Bitcoin (BTC) and Gold.

For the first time, Tether’s fiat-pegged stablecoins are backed up by 90% cash and cash equivalents. According to Tether CEO Paolo Ardoino, this demonstrates our commitment to prudent risk management as a pioneer in the crypto and stablecoin sector.

As a researcher studying the cryptocurrency market, I can share that USDT, according to CoinGecko’s latest data, holds the title as the largest stablecoin pegged to the U.S. dollar with a market capitalization surpassing $110 billion. It ranks third in the overall cryptocurrency hierarchy, following Bitcoin and Ethereum (ETH).

As a researcher exploring the cryptocurrency sector, I’m excited to note that Tether continues to set new standards in terms of transparency and trust.

Paolo Ardoino, Tether CEO

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Gold Rate Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-05-01 17:02