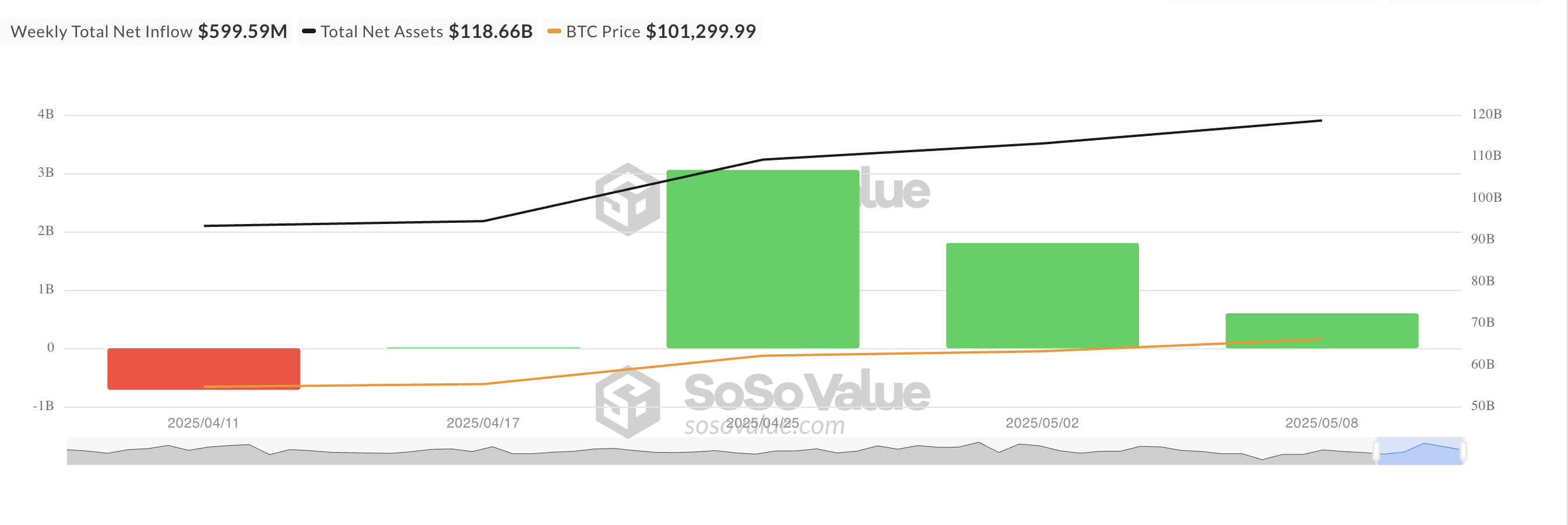

Last week, Bitcoin-backed funds welcomed a cool $600 million in net inflows. A positive, yes, but also a glaring 67% drop from the previous week’s impressive $1.81 billion.

Now, here’s the twist: this was happening as Bitcoin surged past $100,000 for the first time since early February. A remarkable achievement, but oddly enough, instead of sparking wild investor frenzy, it seems to have made some institutional investors put their hands on the brakes. Could it be that Bitcoin’s rise is making them nervous? 😱

Bitcoin ETF Capital Inflows: More Like Capital ‘Caution’?

So, in the past week, spot BTC ETFs saw $600 million in inflows. Sounds good, right? But wait—this is a 67% drop from the previous week’s record-breaking $1.81 billion. Talk about a mood swing! 🎢

What gives? Well, this happened just as Bitcoin decisively crossed the $100,000 threshold for the first time since February. You’d think it would send investors into a buying frenzy, but instead, many ETF holders decided it was time to take profits or hold off on entering the market. After all, who doesn’t like a good ‘wait-and-see’ moment? 🤔

It seems institutional investors are still eyeing Bitcoin, but they’re taking a more cautious approach now. They’ve been waiting three months for the coin to break that $100,000 ceiling, but now they’re holding their breath, wondering if Bitcoin can actually stay above that magic number or if it’s just a fleeting mirage. 🏞️

The Derivatives Market: Where the Bulls Are Roaming

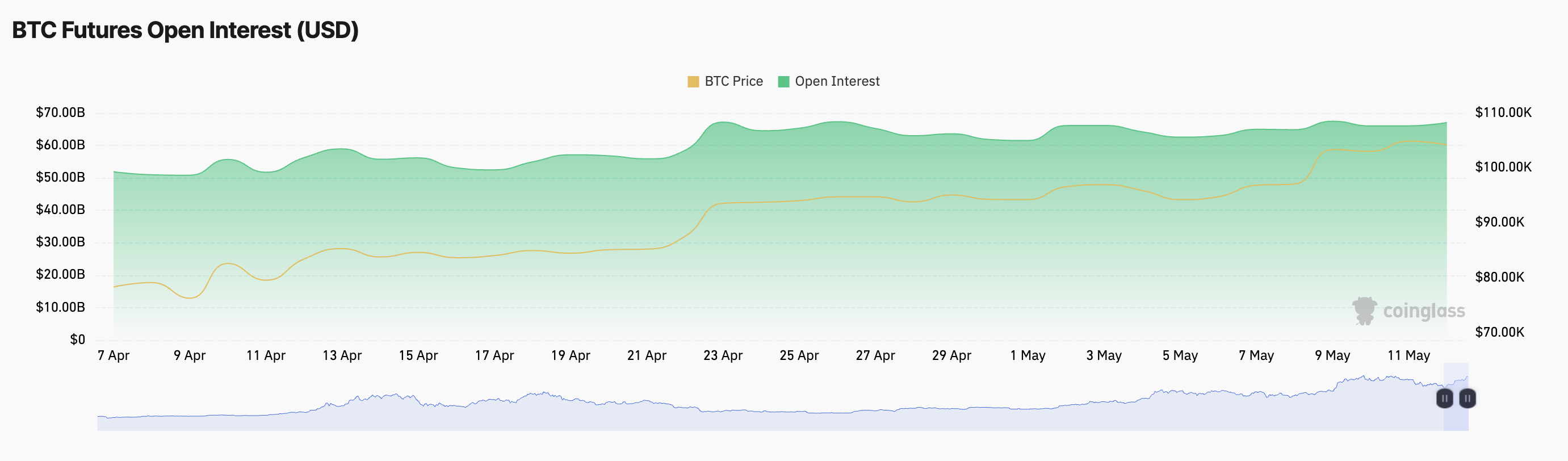

Bitcoin is currently at $103,979—up 0.24% in the past 24 hours. Meanwhile, open interest in BTC futures has risen 2%, showing more traders jumping in with a total of $67.04 billion at play. Now that’s what I call participation! 💸

The price rise coupled with increasing open interest points to growing confidence in Bitcoin’s trajectory. Traders seem to believe the price will keep climbing, as evidenced by the rising interest in positions. Oh, and by the way, the funding rates are still positive at 0.0082%, meaning long positions are paying out the shorts. Translation: people are betting big on a bullish Bitcoin. 🚀

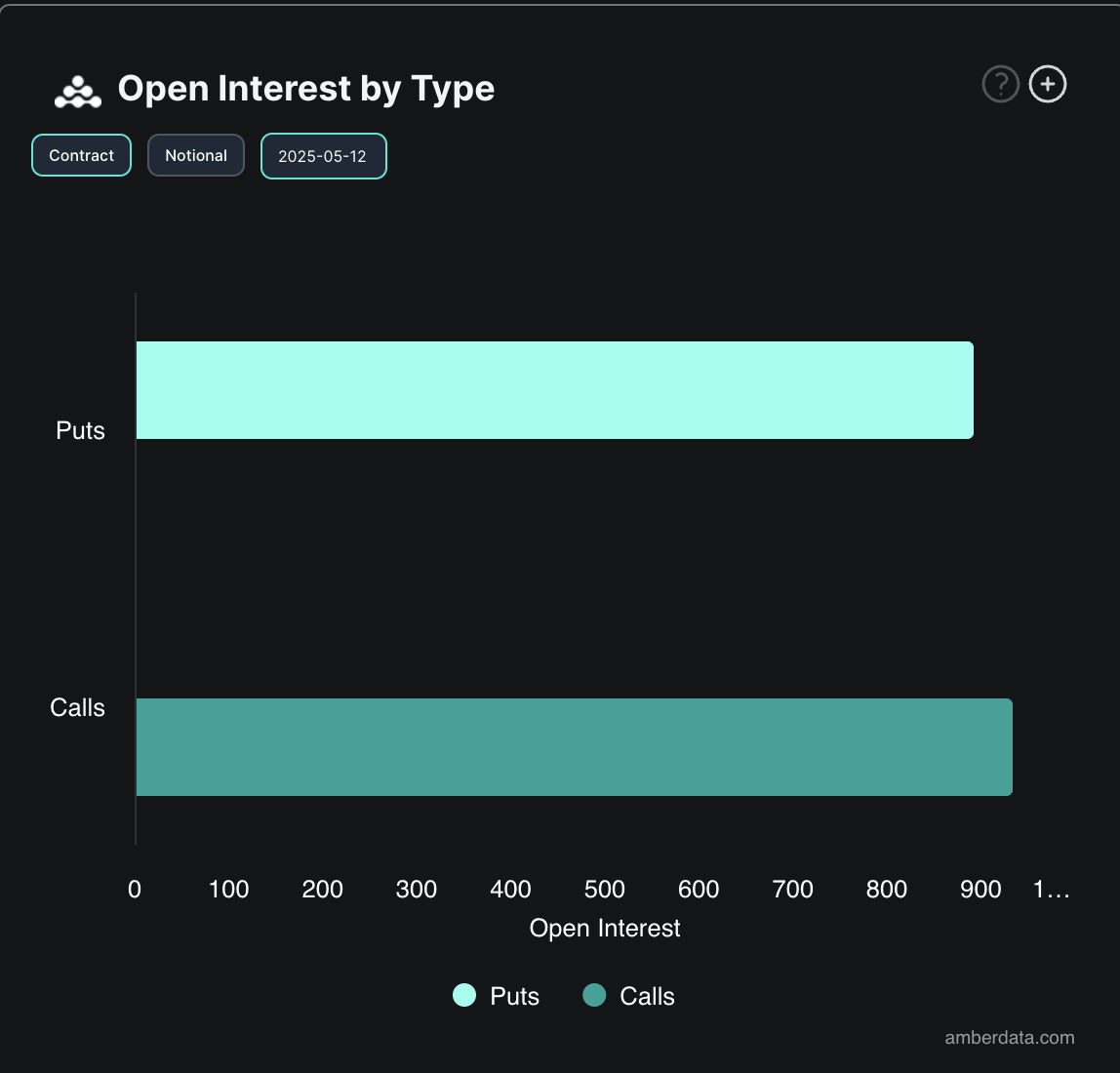

But that’s not all. The options market is also flashing some bullish signals, with call contracts outnumbering puts. Clearly, traders are betting on more upside. The bears are nowhere to be seen. 🐻

So, despite the dip in ETF inflows, it looks like the broader market is still all in on Bitcoin. If anything, it’s a ‘risk-on’ sentiment, and the bears are getting out of town. 📈

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2025-05-12 11:25