💸💥 The Crypto Apocalypse: A Tale of Woe and $325 Billion 💸💥

As I sit here, quill in hand, I am reminded of the whims of fate that govern the world of cryptocurrency. Just as the sun rises and sets, so too do the fortunes of those who dare to invest in this most ephemeral of markets. And so, it is with a heavy heart that I pen these words, for the crypto market has lost a staggering $325 billion since Friday, a sum that would make even the most seasoned investor weep.

According to the esteemed analysts at The Kobeissi Letter, the crypto market cap has shed a whopping $325 billion since the fateful day of Friday. And, as if to add insult to injury, a full $150 billion of that was liquidated in the span of a mere 24 hours. But wait, dear reader, for it gets even better! A staggering $100 billion was erased in a single hour, a feat that would put even the most skilled of conjurers to shame.

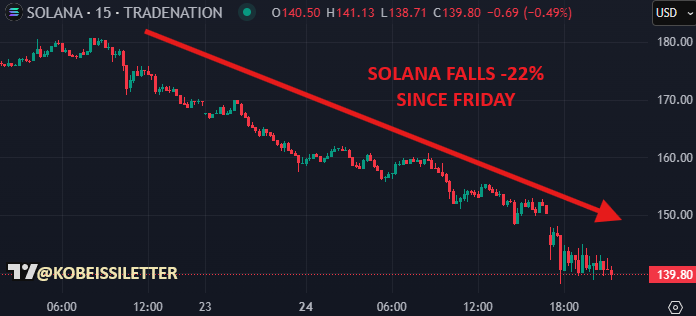

But, as the great philosopher, Dolly Parton, once said, “If you want the rainbow, you gotta put up with the rain.” And so, it seems that the crypto market has been caught in a most unrelenting downpour. The analysts at The Kobeissi Letter point to Solana (SOL) as the culprit behind the downturn, which has crashed a whopping 22% since Friday, leaving its memecoin brethren to pick up the pieces.

And then, as if to add fuel to the fire, Bitcoin (BTC) followed suit, losing its relative strength as the S&P 500 began to pull back on Friday. But, like a bad penny, Bitcoin just won’t quit, breaking below the $90,000 support level and further reinforcing the bearish sentiment. Ah, the humanity!

But wait, dear reader, for the plot thickens! The Bybit hack, now confirmed as the second-largest hack in crypto history, has left the market reeling. On Feb. 21, Bybit lost a whopping 400,000 ETH from its cold wallet, leaving Ethereum (ETH) to pick up the pieces. And, as if to add insult to injury, ETH opened at $2,740 on Feb. 21 and dropped to a low of $2,408 at the time of writing, marking a decline of almost 12%.

And, as the cherry on top of this crypto sundae, Citadel Securities’ $65 billion pivot toward crypto liquidity was met with a resounding “sell the news” reaction in the market. Ah, the irony!

But fear not, dear reader, for The Kobeissi Letter analysts remain optimistic, like a beacon of hope in a sea of despair. “We have seen countless -10% pullbacks in Bitcoin over the course of this bull run,” they say. “Technical pullbacks are healthy.” Ah, the eternal optimists!

And, as a final ray of sunshine, Bybit CEO Ben Zhou announced that the exchange had covered the losses as of Feb. 24 and published a proof-of-reserves audit to reassure the community. Ah, the power of transparency!

But, as the great philosopher, Yogi Berra, once said, “It’s tough to make predictions, especially about the future.” And so, dear reader, we shall wait with bated breath to see what the future holds for this most mercurial of markets.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2025-02-25 12:20