As a researcher with a background in the crypto industry, I have witnessed firsthand the rollercoaster ride of the past few months. The approval of Bitcoin and ETH ETFs, the promise of another DeFi summer, and regulatory clarification from Asian markets were promising signs for the future of our industry. However, setbacks such as the delayed ETH ETF approval in the West and regulatory actions that touched upon the very nature of crypto have caused some disappointment and caution among analysts.

From a crypto investor’s perspective, the past few months have been an exhilarating rollercoaster ride for our industry. We kicked off the year on a high note with the approval of Bitcoin and Ethereum Exchange-Traded Funds (ETFs) in the United States and Canada, fueling optimism about another DeFi summer. Furthermore, regulatory clarifications from Asian markets provided some level of certainty.

If someone had predicted the consequences of these setbacks in the crypto market a few years ago, they might have expected a total market collapse. However, things are different now. The crypto industry experienced immediate market reactions to recent shocks, but its overall response has been relatively stable compared to past instances. So, what sets this year apart from those before it?

As a seasoned crypto investor, I believe that despite the volatile market conditions and conflicting signs regarding the future direction of the industry, there are three essential elements that remain constant:

Champions of the new growth phase: community

Following decades of rebuilding and learning, the industry and its constituents have returned more robust than before. Having weathered past challenges, they now possess the resilience to envision and construct a blockchain-driven economic system and societal structure that endures for the future.

This year, we’ve witnessed remarkable innovations in our community that fuel optimism. Among these advancements are the development and enhancement of modular chains and application layers to boost functionality, increased interoperability and cross-chain liquidity, and the potential for further innovation with Bitcoin layer-2s. These strides propel our industry forward with a clear path to progress, inspiring excitement among community members who are not only investing in new developments on existing platforms but also supporting emerging projects, contributing positively to our industry’s growth over the long term.

The excitement among community members has given rise to a flurry of lively initiatives. In response, KuCoin experienced a significant increase in spot trading volume during Q1 2024, marking a 121.85% hike. Additionally, the pre-market trading volume for tokens soared by an astounding 68%, amounting to $23.12 million. This underscores the readiness of the community to support the industry during its next phase of expansion, which is driven by unique inventions and technological advancements, regardless of project scale.

New blood enters the community: crypto-curious

The initial foray of Generation Z, or the first truly digital-native generation, into cryptocurrencies has given a significant boost to the industry’s ongoing expansion. Previously, Millennials marked the beginning of this trend with increased curiosity towards crypto and a more open attitude towards the sector than their predecessors. Now, as Gen Z begins to engage in financial matters, they bring a heightened enthusiasm for decentralized technologies and assets.

As a researcher studying the crypto market, I’ve observed a significant surge in new users joining the platform. This growth has been fueled by the influx of individuals from Latin America, the Middle East, and Africa. Crypto’s appeal as an alternative to traditional financial systems has been particularly strong in Latin America, where we’ve seen robust grassroots adoption and active engagement on centralized exchanges.

The balancing act: responsible businesses

As an analyst, I believe that the road to long-term success in the crypto industry is built upon solid business foundations. After facing numerous trials, crypto businesses are now prioritizing trust and sustainability through improved governance and infrastructure. Depending on each participant’s level of interaction with the broader crypto community, various steps will be taken to adhere to regulations and maintain responsibility. However, one essential guideline applies universally: the commitment to continually learn and stay informed.

As regulators work to understand and define crypto’s place within the existing financial framework, it is crucial for the industry to collaborate closely with them. By providing clear information about the dynamic nature of crypto and seeking alignment, industry participants can help facilitate a coordinated approach. This process will be intricate, as each jurisdiction presents its unique complexities and viewpoints. Nonetheless, it is our responsibility as industry members to comply with regulatory standards in our respective regions.

Maintaining focus on the end goal

From an industry insider’s perspective, our commitment to staying in this game for the long term is unwavering. We’ve entered a fresh stage of expansion and advancement, fueled by the collective strength of our community, an influx of new users, and improved business frameworks. So why should we pause now?

With robust motivators propelling us forward, market participants can persist in their development, either by preserving solid business results through enhancements to their structures or unearthing fresh opportunities for partnership. The surging trend favors all players, and focusing on industry advancement will empower independent pioneers to reap the rewards of our united progress. By fostering a crypto sector that flourishes on ingenuity, reliability, and unity, we pave the way for a future that enriches everyone involved.

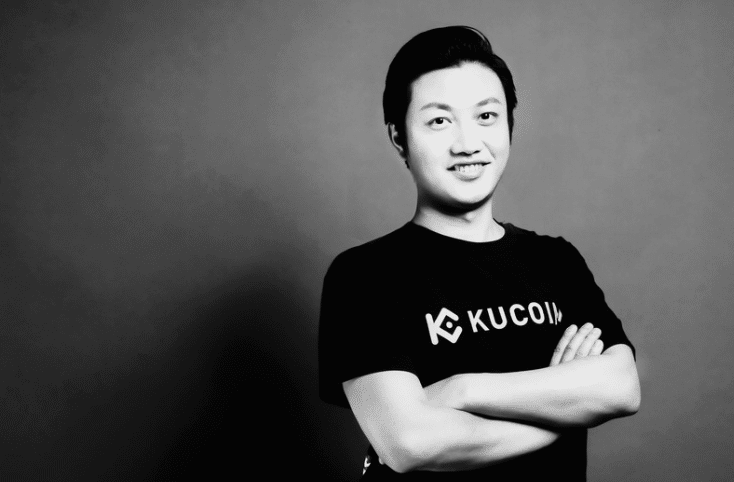

As a crypto investor, I’d put it this way: I’m an integral part of the team at KuCoin, helming the role of co-founder and CEO. Established back in 2017, we’ve rapidly grown into one of the top five cryptocurrency exchanges on a global scale, boasting over 30 million registered users from 207 countries. In my current position, I oversee our daily operations, manage spot trading, and spearhead initiatives like KuCoin Earn. Additionally, I’ve played key roles in the listing direction, business development, and investment team earlier on. I’m also a significant contributor to projects like KuCoin Spotlight and Earn. Prior to joining the KuCoin family, my diverse background included stints in e-commerce, automotive, and tech industries.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD CNY PREDICTION

- USD JPY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-06-09 17:10