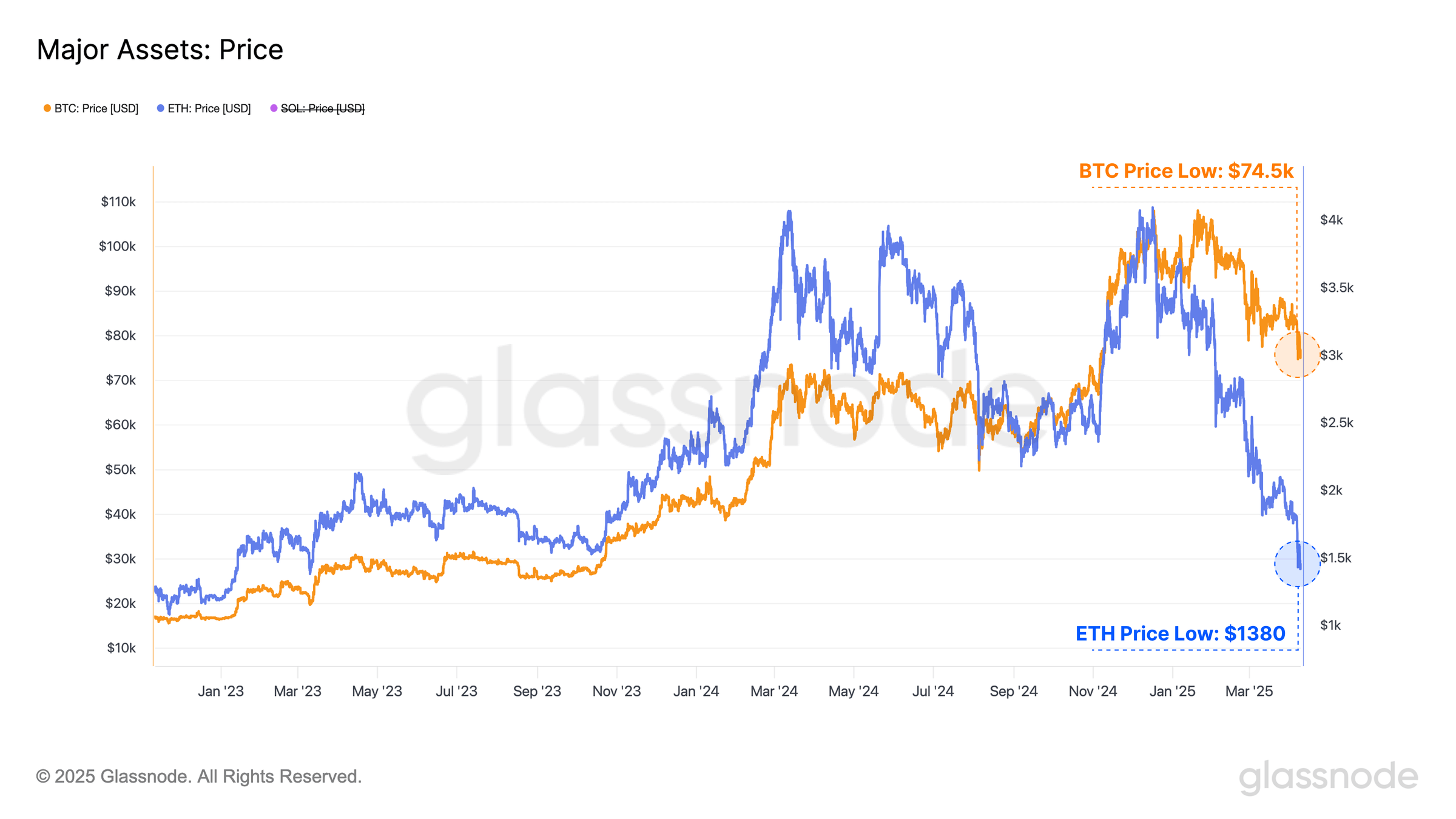

Ah, the illustrious President Donald Trump, in his infinite wisdom—or perhaps folly—unleashed his fabled “Liberation Day” tariffs, setting off a furor akin to a swarm of bees disturbed during a picnic. The financial world trembled, and in the ensuing chaos, bitcoin fell to the pitiful depths of $74,500, while ethereum stumbled to $1,380. Such calamity, my friends, is just what the good folk from Glassnode reported on that fateful April 9, as if the sky itself had decided to take a delightful holiday!

A global financial maelstrom ensued, with markets resembling a ship tossed by monstrous waves. According to the diligent scribes at Glassnode, our beloved digital assets took a beating that even the most stoic of bears could not ignore. Those clever researchers, Ukuriaoc and Cryptovizart, tied this downfall to the tariffs, the ailing U.S. dollar, and fiscal tightening—as if they were trying to create the perfect storm! 🌪️

Now, what’s this? A near-standstill in the flow of capital into our dear assets? Bitcoin’s monthly inflows plummeted from $100 billion to a laughable $6 billion! Ethereum, in a twist of tragic irony, saw inflows of a whopping $15.5 billion reverse into a $6 billion outflow. Why, it’s as if everyone collectively decided that investing in crypto was just so last year! 🥴

Glassnode waxed poetic, declaring that loss-taking events have dwindled, much like the final flickers of a dying candle. “Investors may be approaching a degree of near-term seller exhaustion,” they speculated—perhaps envisioning a weary populace flopping onto their couches and abandoning the market like a forgotten pair of socks.

The report also unveiled bitcoin’s realized capitalization soaring a staggering 117% since November 2022. In contrast, our dear sleeker cousin, ethereum, merely waddled along with a 32% growth. It seems the ratios of these digital darlings tell a tale steeped in suffering for ethereum, which recently dipped below the noble threshold of 1.0, revealing many unrealized losses like an overstuffed suitcase bursting at the seams.

Meanwhile, bitcoin flaunted its MVRV ratio above 1.0, as if boasting about its superior profitability. Ethereum, conversely, crumbled against bitcoin in a display reminiscent of a sad puppy who can’t jump high enough to reach its favorite ball—its ratio plunging 75% since September 2022. Glassnode called this underperformance “atypical.” They should have just said it looked like a fish out of water! 🐟

The curious world of altcoins, too, found itself caught in this tumultuous tide, suffering a 40% contraction since December 2024—an erasure of $417 billion worth of imaginary riches! Even Bitcoin joined the misery with negative three-month returns, proving that not even the mightiest can escape the grip of despair.

Technical wizards have identified a critical zone for bitcoin, somewhere between $65,000 and $71,000. A break below this range threatens to turn investors into melancholic creatures of woe, leading to rampant sentiment-driven sell-offs. Glassnode further emphasized that reclaiming $93,000 is like finding the holy grail—to reignite hope and upward momentum!

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

2025-04-10 21:27