Ah, the American dream of power, wealth, and U.S. Treasuries — but not in the way we thought. Citigroup, ever the bearer of “good news,” has a report that will surely make your head spin: by 2030, stablecoin issuers could become some of the largest holders of U.S. government debt. Yes, you heard that right. Over a trillion dollars in additional demand for Treasuries, all thanks to these cryptic little stablecoins. 🤑

In their infinite wisdom, the New York-based bank claims that if the U.S. government ever gets around to putting some regulatory muscle behind stablecoins, the floodgates will open. And stablecoin issuers will start scooping up U.S. Treasuries faster than a hotdog-eating contest on the Fourth of July. A new framework for stablecoins could drive an insatiable demand for “dollar risk-free assets”—whatever that means—inside and outside the U.S. 😏

“Creating a U.S. regulatory framework for stablecoin would support demand for dollar risk-free assets inside and outside the U.S. The stablecoin issuers will have to buy U.S. Treasuries, or comparable low-risk assets, against each stablecoin as a measure of having safe underlying collateral.”

— Citigroup

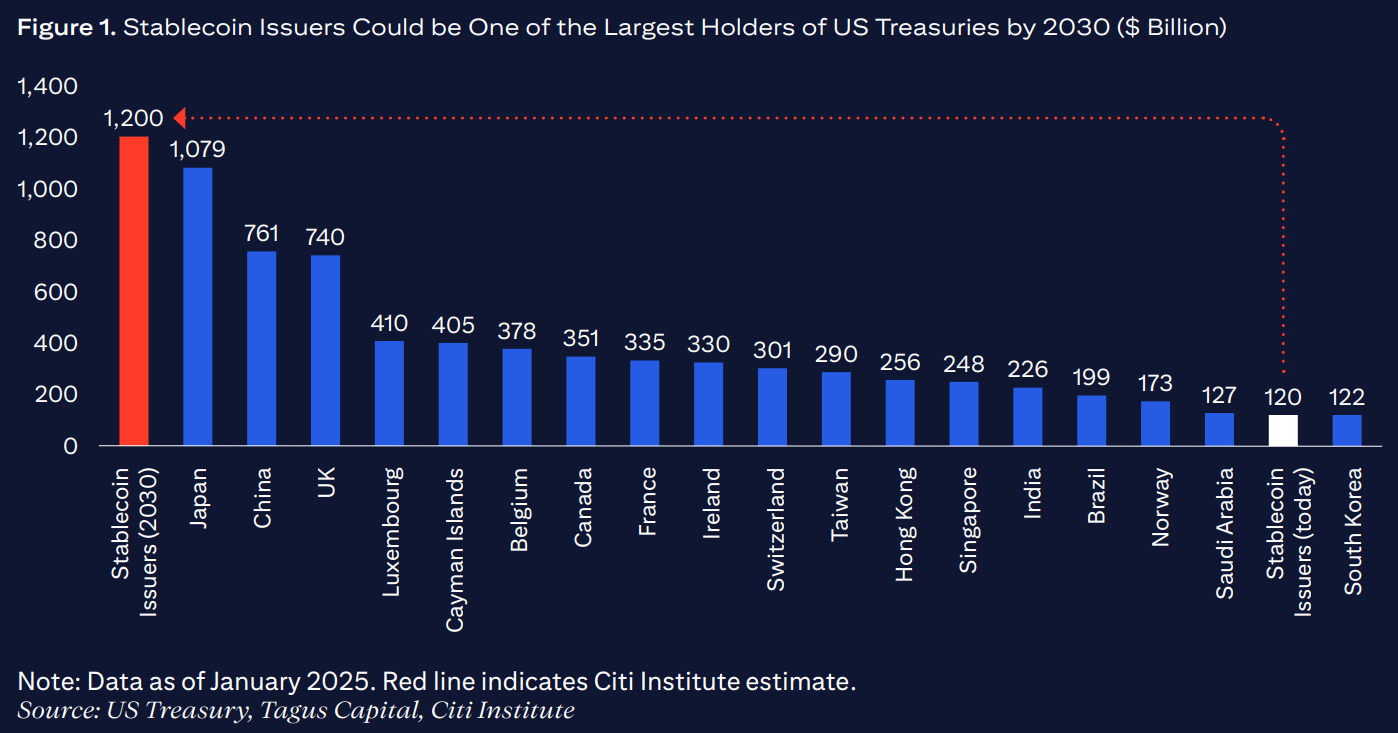

And so, Citigroup’s base case presents a shocking reality: stablecoin issuers could end up holding more U.S. Treasuries than any single country today. Forget China or Japan — we’ll have stablecoins flexing their muscle. The idea of these crypto-backed titans owning the government’s debt is so absurd, it just might be true. 🎭

But, of course, all that glitters is not gold. Citigroup’s analysts are wise enough to point out that stablecoins come with a hefty side of risk. Run-risk, anyone? If a major stablecoin issuer trips over its own feet, expect a contagion effect that could ripple through the financial ecosystem. And just to keep things spicy, let’s throw in the fact that stablecoins de-pegged nearly 2,000 times last year — and about 600 of those were from large-cap stablecoins. Oops! 😬

Then there’s the geopolitical party pooper: stablecoins might be seen as just another tool for the U.S. to enforce its almighty dollar hegemony. Heaven forbid! Other parts of the world, namely China and Europe, might counter with their own centrally issued digital currencies. No one likes a bully in the playground, right? 🇨🇳🇪🇺

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2025-04-25 09:37