Bitcoin, once a revolutionary symbol of financial freedom, now finds itself stumbling in the face of evolving technological threats and growing political pressures. The very thing that promised to unshackle mankind from traditional finance may soon find itself shackled by forces far beyond its control.

A recent roundtable of the cryptocurrency intelligentsia delved into what many are calling a “black swan event” for Bitcoin’s future. Spoiler alert: It doesn’t look good.

So, What’s the Worst That Could Happen to Bitcoin?

Lyn Alden, a self-proclaimed oracle of investment wisdom, asked the poignant question: “What’s the biggest structural risk to Bitcoin in the next 5-10 years?” Naturally, this sent investors, experts, and fortune-tellers scrambling to find an answer. The consensus was as unanimous as it was terrifying.

One culprit, constantly whispered about in the dark corners of the internet, is quantum computing. Nic Carter, the ever-vigilant general partner at Castle Island Ventures, summed it up in a single word: “Quantum.”

“I increasingly agree. That was the catalyst for my thread/question, tbh,” Lyn Alden responded, as if admitting some long-hidden truth.

Ah, quantum computers. With their promise of near-infinite processing power, these machines could break Bitcoin’s supposedly unbreakable encryption algorithms. The most infamous of these, the Elliptic Curve Digital Signature Algorithm (ECDSA), which protects Bitcoin wallets, could be undone in a heartbeat. Imagine a world where a quantum computer could forge a digital signature and rob your wallet blind. But no worries, right? It’s not like we’re about to develop quantum computers capable of doing that… oh, wait.

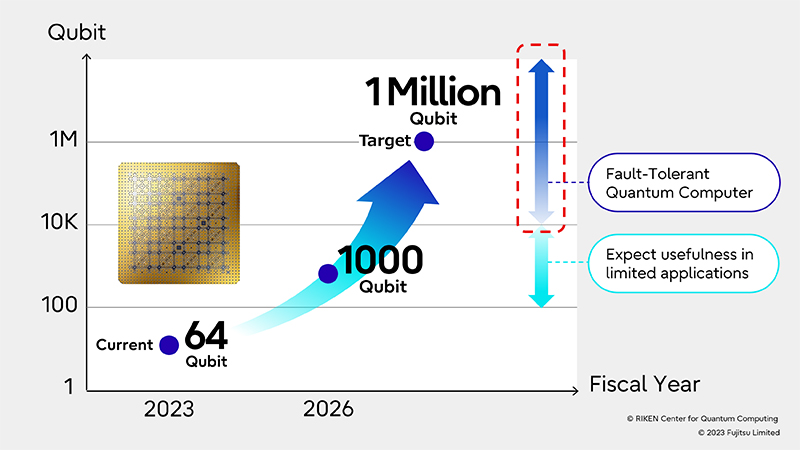

In fact, River’s research suggests that with a quantum computer boasting just 1 million qubits (think of it like a trillion times more powerful than anything we’ve got now), even the most secure Bitcoin address could be cracked. Microsoft, ever the optimist, claims that their new Majorana chip is working toward that milestone. The question then becomes: How much time does Bitcoin have left to scramble and patch its defenses?

But quantum computing isn’t the only problem, of course. According to some experts, the true danger lies in Bitcoin’s ability to unite its ever-bickering community to agree on quantum-resistant solutions before it’s too late.

“That’d be not coming to a consensus fast enough on the implementation of a quantum-resistant hashing algorithm,” said Stillbigjosh, former cybersecurity whiz at Flutterwave. Looks like the community’s ability to agree on pizza toppings may be more functional than agreeing on cryptographic resilience.

On top of this looming quantum threat, Ari Paul, founder of BlockTower, pointed out a more immediate and terrifying reality: The cost of attacking Bitcoin’s network has become so laughably low, it’s like buying a discounted ticket to a zombie apocalypse.

“Someone shorting 10%+ of BTC’s market cap then spending ~1/10th that to gain 51% control of hash power and mining empty blocks indefinitely, effectively turning off the network. Could fork the PoW algo, but just means the attack on the new network now costs <1/1000th the previous one,” Ari Paul mused. So much for decentralized power, huh?

The Clash of Ideals: Bitcoin vs. The Bureaucrats

Now, as if these tech nightmares weren’t enough, some of the more paranoid investors are looking over their shoulders, wondering if the real threat to Bitcoin isn’t some futuristic supercomputer, but the very governments they were trying to escape in the first place.

“Government and institutional involvement changing the incentives of everything,” said Investor Shinobi, a man whose username is probably more profound than his actual identity.

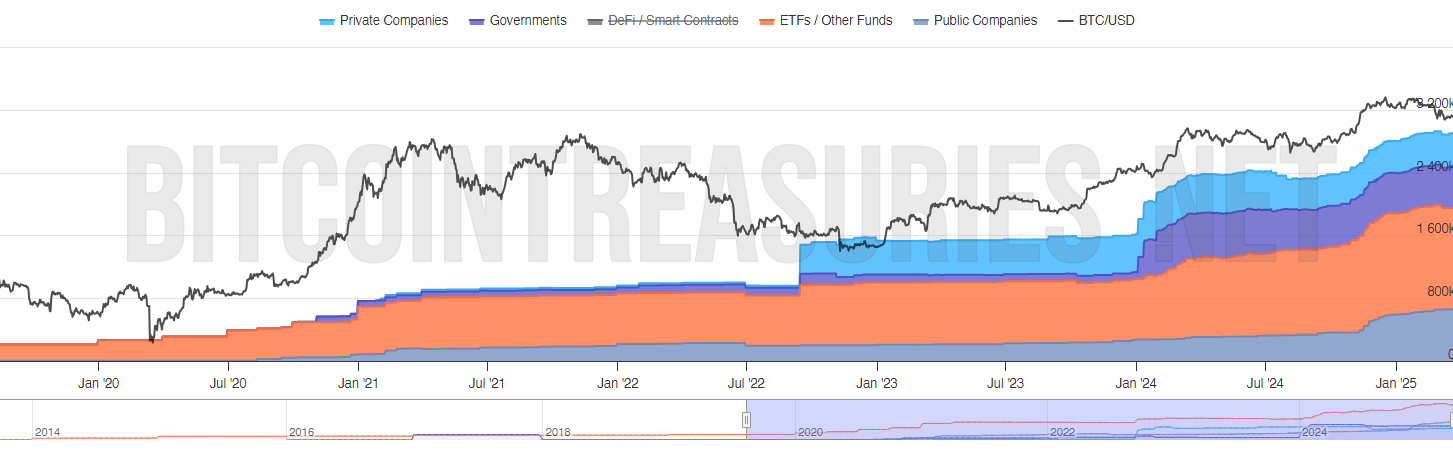

In a somewhat poetic twist, Bitcoin holdings by private companies, public companies, governments, and ETFs have increased by more than 12 times over the past five years—rising from 210,000 BTC to a staggering 2.6 million BTC. Now that Bitcoin is in the hands of the establishment, could the government’s ever-tightening grip bring about Bitcoin’s downfall?

“The biggest structural risk is the friction between Bitcoin’s decentralized ethos and the increasing push for centralized regulatory oversight. In essence, as governments and large institutions tighten control and enforce compliance, the network might be forced to compromise on its core principle,” warned Investor MisterSpread, as if foretelling the apocalypse.

As Bitcoin’s systemic risks rise with the sun of political instability and the moon of artificial intelligence, the cryptocurrency world stands on the brink. The discussion, sparked by Lyn Alden’s seemingly innocuous question, suggests that Bitcoin may face its reckoning in ways no one truly expected.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2025-03-25 12:09