Ah, SUI! The darling of the crypto world, which recently decided to bless its faithful followers with a 12% rise. How delightful, how promising! Yet, let us not be deceived, for behind this surge lies the grim reality of impending disaster for the traders who have, perhaps, become a little too hopeful.

This rally, much like the brightest flame, burns with an exquisite double-edged sword, ready to chop off the heads of any short trader foolish enough to be in its path.

Traders, Prepare for Woe

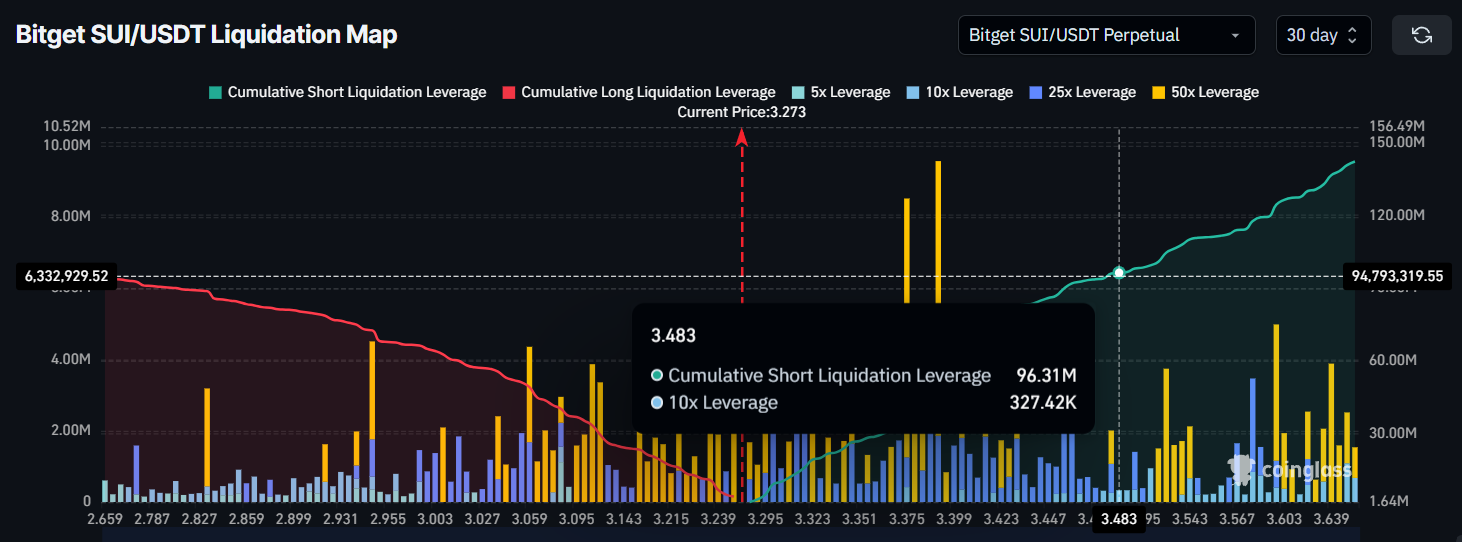

Alas, according to the direst of liquidation data, if SUI’s price dares to touch the lofty heights of $3.48, the resulting liquidation storm could amount to a staggering $96 million. Yes, you read that correctly. Those poor souls who bet against SUI’s rise — the short traders — will bear the brunt of this wrath.

And should the price surge towards this dreaded number, the short contracts will be liquidated with such force, as if the hand of fate itself were pushing traders to the brink, forcing them to cover their positions. This, of course, will only fuel the ever-growing rise of the price. A most delicious paradox, don’t you think?

This potential liquidation debacle serves as a cruel reminder of the fickle nature of SUI and the perilous risks lurking in the shadows for anyone foolish enough to bet against it. The short traders, their hearts filled with dread, will inadvertently push the price higher, creating a vicious cycle of volatility.

And so, dear readers, we watch as both short and long traders become mere puppets, dancing to the tune of unpredictable price movements. How terribly amusing, in a way!

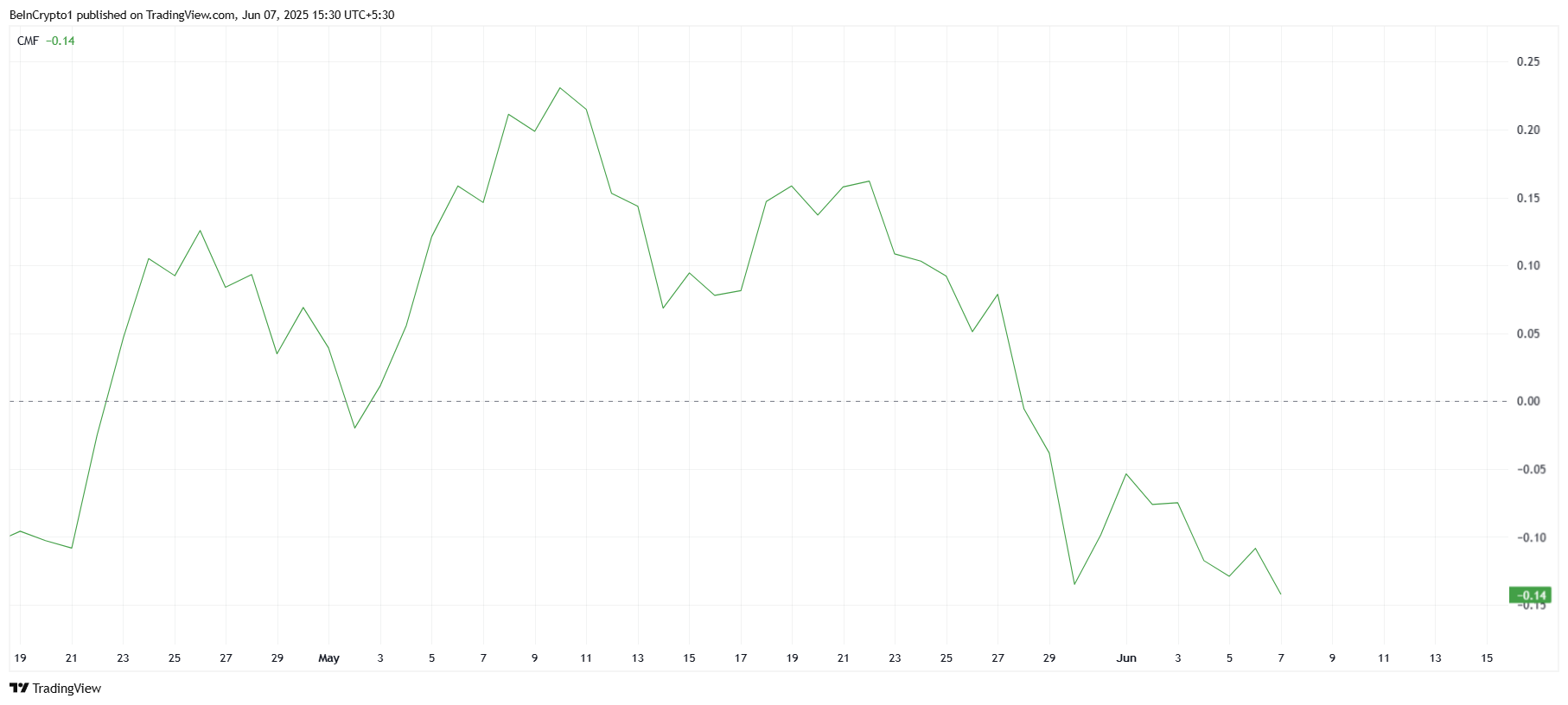

Despite the recent 12% rise, one must not be fooled. The Chaikin Money Flow (CMF) — that unrelenting force of market wisdom — shows a sharp decline, suggesting that the inflow of investments is hardly as grand as one might hope. The CMF is quite negative, a harbinger of doom that signals SUI’s recent rise is perhaps more about short covering than any real surge in buying interest.

If these outflows persist — and why wouldn’t they? — SUI’s price could soon find itself under further pressure, leaving us all to wonder how long the recent rally will last before it collapses into the abyss of disappointing reversals.

The Price Surge: A Tale of False Hope

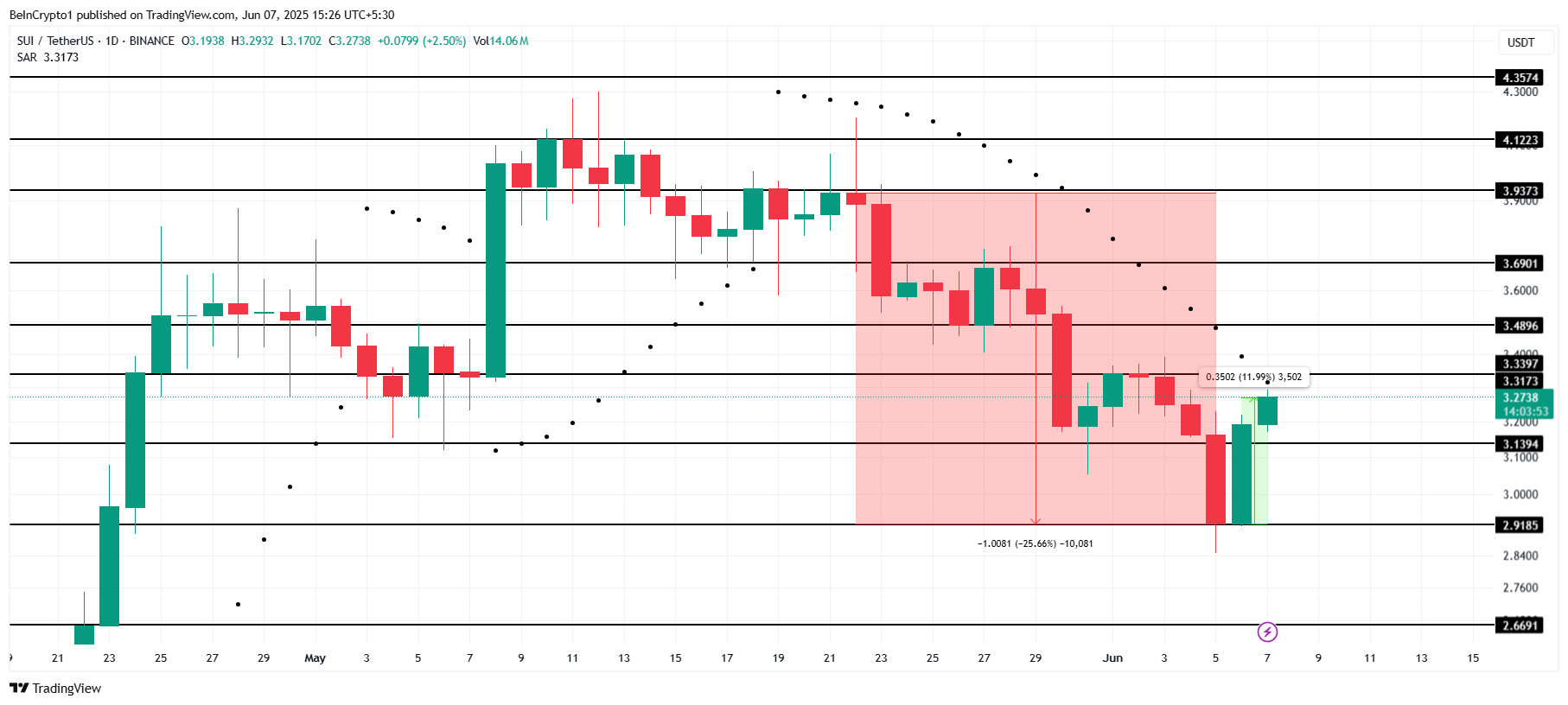

As of this moment, SUI is trading at $3.27, still basking in the afterglow of its 12% rise. Yet, there lies a formidable wall of resistance at $3.33 — a level that has proven itself impervious to the most valiant of attempts.

Given the ongoing outflows, one must wonder if SUI will ever break through this barrier. It seems unlikely, my dear friend. If the price fails to breach the resistance, it could fall back to lower levels, perhaps to $3.13 or even $2.91, erasing all the recent gains. A most tragic reversal, wouldn’t you agree?

However, let us not forget the Parabolic SAR indicator, which is inching closer to a key level. Should it flip below the candlesticks, one might consider it a sign of an uptrend to come — a most intriguing twist of fate.

If SUI does indeed break through $3.33, the price could surge to $3.48, triggering a wave of liquidations and pushing the price even higher. But beware, for the bear’s claws could still remain sharp, waiting for the right moment to strike.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- Pi Network (PI) Price Prediction for 2025

- Castle Duels tier list – Best Legendary and Epic cards

- How to Watch 2025 NBA Draft Live Online Without Cable

2025-06-07 17:56