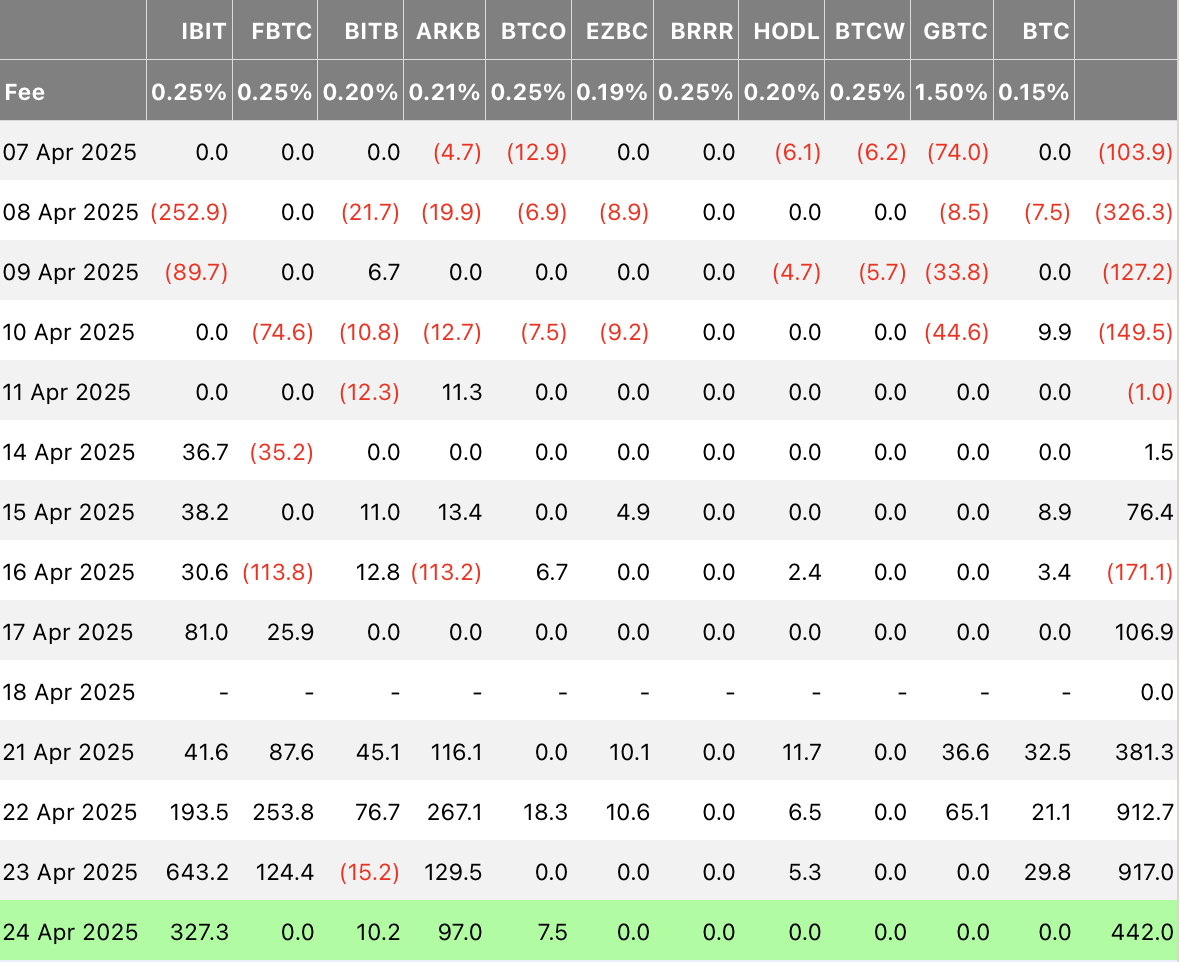

BlackRock’s IBIT is basically that one friend who always steals the spotlight — again, snagging a casual $327.3 million. Thanks, Farside, for the numbers that make us all feel like amateurs. ARK Invest and 21Shares came in next, holding hands with $97 million like a cute couple you can’t help but root for. Bitwise’s BITB threw in $10.2 million, and Invesco’s BTCO chipped in $7.5 million—as if pocket change matters in this high-stakes game.

But wait, before you start planning your yacht party, the total ETF trading volume took a nap, dipping from $4 billion on Wednesday to a “measly” $2 billion on Thursday. No worries though, that was after a couple of days so wild ($916.9 million on Wednesday and $936.4 million on Tuesday) it probably needed a cold compress and some Netflix binge time.

So yeah, despite the crypto rollercoaster making even the bravest of us clutch our coffee mugs tighter, these big institutional beasts keep gobbling up Bitcoin exposure like it’s the last slice of pizza at midnight. 🍕💸

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-04-25 13:36