As a researcher with a keen interest in blockchain technology and a background in the gaming and video industries, I find Theta Network’s latest rally particularly intriguing. Having worked with Tapjoy and Gameview Studios myself, I can appreciate the expertise Mitch Liu brings to the table, having founded such successful ventures.

The recent surge in Theta Network’s value can be attributed to increased activity from derivatives traders, as the number of active contracts (open interest) reached an all-time record high.

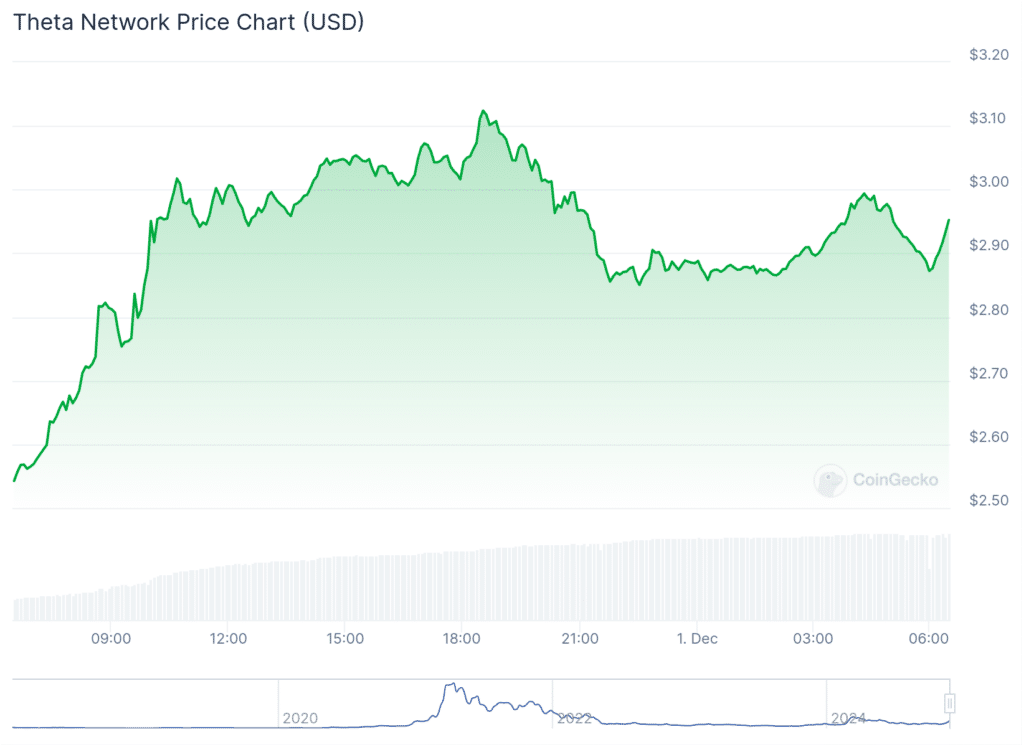

On Saturday, Theta Network (THETA) hit an eight-month peak of $3.17, with its daily trade volume significantly increasing by 440% to reach approximately $680 million. However, a mild correction occurred earlier today, and at the moment of writing, THETA is being traded at $2.95. Check out the details below.

Currently, the value of this particular token’s total market capitalization stands at approximately 2.78 billion U.S. dollars, earning it the 53rd position among the top-ranked cryptocurrencies.

The Theta Network functions as a blockchain platform operating at the foundational level, specifically designed to offer infrastructure suitable for multimedia and artificial intelligence applications.

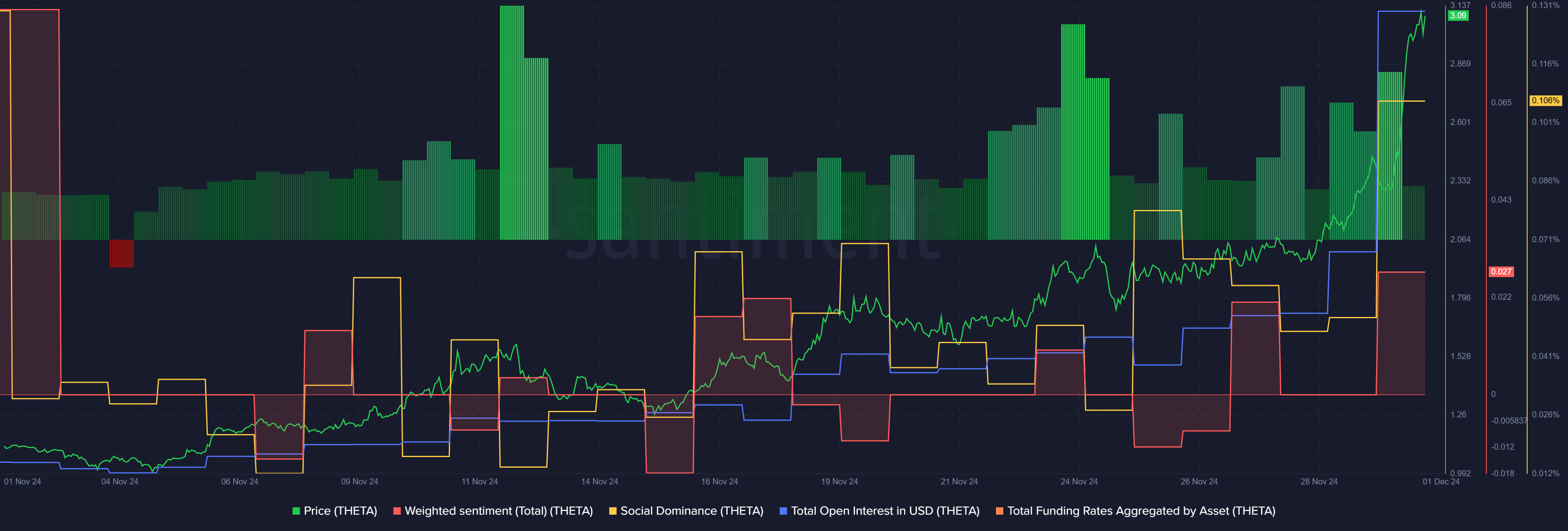

The data indicates that a significant rise in price has drawn a massive influx of derivatives traders, as evidenced by a 77% increase in open interest within the past day, which peaked at an all-time high (ATH) of $84 million, according to Santiment’s reports.

Theta chart

Conversely, the combined funding rate across all trading platforms dropped from 0.03% to 0.009%, according to Santiment’s data, as the asset’s value began to adjust downward.

The chart suggests a rise in the number of people predicting a decrease in the asset’s price. This could lead to higher price fluctuations because even small shifts might cause more sell-offs, amplifying the volatility.

Information gathered from our market analysis tool indicates a surge in favorable public opinion and active conversations about blockchain over the past month. Such an increase might trigger a sense of fear of missing out among potential investors.

More specifically, price surges triggered by fear of missing an opportunity (FOMO) often prove to be extremely unstable because they lack significant triggers or causes.

In the year 2017, Theta Network was established as a joint venture by Mitch Liu and Jieyi Long. Notably, Mitch Liu has extensive experience in the video and gaming sectors, having previously launched companies such as Tapjoy and Gameview Studios.

IronSource purchased Tapjoy for $400 million.

Long is a specialist in blockchain, virtual reality and live-streaming.

Notable investors and strategic partners across multiple sectors such as Samsung, Sony, Digital Currency Group, Sierra Ventures, and Heuristic Capital Partners have shown interest in Theta.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-12-01 14:36